TRADE DEALS… BOOM! – 28-07-25 – MMT Analysis

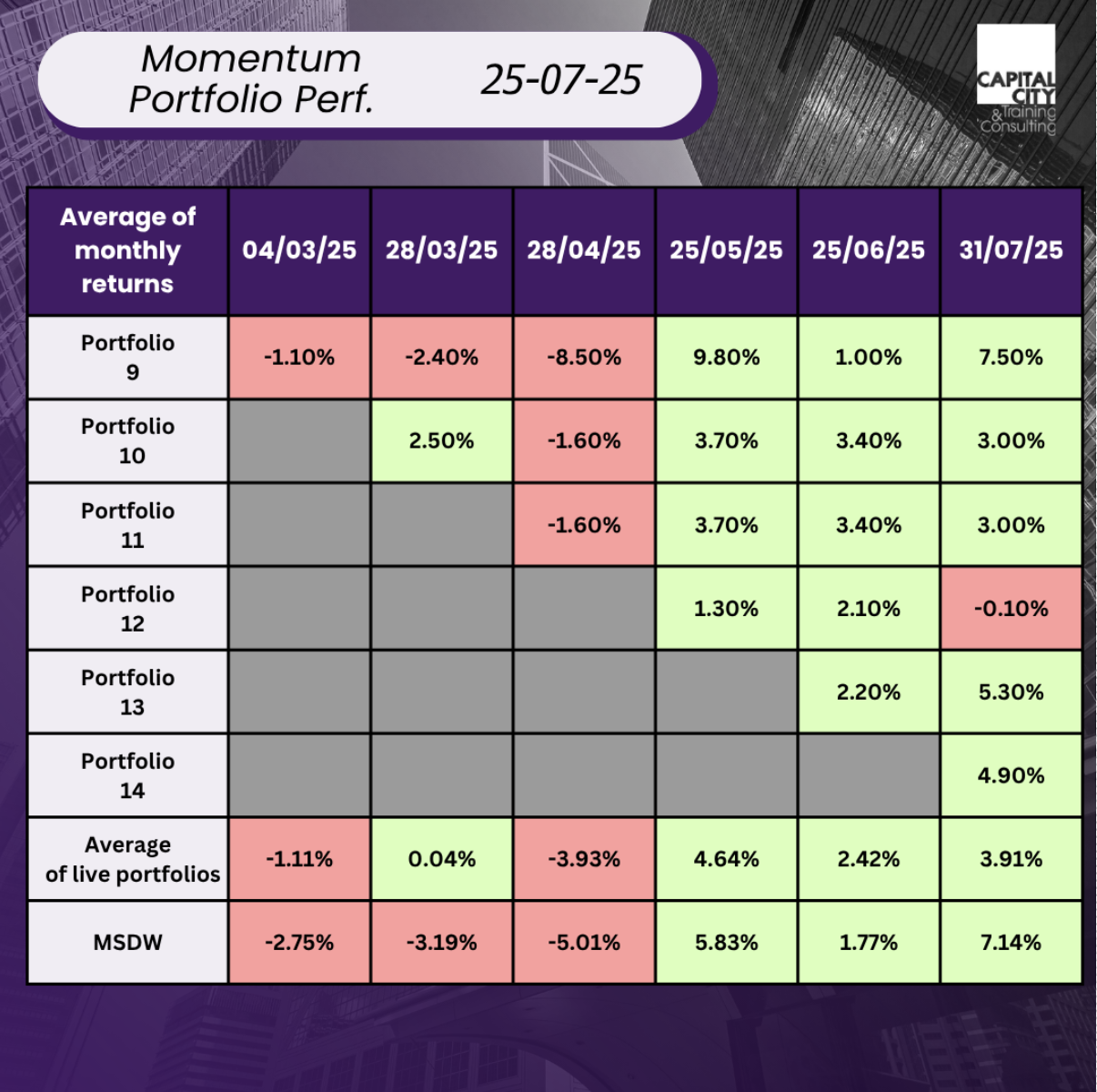

The positive momentum which started the month has carried through and the US markets and all the portfolios have moved up over the month.

