TACO! – 28-05-25 – MMT Analysis

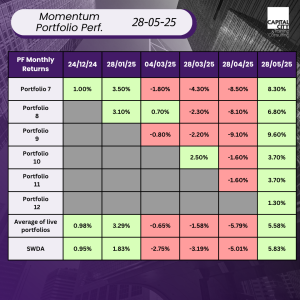

This is the 11th month of running our momentum portfolios and performance has rebounded for all funds and the index.

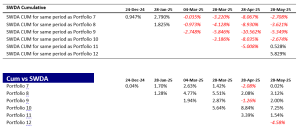

Is there value in the strategy? The following tables shows 1) cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see five out of six portfolios have outperformed in this period of volatility!

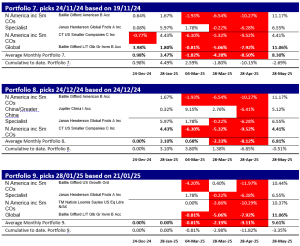

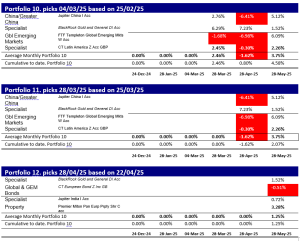

What are the factors driving the performance? Here are the individual portfolios:

=

Last month we led off with the comment that our valuation date was unfortunate in that the valuation date preceded a rapid recovery. That continued and May has given us the best month of 2025 so far.

The “TACO” Trade

A new buzz phrase has entered the market lexicon: the “TACO” trade. Trump Always Chickens Out. The president’s rapid deals watering down sanctions have been received very positively by the markets. President Trump delayed the imposition of Tariffs on two of the policy’s biggest targets – China and the EU. Both contributed to the improving market sentiment.

Gold

Gold continues to perform well (if less spectacularly) but fulfils its real role which is to be uncorrelated with – and currently negatively correlated – with equities. In the middle of the month gold was weaker.

Bond Yield Jitters

The general rebound aside, the question in the markets is moving away from tariffs and instead towards President Trump’s tax and spend package which is causing bond yields to rise.

Bank Performance

The financial funds have rebounded and there is good reason to think that this performance may continue.

There have also been a couple of corporate stories supporting this Bank stock story, namely the ending of Government support for ABN Amro in The Netherlands.

And RBS/NatWest in the UK “NatWest profits surge as bank nears full private ownership.”

“NatWest returns to full private ownership 17 years after £46bn UK bailout”

European Defence

European defence stocks also continue to perform well, Tariff volatility notwithstanding WDEP – a European defence stock fund has risen 16% since launch in March 2025 and European funds are dominating the momentum picture over the last 6 months, even if the short run is less appealing.

Momentum in May and a new Portfolio

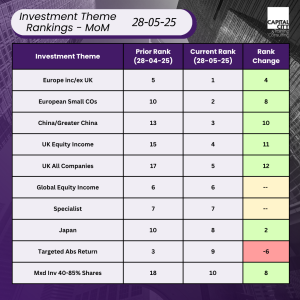

Continuing with the change in approach we began in March, i.e. looking at short run momentum as well, how different does the story look and will that give us a different portfolio? If we look at the short run momentum, the top ranked sectors are:

- Technology

- UK all

- UK small caps

- Global

Portfolio twelve

Given the uncertainty around tariffs, it is difficult to justify making a momentum bet based on the last four weeks: The UK has rebounded strongly following the quick deal with the US. The EU is in jeopardy as Trump threatens, then holds off, on imposing tough sanctions on the EU. Tech has rebounded on the TACO trade idea. Are any of these short run trends likely to continue? The UK is facing new tax raids; an EU deal is not assured. Tech has rebounded; the tariff threat seems diminished.

Momentum is not necessarily a strategy for all market conditions, and I would suggest that at the moment, until tariff uncertainty is removed, then I am unhappy to even suggest our previous pure momentum approach.

If not that, then what can we do? If we discount the UK and EU for now, what other trends are there? Perhaps a less tariff sensitive bet is as follows:

- Tech

- Financials

- EU defence stocks

If we are trying to outperform the SWDA, then perhaps also gold shares. Fundamental performance is strong and whilst gold may weaken as tariff concerns abate, broader geopolitical concerns remain. The miners will be very profitable and potentially continue to be rerated in a world with stable higher gold prices.