LDI nuts and bolts

It’s hard to have escaped all the recent noise in the media about the UK’s mini budget (ironically with not-so-mini consequences!) and the repercussions through financial markets. And one of those headline consequences was pension funds being plunged into liquidity crunches due totheir LDI strategies. Again, ironically, the funds hit by the severe consequences are those that took the approach of hedging the risks inherent in their financial obligations: following an LDI approach (“Liability Driven Investment”). The problem with hedging strategies is the use of derivatives. And derivatives’ liquidity demands can be over-whelming. All major derivative disasters are not about market risk so much as liquidity.

How did it happen? What were the triggers? What are the investment structures behind this? Didn’t they prepare for the stress like banks have to? Well….there was a perfect storm, or at least a tornado that hit them full on and they were in the wrong place at the wrong time.

The triggers

In short, it was the rapid rise in rates / government bond yields in the UK that triggered the chain of events. The Bank of England had undertaken an emergency bond-buying program to calm the markets following the Ca-Truss-trophic mini-budget announcement in early October 2022. LDI funds were already nervous. Then the Bank confirmed it would end its program and the ripples of nervousness built into mini-tsunamis. The sell-off effects were felt everywhere from New York across to Sydney. UK pension funds are BIG and the selling pressure they created went global.

The structure of a synthetic LDI fund

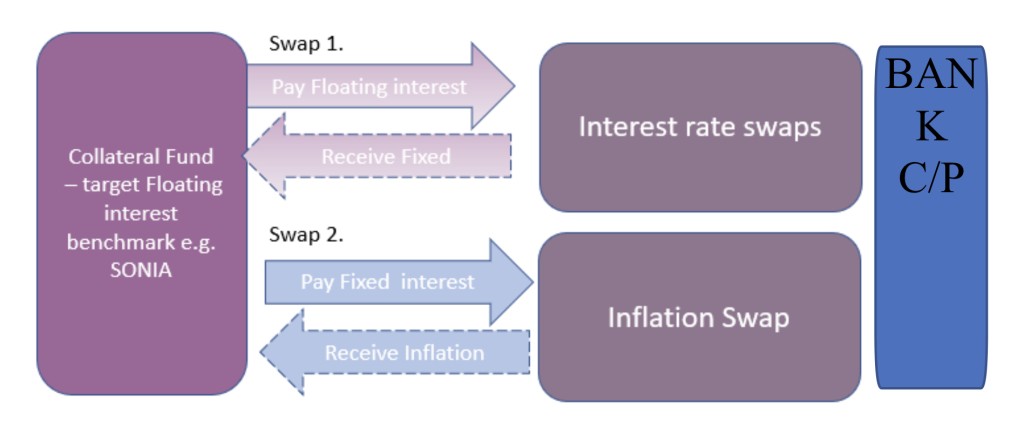

Although most DB pensions funds are closed in the private sector, there are still many public sector funds and plenty of trail in the private sector (closed to new employees, but plenty still members of the old plans). The premise is simple. And based around what are simple swap overlays onto underlying low-risk assets.

I just want to spell out the core structure and all else follow from that.

The pension funds themselves will have modelled liabilities out for years to come. These are, in essence, fixed – not in absolute terms, but can be calculated methodically using actuarial assumptions around retirement ages, life-expectancy, inflation etc… Although not 100% accurate, they are fixedliabilities, growing in line with a retail price index (RPI). Some have an inflation cap, say 5% (so following a Limited Price Index – LPI)

The funds want to invest in assets that follow this liability path. Matching cash flows as closely as possible. So, Fixed income makes sense. The problem with fixed income of long duration – as long as the life of the liabilities – is lack of liquidity. There’s just not enough of it to go round. So, using derivative makes sense, using an interest rate swap to fix returns benchmarked to a long-dated government bond.

To cover the inflation risk, the funds also buy Inflation Swaps, buying a stream of cash that goes up in line with the RPI.

We are left with a ‘synthetic’ inflation linked fixed rate investment. Just what the doctor ordered.

The problem….

In the above diagram, I have noted what many pension plans used to do. That is, invest in cash, earning floating rates andwell hedged with the ‘Pay Floating’ leg of Swap 1. But at this point, it is key to mention negative rates, or very low rates. Many funds found their Swap 1 deeply in the money as rates fell post credit-crunch when they were holding negative-yielding, or very low-yielding collateral. This was sub-optimal so, en-masse, they decided to restrike their swaps at prevailing market rates. They converted the cash into capital cash and re-deployed into much more attractive returns in bond and equity markets. So, note they were in a position on their swaps to receive fixed interest at prevailing all-time low rates!

Then we got rising rates, globally. Fast. Equity portfolios fell, bonds crashed, and the interest rate swaps moved well out of the money, triggering collateral call after collateral call to be paid within hours. Unprecedented and very painful for all involved. Invested assets were dumped to cover the collateral and this just magnified the problem.

I blame the accountants and the regulators

The LDI crunch was always waiting in the wings. LDI strategies never really made sense. It was all about ensuring the numbers on the corporate sponsor’s balance sheet remained in aligned. So, using an investment strategy that matched Liability valuation created a screen for what really mattered. The rate at which a pension is amortised is not inherently a risk to the pension, it is just a cause of variability in the intermediate valuations, but not a risk themselves to the pension. Another thing to note is that when interest rates are low, corporate profits typically rise, so there is a natural hedge between a corporate sponsor and the pension scheme. So was LDI ever needed? Well, only to keep numbers off the balance sheet – numbers that would have melted away over timeanyway. Instead, we now have these funds that end up as a supplier of liquidity to the markets just when it’s stressed and expensive.