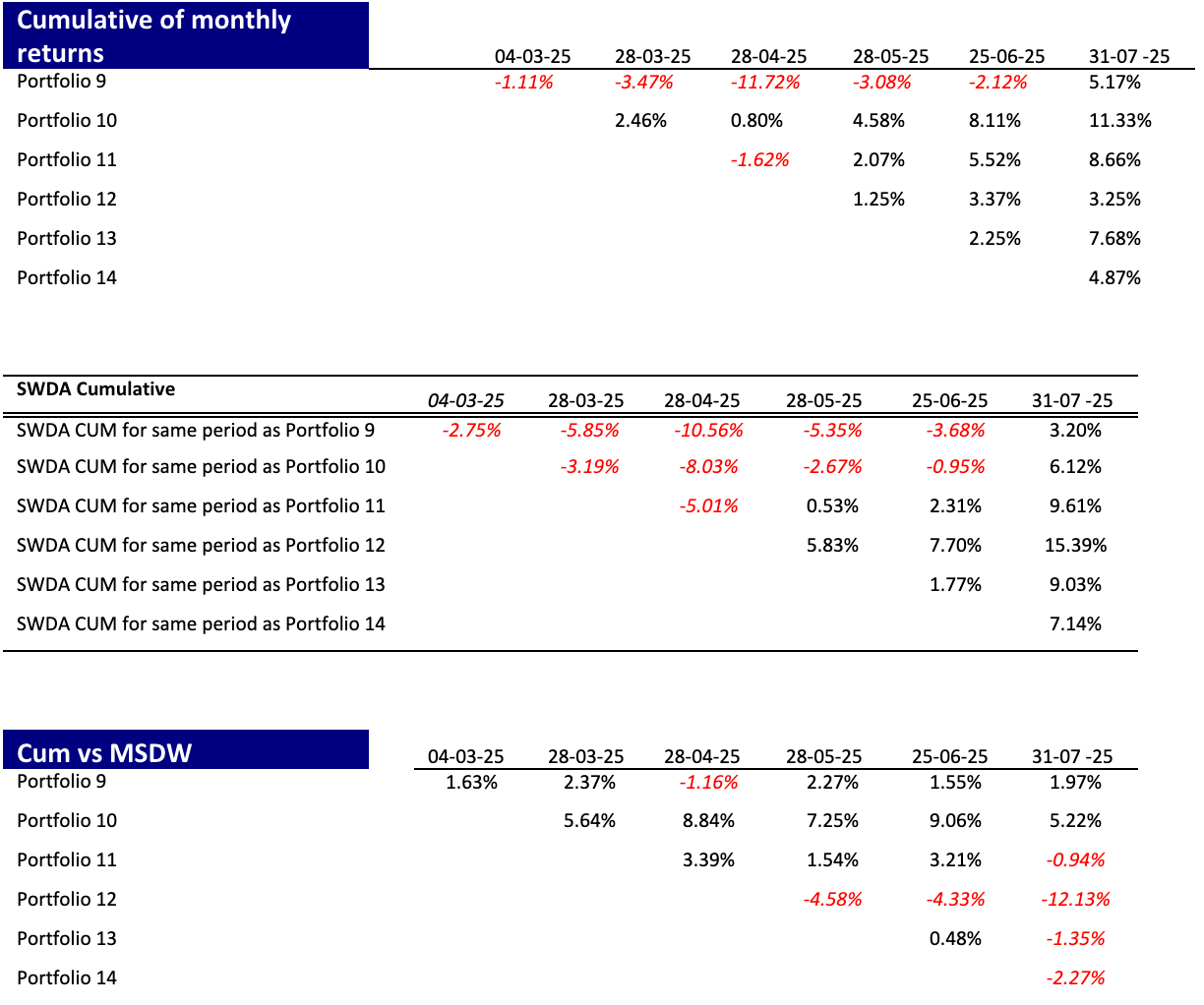

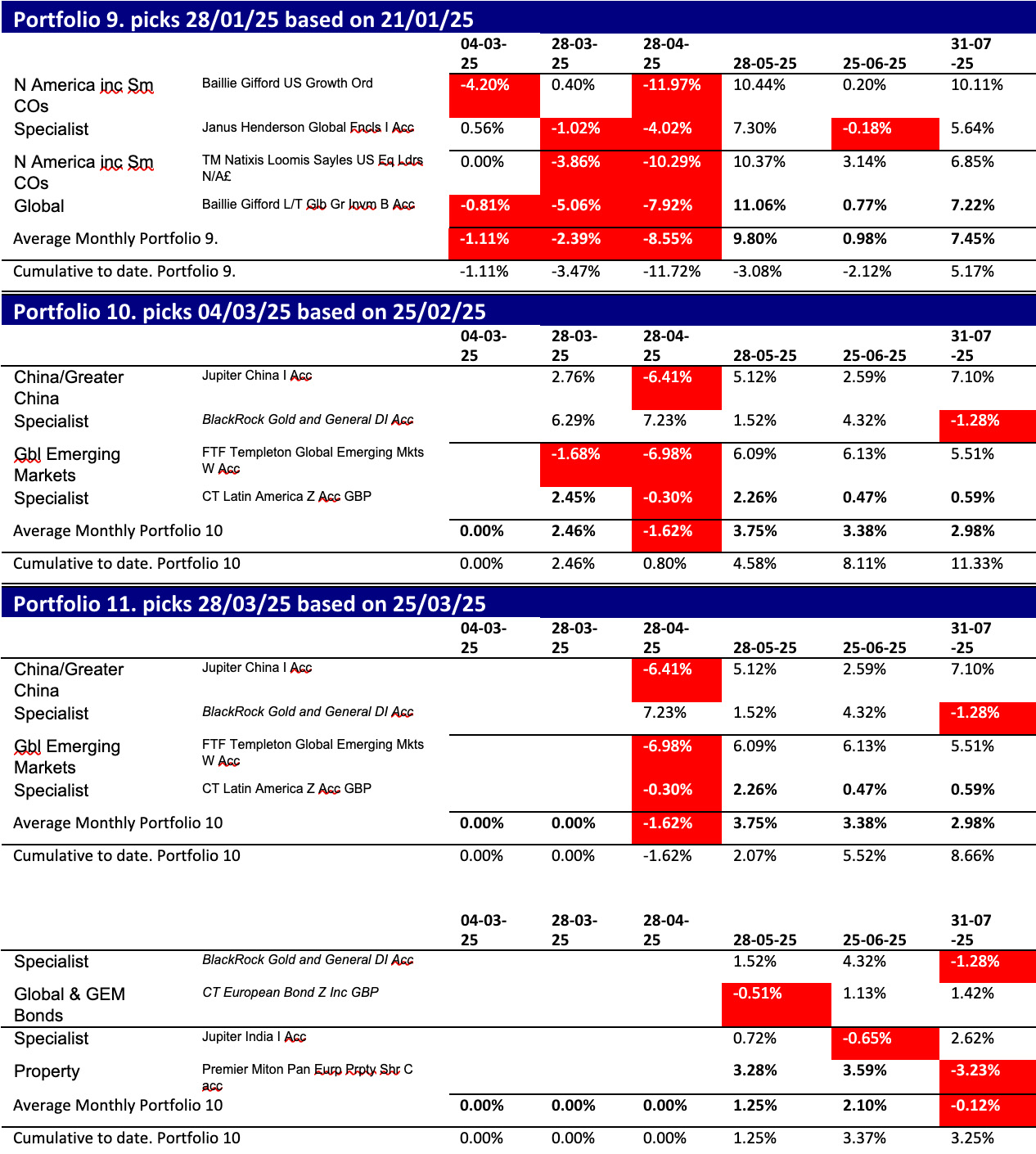

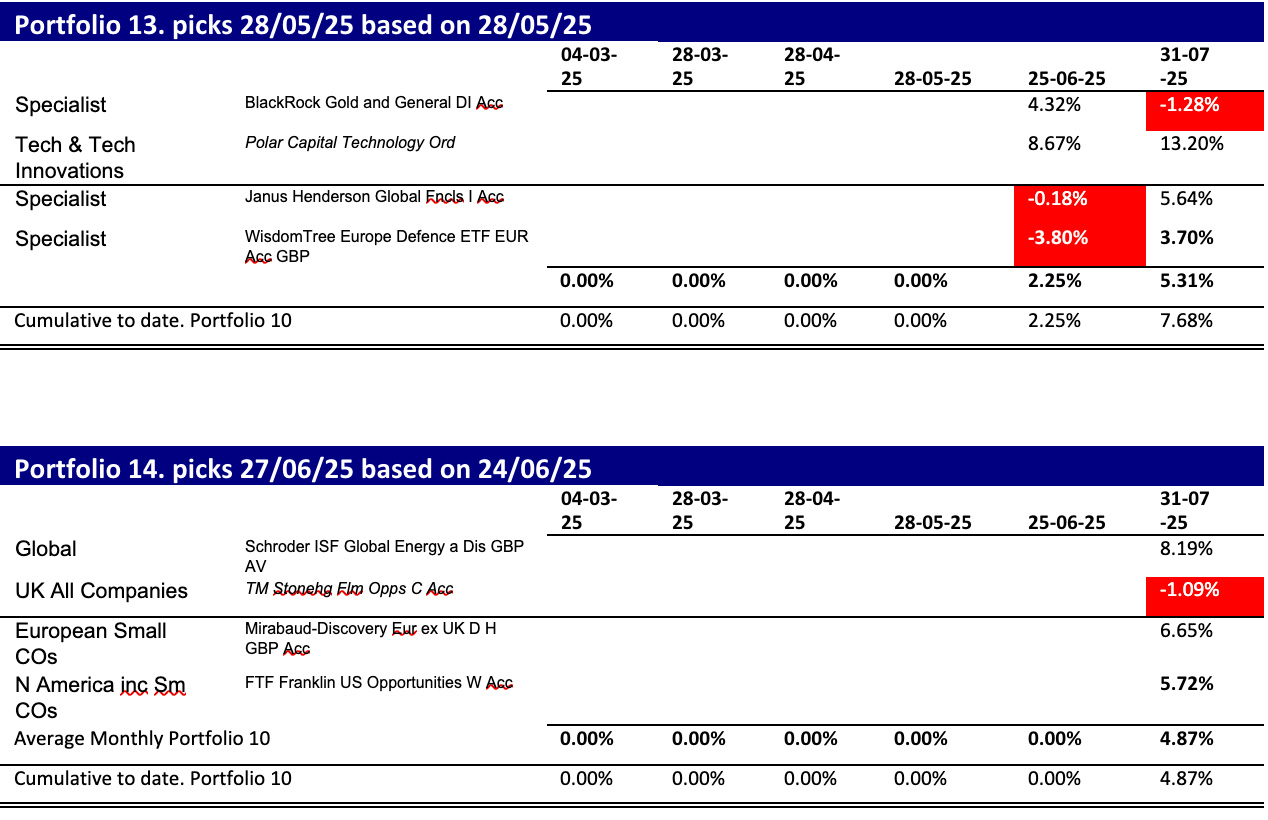

Is there value in the strategy? The following tables shows 1) Cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see five out of six portfolios have outperformed this month, longer term, the results favour SWDA.

US PERFORMANCE

At the risk of repeating the same message, the key issue here is US out/(under)performance. It dominates SWDA. An interesting question now is: “will the US keep pushing SWDA ahead of other markets”? Valuation articles last month were concerned about the difference between US and rest of the world valuations. Now the voices are shriller, and we keep hearing the word bubble!

