Summer Stock Volatility – MMT Analysis – 22-08-24

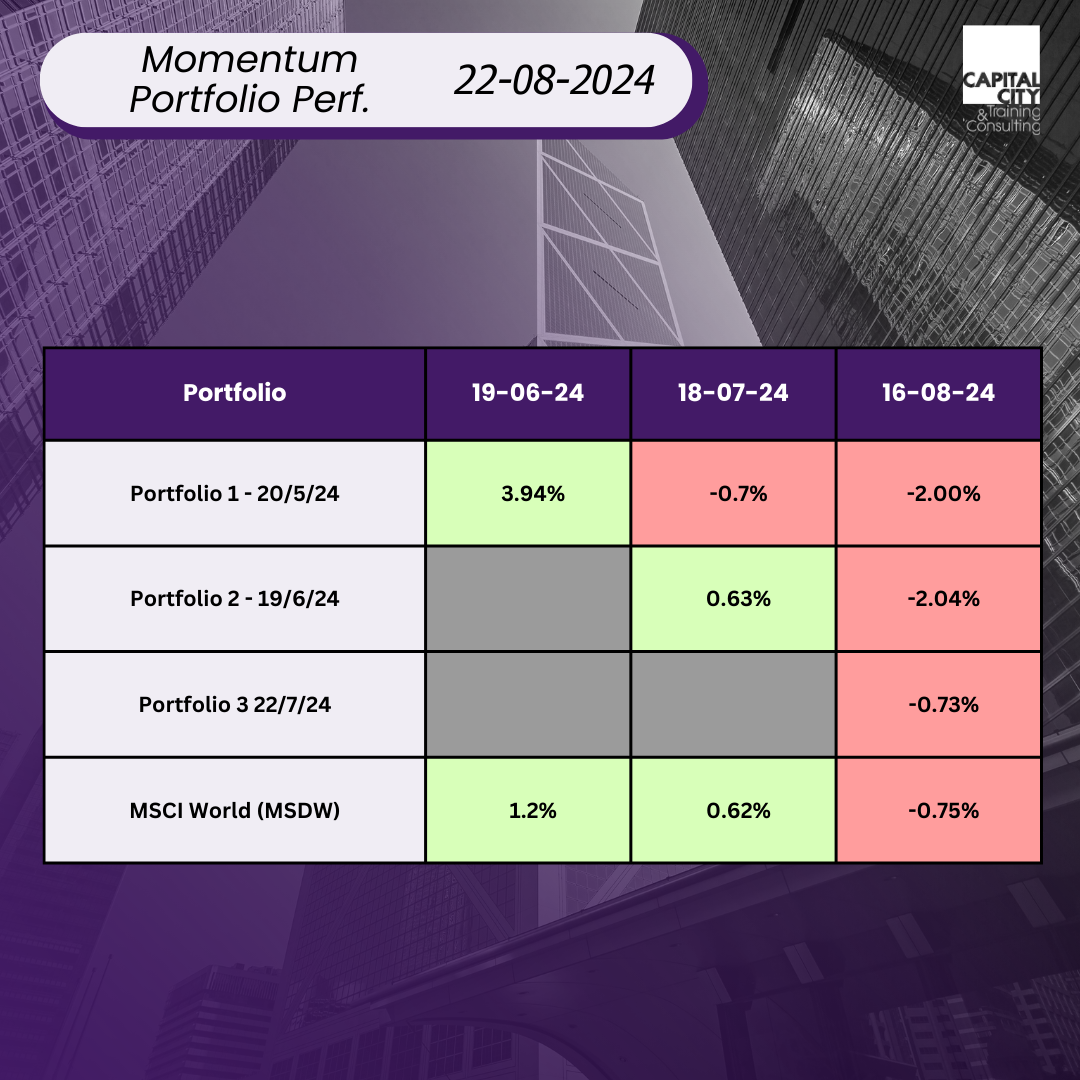

This is the third month of running our momentum portfolios and performance has already begun to diverge:

Oh dear! The problem with momentum is that it outperforms on the upside and the downside!

