One of our tech team was reviewing and testing our website and pointed out that whilst we were selling LBO modelling, we didn’t actually explain what an LBO was! So here goes.

We need to start off with the private equity industry which really began in the 1980s – or rather that’s when one part of it “the buyout business” came to fame or notoriety, depending on your point of view, when the Private Equity partnership, KKR, bought RJR Nabisco in a hostile takeover. The deal was immortalised in the book “Barbarians at The Gate”.

The Private Equity Industry is now huge. In 2022, the top twenty-five funds held US$460Bn in assets. This covers four sectors – P/E, VC, infra and real estate, but it gives you a feel for their scale. The amount of unused investor capital was even higher! Who are they? Blackstone, Carlyle, KKR, TPG, Warburg Pincus, NB alternatives, CVC, EQT, Advent international, Vista Equity Partners were the top 10 in 2022. Interestingly, following the credit crunch, many of the P/E managers also became debt fund managers, raising money from investors to provide debt financing to the deals that the managers invest equity into.

The pitch that groups like KKR make to their equity investors is straightforward: “we are experts in spotting undervalued/underperforming/quality businesses which we are also expert in managing to increase their value. Give us your money we’ll use it, together with borrowed money from banks and other sources, to buy businesses to give you a return of 20% per year.”

If you are an investor those are pretty exciting numbers, if you consider that around 10% is a typical average return that you would expect from investing in shares listed on a stock market.

“Oh, by the way, this will take a while, so you’ll have to commit your money for 7-10 years. We will return as we sell the individual companies we’ve bought on your behalf. You will pay us a basic management fee while we invest for you and if we make you more than 9%, we will get to keep 10% of the profits over this level. If we make you over 20%, then we will get 20% of the profit over that high mark.”

So, that all begs a few questions: Do they do what they say? How do they do so well? Wow, how do I invest? And then, maybe, what could possibly go wrong?

Do they do what they say:

Funds generally keep their returns confidential, but top quartile funds will make in excess of 15% compound returns, so the best do really well.

How do they do so well:

Fundamentally they have to improve the businesses they own and do a good job of buying well – i.e., not overpaying, and selling well– getting good prices when they exit. When market conditions are poor – such as during the credit crunch or now, the disposal activities of P/E funds really slow down. Selling for a higher multiple of earnings than you paid has a huge impact on returns. Another key driver of returns is the “L” word – leverage or debt.

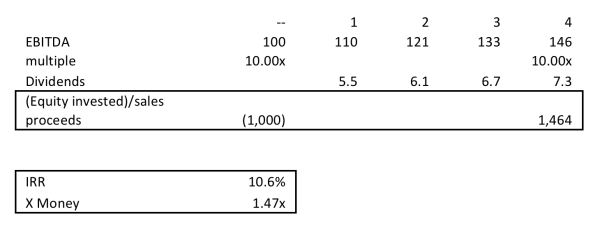

In the following example we buy a business with our own money. The company goes up 10% in value each year and we sell after 4 years. A key number in this case is the company’s Earnings before interest tax and depreciation (EBITDA). We usually talk about how expensive a business is by measuring the multiple of EBITDA we have paid. So high multiple expensive, low multiple cheap. (If you don’t know what E, B, I, T, D or A are you might want to do our Intro to Accounting and Analysis e-learning.)

A you can see the 1,000 invested has gone up nearly 50%, giving an Internal Rate of return (IRR) of 10.6%. (If you don’t know what an IRR is – do our time value of money eLearning bootcamp module.) In a nutshell the IRR is the annual compound rate of return that you have earned in the investment.

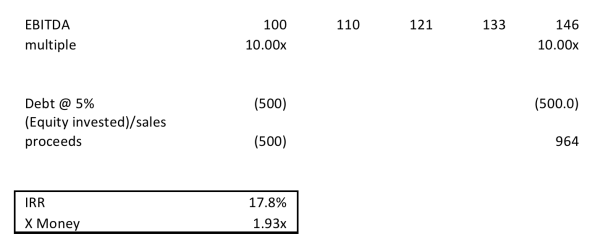

So far, so good, not a bad return. Now let’s do it using debt, so this time we are going to borrow half of the money we are using to buy the target company.

So, as you can see, we’ve nearly doubled the return. You’ve made similar absolute profits, but in the leveraged case, you invested half as much. Now we’ve ignored some details – we didn’t look at the cost of debt (although we did assume no dividends), we’ve ignored tax, but these are details in the big picture. Debt is good, it is a LEVER we use to leverage up returns.

Wow, how do I invest?

Well, the short answer is for the Giants of the industry – the KKRs and Blackstones, you can’t directly, unless you have a few million lying around. The minimum investment amount is aimed at their original core investor group of high-net-worth individuals and family offices. Even if you have the money, they most successful funds tend to prioritise investment by their existing investors and their own money. A big part of the money in the fund – after decades of success and high success fees-will be the own money of the managing partners. If you have a pension, you are already an investor as today, over 30% of the money flowing into private equity funds today comes from conventional pension fund managers.

All is not lost however, there are a number of listed vehicles where you can invest in funds: in the UK, Oakley Capital, Hg Capital, NB Private Equity, Harbourvest Global P.E. These are typically set up as Investment Trusts, so you buy shares in a listed company whose only business is owning stakes in private equity funds.

What could possibly go wrong?

When we talked about leverage earlier and the benefits of debt, it sounded like a free lunch. Unfortunately, there is no such thing as a free lunch and debt is a double-edged sword! Sorry about the car-crash of metaphors: Leverage works both ways unfortunately – it magnifies your returns, but it also magnifies your losses. Not all P/E deals are a success and there is a big dispersion of returns from the most to the least successful funds. There are many high–profile deals where private equity funds “handed back the keys” to the lenders and wrote off their investments (It happened to a P/E investment of mine!). There are others where companies performed badly – Thorn/EMI being one such company when it was owned by the fund Terra Firma. In this case, the banks who lent to the company seized it from the fund when it couldn’t pay its debts. When Terra Firma subsequently sued, saying that the banks had been underhand. The Fund lost. The Ferretti shipyard in Italy fell into difficulties due to the Global Financial Crisis. It’s owners the P.E. Fund Candover wrote off its investment. How confident are investors about P/E now? Well,if we look at Harbourvest Global Private Equity (HVPE), the fund has produced a 168% return over 5 years (source: Citywire), but it is trading at a discount to NAV of 40% (source: HL.co.uk). So,you can buy £100 of the fund’s portfolio for £60!? The implication is that investors have been losing confidence and selling.

This begs the question how does the future look for P/E?

As I write this in mid-2022 and the US Fed is signalling more interest rate rises and recession looms in an environment of high interest rates and high inflation, this is a challenging environment: funds that invested in 2015-2017 will be having a difficult time: the economy is bearing down on performance of their businesses. Availability of new debt financing is lower and it’s much more expensive. Buyers of businesses will be less able and willing to pay the high valuations that those funds need. We may see delayed exits; funds asking investors to extend fund lives and keep their money in for longer (so they don’t have to “sell low”) and failures of some investments as the banks take over.

Investing today: 2022 “vintage” funds (yes funds are like wine, a manager will, when they have fully invested fund no.1, launch fund no.2 a couple of years later and so on), may be a very good investment: the problems of older vintages may be an opportunity for investors to buy cheaper perhaps distressed assets today and benefit from a gradual improvement in the economy over the next few years. Providing of course the economy does improve…. A very interesting time to be placing your bets! Good Luck.