The earnings season is underway, and a mixed set of results has not stopped the markets going better.

TARRIFS & TRADE DEALS

And it is being argued that US investors are looking through the potential short-term disruption from tariffs to the strengthening of US companies from reshoring and inward investment.

Two months ago, our headline was “TACO,” reflecting the markets recovery post “Liberation Day”. This month, trade deals around the world have moved markets up, Europe similarly has risen over the month, even if the post-deal response of EU member states seems to be one of remorse. And the US in particular has romped ahead.

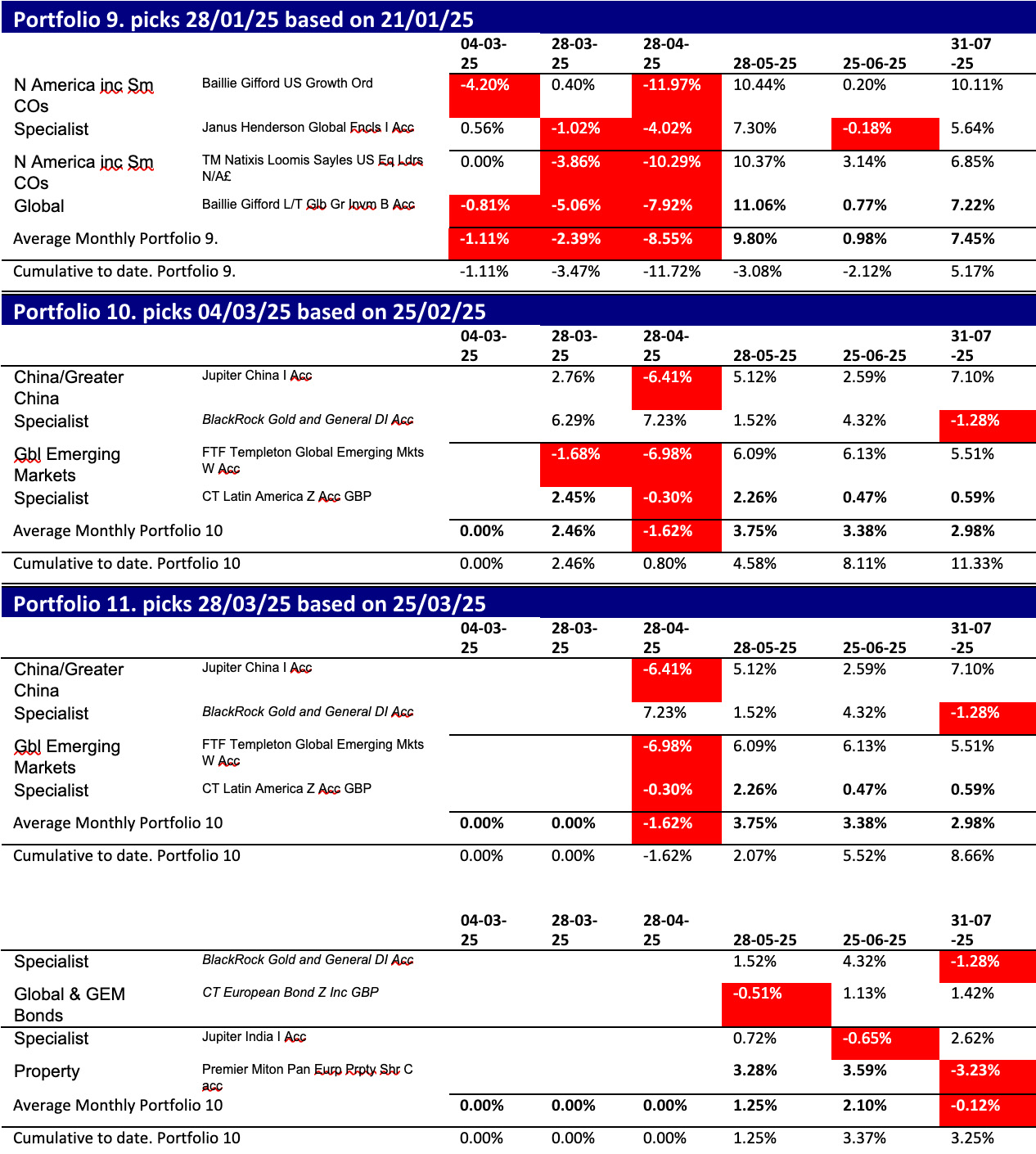

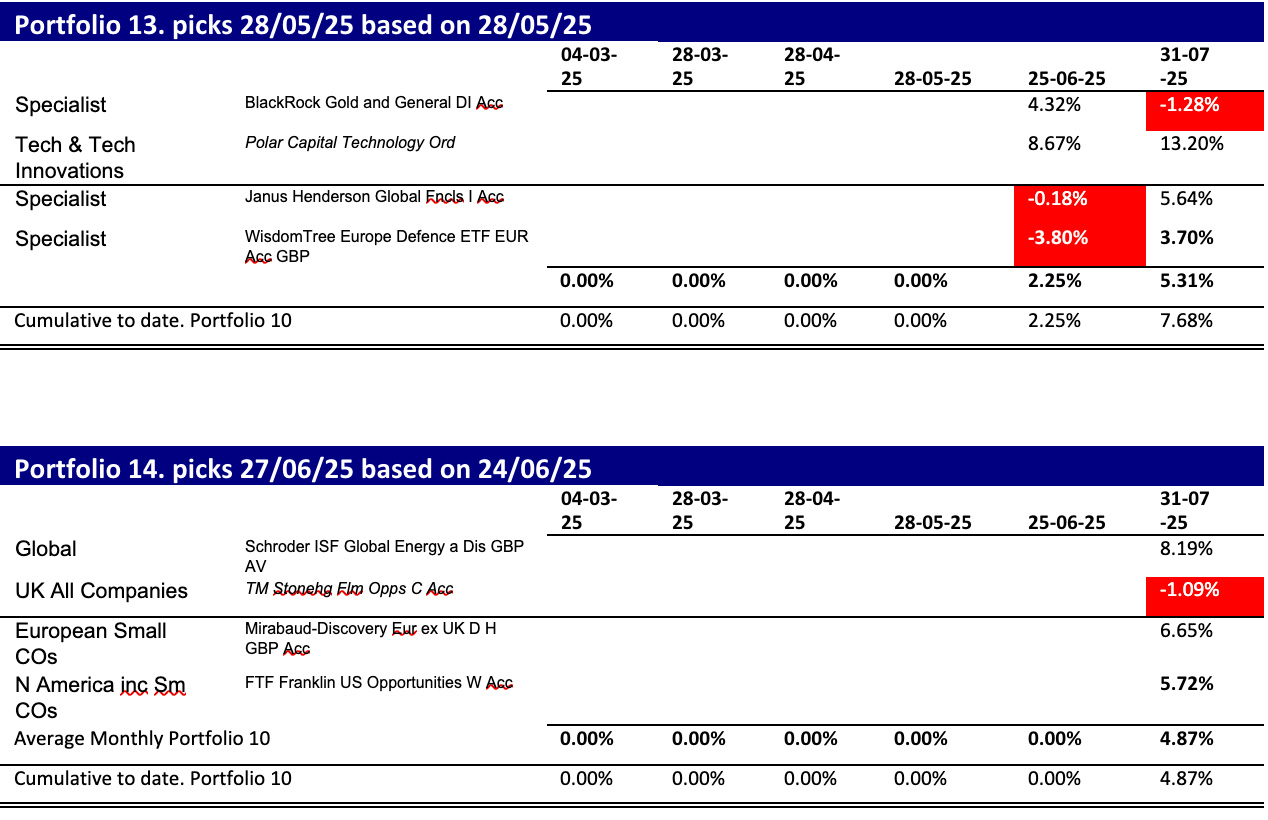

What are the factors driving the performance? Here are the individual portfolios:

SHIFTING MOMENTUM

Last month concerns in the US were over a recession and interest rates and the potential sacking of the Fed Governor. These have not been big drivers as Powell seems secure, even though weakening consumer demand seems real.