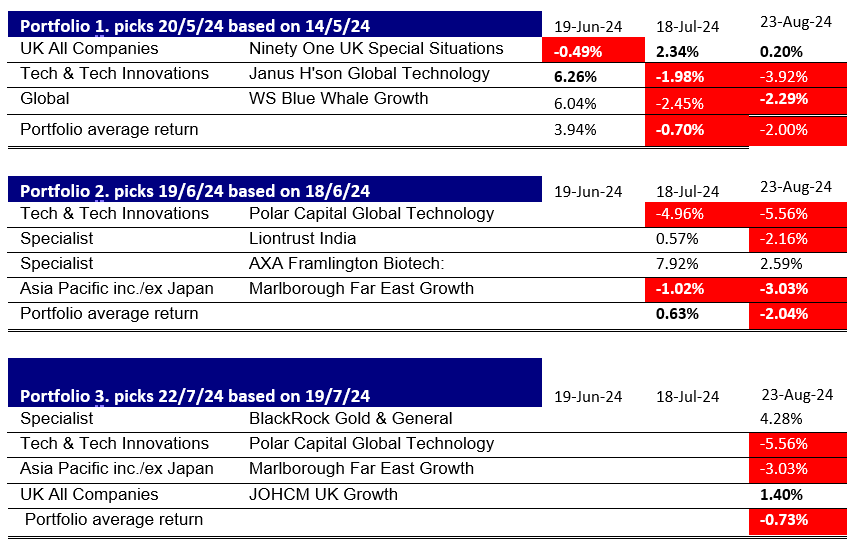

What are the factors driving the performance? Here are the portfolios:

August was a lesson in correlation and the danger of momentum investing. Momentum is a double-edged sword.

It remains to be seen whether we’ve reached a turning point in market sentiment, but technical factors and bad news conspired together to give a hugely volatile month.

US Market Woes

Poor US economic news at the start of August showing lower construction spending and weakening employment hit stock market indices and pushed down US bond yields with the US10 yr treasury falling below 4%.

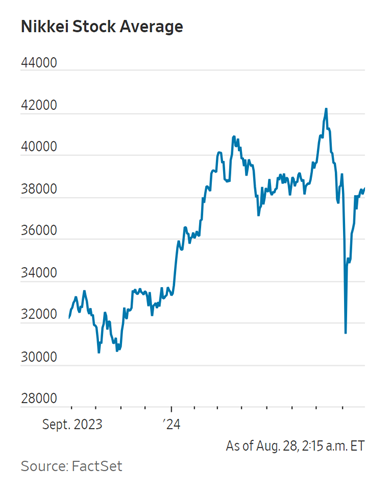

Summer Trading in the Nikkei

Summer can be more volatile as smaller trading volumes while traders are on holiday can lead to bigger swings. After the initial bad news, the action moved to Tokyo where the Japanese market saw a dramatic increase in the value of the yen and a crash in the stock market, seeing it’s biggest fall (of 12% in a day) since 1987.

The US indices fell as well as Hedge funds exited carry trades: i.e. borrowing in a low-interest rate currency – the Yen – to invest in higher yielding currencies/stock markets.

Things then calmed down as more reassuring data came in from the US.

But now two weeks later, the picture looks increasingly like the potential for a “hard landing” in the US, (i.e. a recession caused by high interest rates) is much more probable. Whilst earnings growth seems solid for the year, consumer demand may be weakening.

US Job Data Revision

A big downward revision of US job data is also now being discussed by the US labour department. Potentially US employers may have added 818,000 fewer jobs in the 12 months to March 2024. This implies that the US added only 178,000 jobs per month over that period, as opposed to the current estimate of 246,000 jobs per month.

In addition to this cloudier picture, we need to look at the fiscal backdrop: combined federal and state deficits are 8% of US GDP. This doesn’t represent enough stimulus to drive employment up. US mega-caps are also very highly valued.

The questions facing investors over the late Summer/Autumn is will the Fed lower interest rates fast enough to stop the US economy contracting?

What has performed, given the panic in stocks?

Two areas stand out, Gold, the classic safe haven, has reached new record prices in Dollars.

UK stocks post-UK elections have improved as interest rates in the UK have started to fall. UK growth indicators

Are also more positive than the EUs and of the G7 only the US grew faster in the first half of 2024.

Interestingly biotech has also performed. This sector is not correlated with the broader tech space.

Momentum in August and a new fourth portfolio

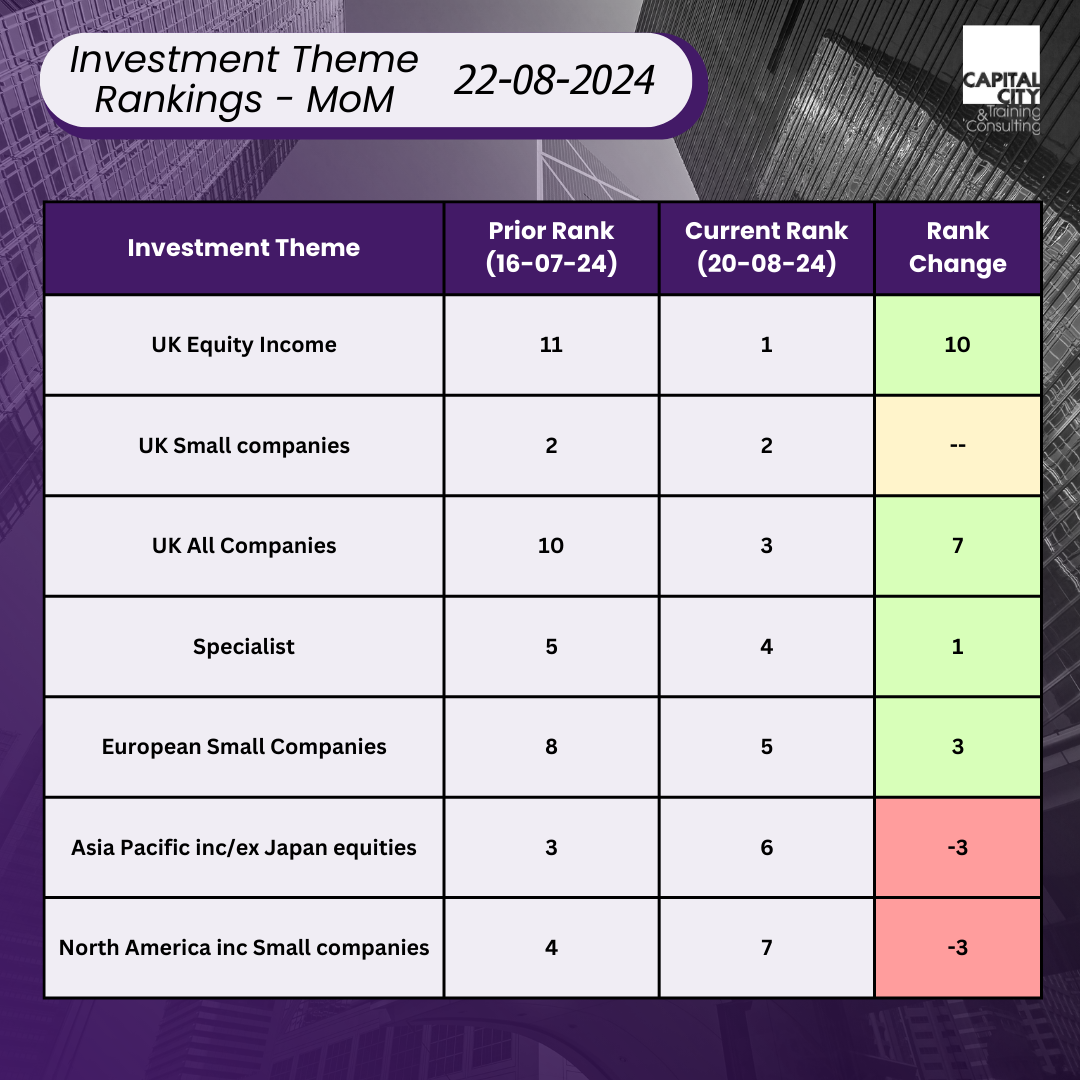

So, has the overall momentum picture changed much? Here are the top sector rankings:

The change is dramatic. Technology has fallen completely out of the top momentum group. It is interesting to look at Polar Capital: Over the last twelve months it has returned 43%! Over the last 6 months, only 1.15%. Over the last month -3.15%. All those funds heavily weighted with the “Magnificent 7” will have performed similarly. Is tech and the NASDAQ out of momentum for now!?

The UK market broadly though continues steady progress.

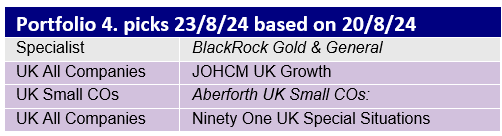

The new portfolio for August is as follows:

We explained the story behind BlackRock Gold & General in last month’s Momentum update.

Is the portfolio too concentrated?

Our strategy has been to try and take four different segments each month. Is three UK focused funds breaking the rule?

In previous months it has been difficult to find top performers with different strategies because of the high weightings of the Magnificent 7 in tech, US, and global portfolios. The three sectors have a big overlap.

In the UK however we have some quite distinct strategies: JOHCM UK growth majors on large caps like BP, Shell, Astra Zeneca, ABF, Stan Chart and HSBC.

Aberforth Smaller Cos has, unsurprisingly, no overlap with these large caps. The Ninety-One Special Situations Fund is 41% US companies and again has no overlap. So ironically although all “UK” highly diverse in terms of constituents and Geography of earnings.