Boooom!! – CCT MMT – 30th September 2025

Last month’s “nuanced story” is now looking less nuanced!

With only the Dax indices going backwards, the US market has moved up setting new records

We can always hear warning voices, in the Wall Street Journal for instance:

- The Market’s Riskier Than It Used to Be—and Investors Love It

- Why You Don’t Want to Trade Stocks Like a Member of Congress

- Financial Bubbles Happen Less Often Than You Think

- Investors Are Fretting That the Stock-Market Rally Is on Borrowed Time

- The Credit Market Is Humming—and That Has Wall Street on Edge>

And there are negative indicators, weak employment numbers (see below ) and weakening lumber prices, but the tone of the market is of broad confidence. What are the indicators of continuing strength that we can see?

- Huge inflows into ETFs

- Investor indifference to signs of weakness in the US, sticky inflation and weak employment

- Delight at falling interest rates

- The belief that rates may fall faster than the Fed signals

This of course is all commentary, but there are other broader themes that suggest continuing strength in US markets:

- A strong IPO market

- Rising investment bank hiring and M&A volumes

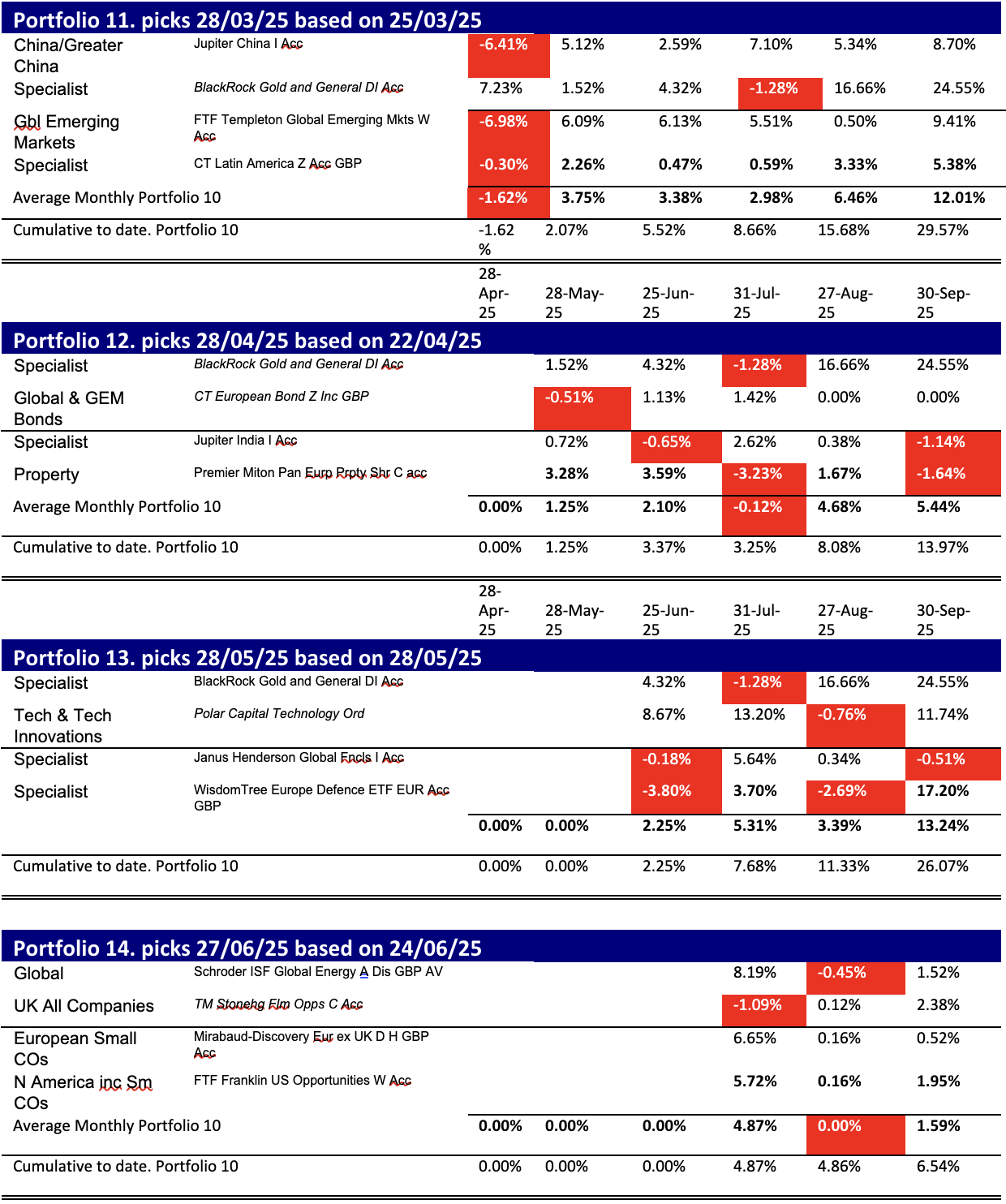

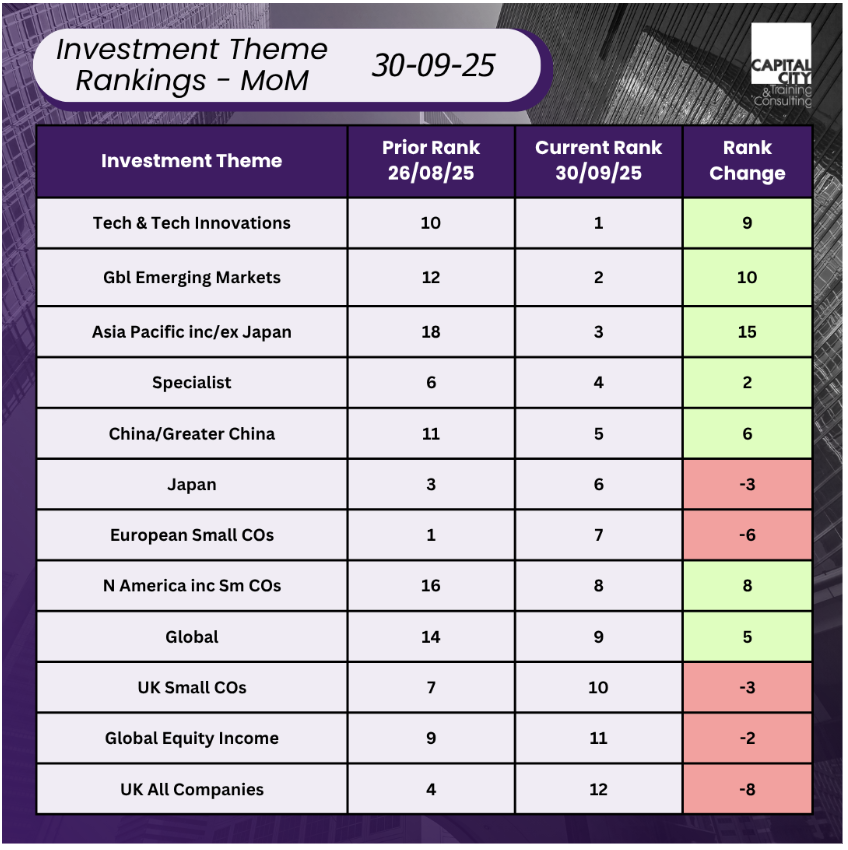

This positive US picture is a great backdrop for international markets and if we look at the table above, we see one of our two picks for last month, China has been a standout performer. The other half of the story is Gold, again! There are broader themes continuing though – emerging markets and China Tech.