In the UK, recession and stagflation are increasingly concerns.

So, what have been our worst and best portfolios? In absolute terms our winner to date is portfolio 10:

The Best – Portfolio 10

All of its components, none of which are US, have all performed well. China is interesting, the Mainland market is flat, being dominated by old economy stocks, but Hong Kong in contrast is up 20% as Chinese investors seek out tech stock opportunities. So, an Asian spin on the tech theme. Equally Emerging markets which are the other big component of the portfolio have performed well. The argument here is that investors are diversifying away from US assets. This may be happening, but interestingly Credit Suisse’s family office survey shows its respondents staying firmly and heavily weighted towards the US markets.

The Worst – Portfolio 12

The portfolio has made a 3.5% return. However, the SWDA has returned over 15% in the same period. All of the components performed well as the US did badly but are now not benefiting from the rebound in the same way. European bonds – steady, now showing more typical low volatility, Blackrock gold and general slowing down as concerns over Iran and tariffs wane, India suffering over tariff uncertainty, particularly in light of President Trump’s threatening tone towards countries like India, indirectly supporting Russia through trade. In retrospect this looks like a low Beta portfolio.

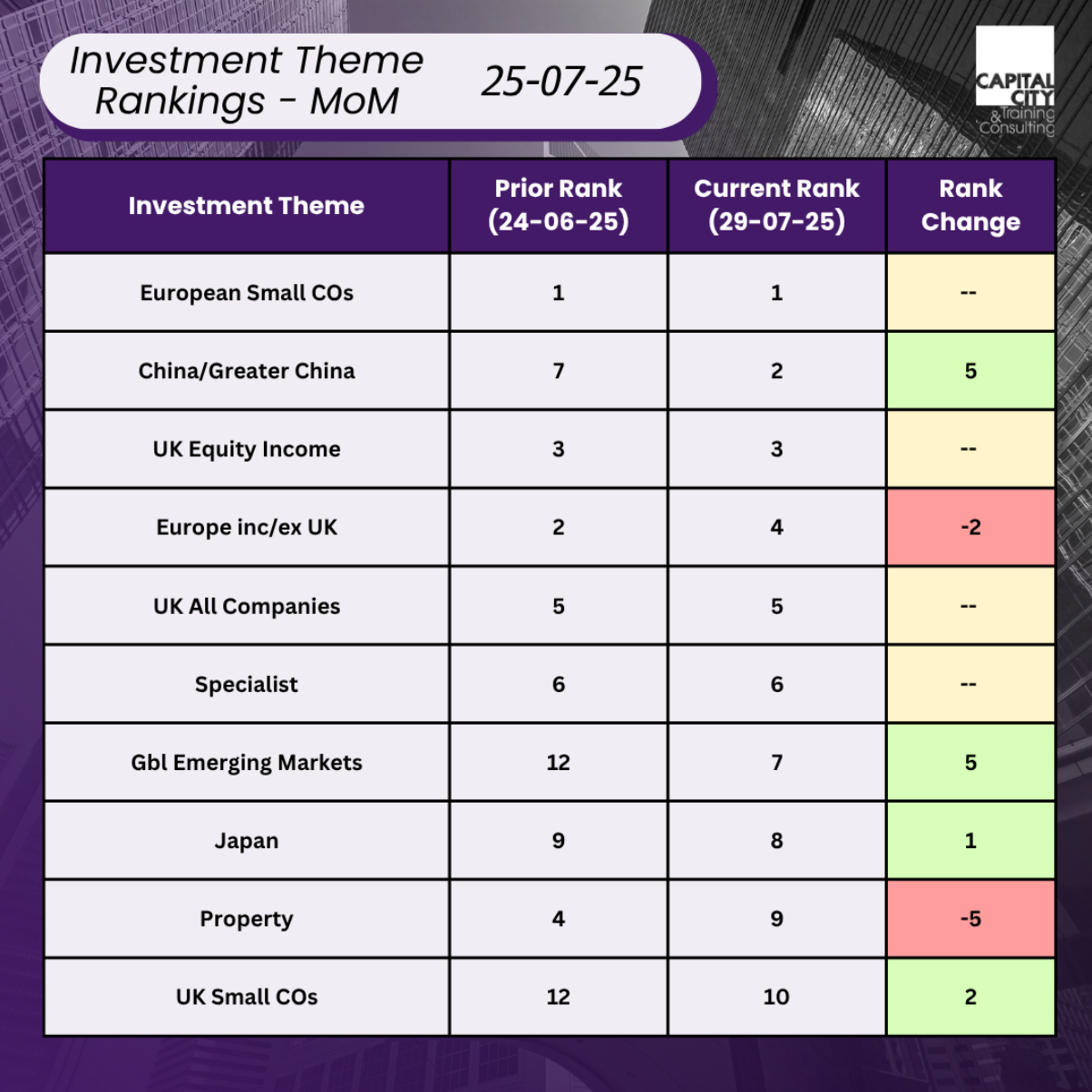

MOMENTUM IN JUNE AND A NEW PORTFOLIO FIFTEEN END JULY

Last month given how the trade arguments had calmed, we went back to a purer momentum approach, if we continue, then the 6-month data suggests:

- EU

