Course

Highlights

We are trusted by some of the

biggest names in the Industry:

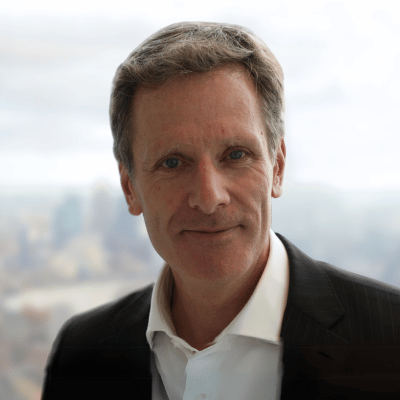

Meet Your

Expert Instructor

Greg Mayes

In Singapore, this course is recognised under the IBF Financial Training Scheme (FTS) and is eligible for FTS claims subject to all eligibility criteria being met. Please note that in no way does this represent an endorsement of the quality of the training provider and course. Participants are advised to assess the suitability of the course and its relevance to his/her business activities or job roles.

The FTS is available to eligible entities based on the prevalent funding eligibility, quantum and caps. FTS provides up to 70% course fee subsidy support for direct training costs subject to a cap of SGD 500 per candidate per course subject to all eligibility criteria being met.