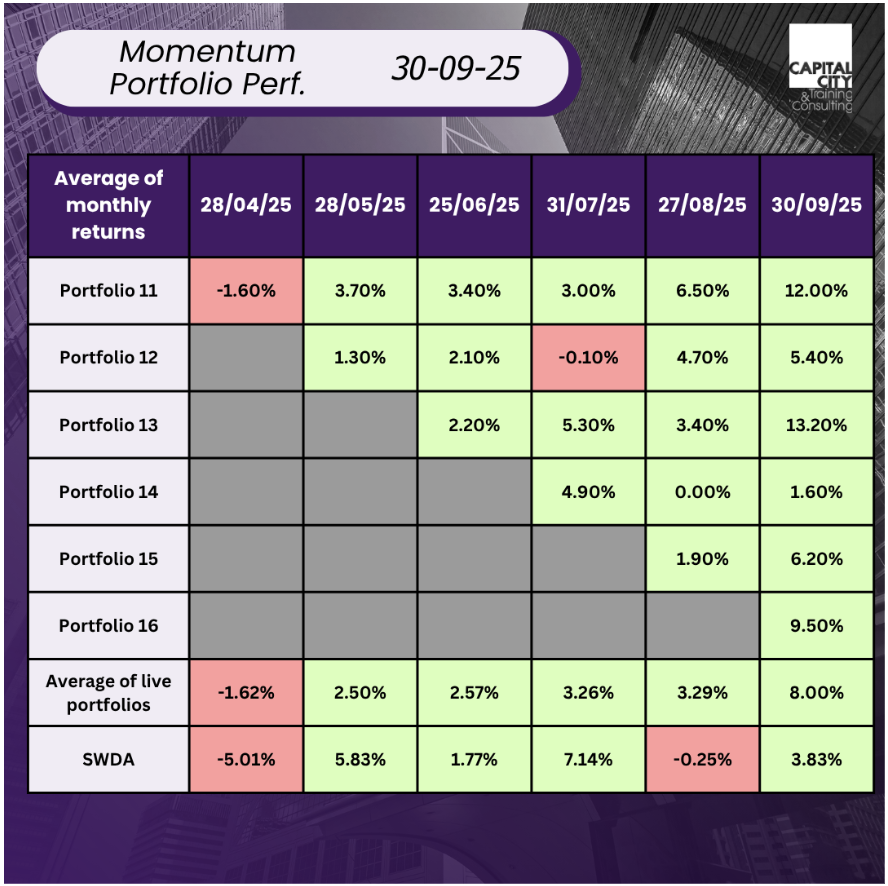

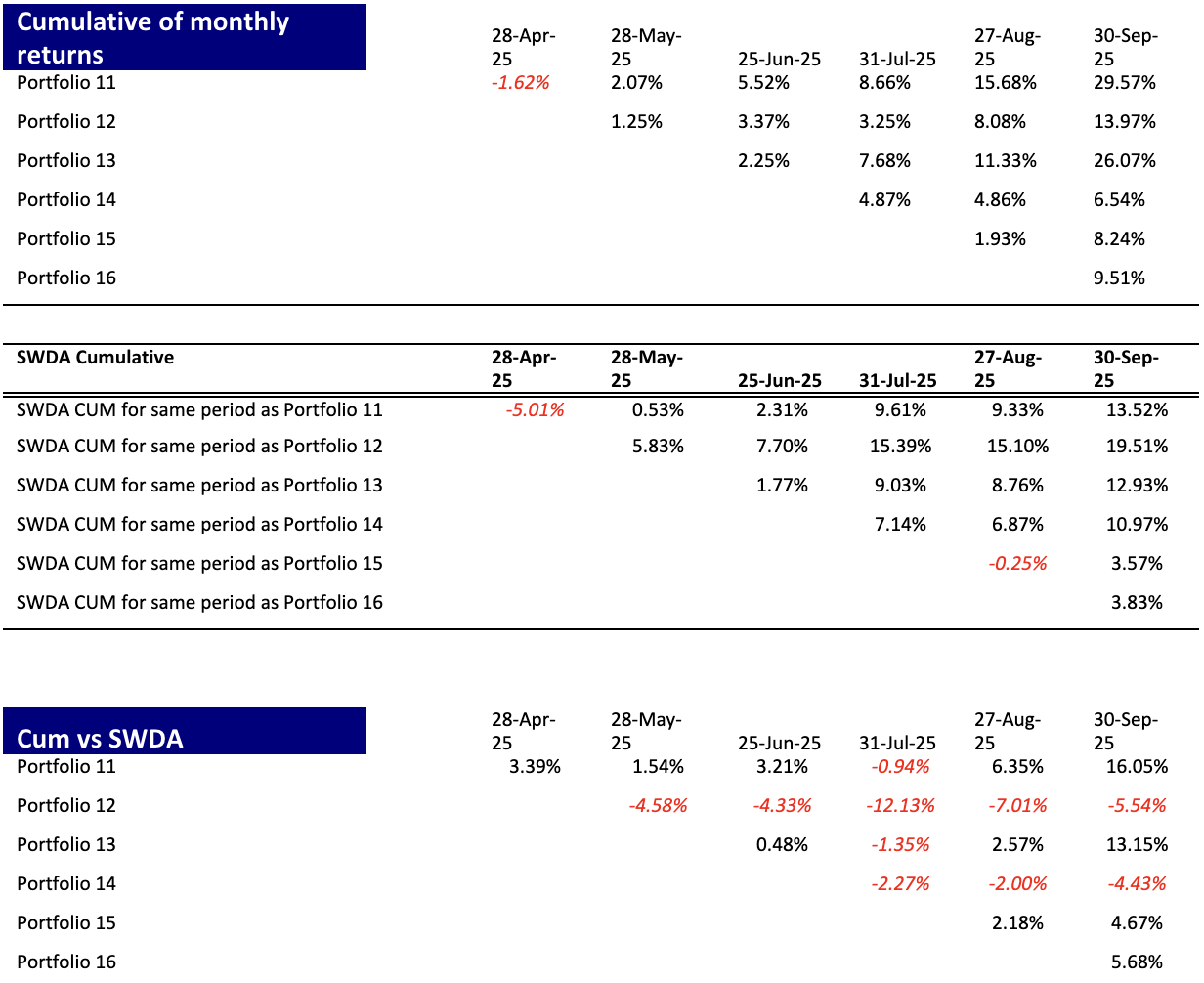

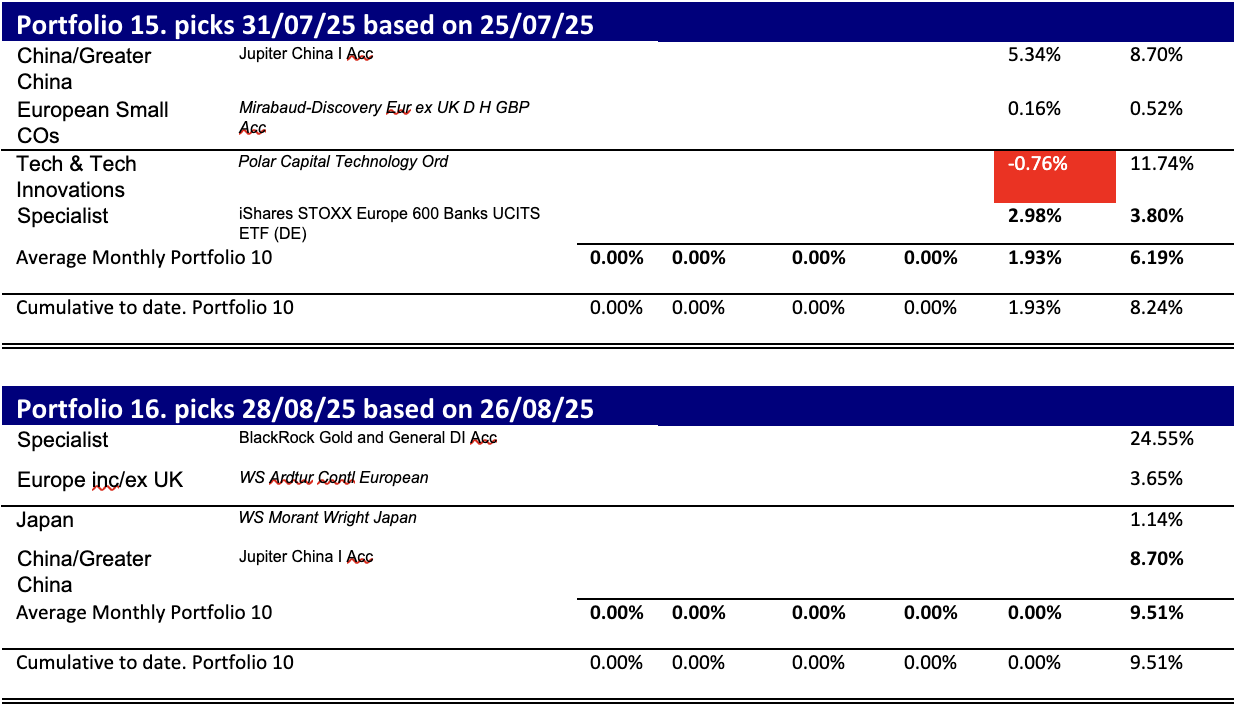

Is there value in the strategy? The following tables shows 1) cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see the average of the portfolios has outperformed in four out of six months.

The “mood music” mentioned last month, against the US and AI and pro – EU, Asia, and emerging markets: has been borne out. The US has had a good month, the magnificent 7 have performed well over the month pulling up the market, the rally is broadening – the Russell 2000 has hit its first all-time high since 2021, but Emerging markets – China and Brazil have both outperformed.

Last month we commented: “Whilst the news on gold has been almost non-existent, gold miners are catching up with the gold price, as we see in the performance of Blackrock Gold and general. This implies that even if gold prices aren’t going to continue up, current price levels are a “new normal.” Discuss!?” Gold has hit new highs and Blackrock Gold and General – our portfolio pick last month is up 24.55%!

Blackrock Gold and General acc.