- China (specifically HK)

- Maybe Biotech, OR

- Financials – in this case the US results season have been very good:

And EU bank performance has been spectacular (EXV1):

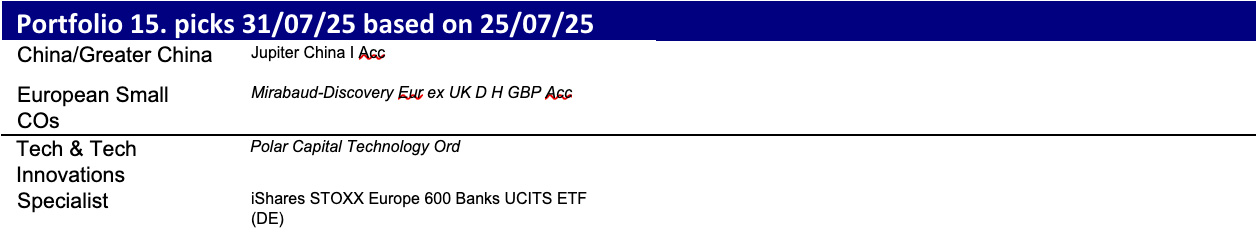

This presents us though with the classic dilemma of the fund manager, how much do I dare diverge from the index? If I want risk and to outperform, I should probably choose a tech heavy fund like Polar Capital as the Magnificent 7 and the NASDAQ are driving the US up: i.e. capture the driver of value at the core of SWDA.

This month’s portfolio:

US PERFORMANCE

At the risk of repeating the same message, the key issue here is US out/(under)performance. It dominates SWDA. An interesting question now is: “will the US keep pushing SWDA ahead of other markets”? Valuation articles last month were concerned about the difference between US and rest of the world valuations. Now the voices are shriller, and we keep hearing the word bubble!

The earnings season is underway, and a mixed set of results has not stopped the markets going better.

TARRIFS & TRADE DEALS

And it is being argued that US investors are looking through the potential short-term disruption from tariffs to the strengthening of US companies from reshoring and inward investment.

Two months ago, our headline was “TACO,” reflecting the markets recovery post “Liberation Day”. This month, trade deals around the world have moved markets up, Europe similarly has risen over the month, even if the post-deal response of EU member states seems to be one of remorse. And the US in particular has romped ahead.

What are the factors driving the performance? Here are the individual portfolios: