Tariffs! – 28-04-25 – MMT Analysis

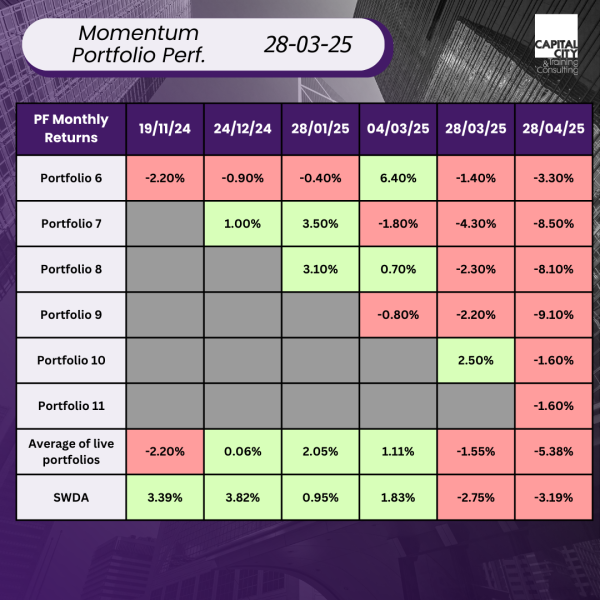

This is the tenth month of running our momentum portfolios and performance has been poor for all funds and the index.

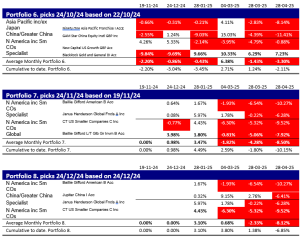

What are the factors driving the performance? Here are the individual portfolios:

The valuation date is unfortunate, in that US stocks have added nearly 6% in the week following the 22nd April. Unfortunately, this month’s big story – President Trump’s tariff threats – have taken markets down dramatically.

And then, in the case of the US, almost fully recovered following his decision to delay imposition by 90 days.

The problem for the momentum portfolios is that largely the impact of tariffs has been asymmetric: i.e. almost uniformly worse for non-US markets. The chart below shows the impact on the UK’s biggest Vietnam fund vs the S&P500.

US Recession Worries

It has still been a bad month for US equities potentially the worst since 1932. Recession worries continue and signs of weakness in consumer demand continue are being affected by concerns about inflation.

Bonds not safe!

Treasuries have had a wild ride also in April as investors responded to Tariffs, and then to the President’s attack on Reserve chair Powell.

Gold wins again

As in the last month, the only winner is gold and gold mining stocks returning 10-13% over the month. Equities, even from Europe which as been a relative beneficiary are still down over the period. This is reflected in the performance for the month (see below), where we see top performing segments, after gold and gold linked are money markets – (small but positive returns), Sterling high yield and absolute return funds.

The purpose of the blog is to look at the potential for momentum funds – is it a viable strategy? The geopolitical events over the last year have meant that this strategy has suffered badly. In contrast, a conventional diversified portfolio – 10% gold. 30% bonds and 60% equities has experienced for less volatility. Gold has fulfilled its role as “insurance” when everything else goes down, as has happened for periods in April, gold is the safe haven.

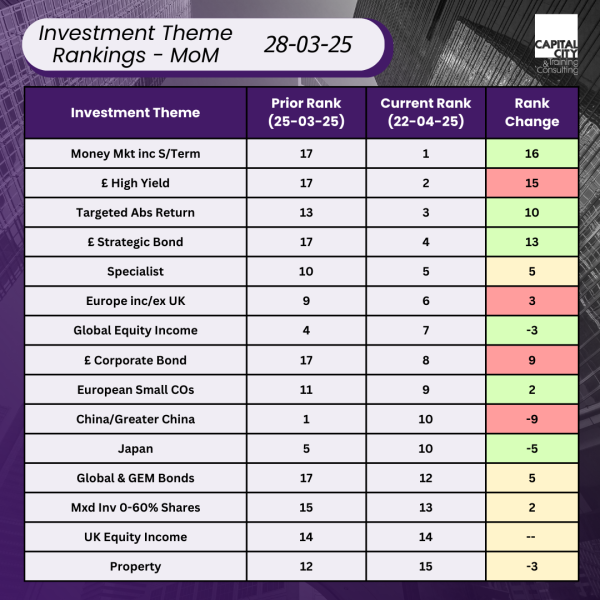

Momentum in April and a new twelfth Portfolio

Continuing with the change in approach we began last month, i.e. looking at short run momentum as well, how different does the story look and will that give us a different portfolio? If we look at the short run momentum, the top ranked sectors are:

- Physical Gold and gold equities

- European bonds

- India

- UK and EU real Estate.

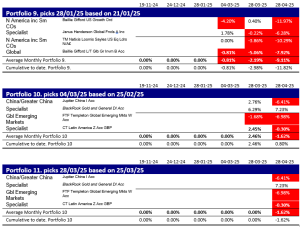

Portfolio Eleven

Like last month, rather than taking a pure momentum approach, I will use some judgement to see if we can improve performance. I am now going to use 4-week momentum again to choose funds. Given the continuing uncertainty and recession risk, it begs the question, should we invest in equities at all at the moment? India has benefited from stories about Apple accelerating the move of assembly of iPhones to India. We are gambling on who will get a good deal from Trump and on a recession in the US contaminating equities more generally. Will we outperform with bonds?