Why gold? Central Bank buying and de-dollarisation now appear to have been joined by big retail flows. For now, though, small miners are romping up, with names like Serabi, Hochschild and Fresnillo up 25%+ in a month. As a trader this feels like the (beginning of the) end of the rally, or at least the late phase. When everyone owns gold, what will push up the price? A problem that Bitcoin is starting to face.

The positive China sentiment and signals continue, with Chinese tech stocks now starting to rally, following the US AI story, and with increasing successful IPO issuance:

- Chery Seeks to Raise Up to $1.2 Billion in Hong Kong IPO

- Zijin Gold’s Blockbuster Listing Delayed as Typhoon Hits Hong Kong

- Zijin Gold shares soar in Hong Kong trading debut

Source: Interactive Investor

How have the individual portfolios performed?

So, what have been our worst and best portfolios: Last month’s winner portfolio 10 has now matured- having reached the age of 6 months. The best current portfolios are portfolio 11 & 13, having achieved total returns of 29.57% and 26.07% respectively over 6 and 4 months. Portfolio 12, the least-momentum portfolio has been sedate.

The best portfolios

Portfolio 13 has benefited from containing two of the four enduring themes: technology and gold and also getting a one-month bump from the impact of increasing tensions with Russia on Defence stocks. Portfolio 11 has a full set of winners: gold, technology EM, and China in particular.

The worst portfolio 12

The portfolio has made an 8.5% return. Still good, just nowhere near SWDA’s 15% over the same period. Again, like portfolio 10, the themes and momentum seem settled for now. European bonds – steady, now showing more typical low volatility, Blackrock gold and general moving ahead strongly again after a slow month. India markets have gone sideways, suffering over tariff uncertainty. Unfortunately, immediately after the portfolio snapshot above, India has finally been hit by punitive 50% US tariffs for buying Russian oil.

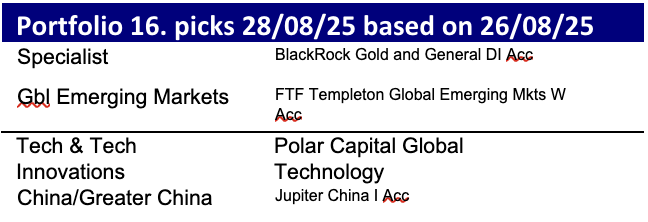

Momentum in September and a new portfolio Seventeen end August

Staying with the pure momentum approach, if we continue, then the 6-month data suggests 1) Gold, 2) Emerging markets 3) China in particular, and 4) technology.

If we look at the last four weeks as a guide, then that suggests 1) Global Emerging Markets, 2) Technology 3) China and 4) Asia Pacific Ex Japan

This month’s portfolio