What is beta, levered beta and unlevered beta?

Beta is a measure of the systematic risk associated with investing in a particular asset or security. It indicates how sensitive an investment’s returns are to the overall fluctuations in the market. Beta is an important concept in corporate finance and investment analysis as it allows investors to evaluate the risk-return profile of an investment relative to the broader market.

Levered and unlevered beta refer to different ways of calculating the beta based on a company’s capital structure. The levered beta incorporates the impact of financial leverage, while the unlevered beta excludes it. Understanding the difference between levered and unlevered beta is crucial for cost of capital estimation, corporate valuation, and ultimately investment decision making.

Article Contents

- Unlevered Beta

- Levered Beta

- Levered and Unlevered Beta Formulas

- Impact of Leverage on Beta

- Comparative Analysis: Levered vs. Unlevered Beta

- Methods for Estimating Beta

- Calculating Historical Beta in Excel

- What is Adjusted Beta?

- Practical Application of Beta in Investment Banking and Corporate Finance

Key Takeaways

| Concept | Definition | Key Points |

| Beta | Measure of systematic risk of an asset or security relative to the overall market | – Indicates sensitivity of investment returns to market fluctuations

– Important for evaluating risk-return profile |

| Unlevered Beta (Asset Beta) | Beta reflecting only the risk of a company’s underlying assets and operations | – Excludes impact of financial leverage/debt

– Useful for comparing business risk across companies with different capital structures |

| Levered Beta (Equity Beta) | Beta reflecting the risk to equity holders, including the impact of financial leverage/debt | – Always higher than unlevered beta due to amplified risk from debt financing

– More relevant for equity investors and analysts |

| Formulas | Levered Beta = Unlevered Beta * (1 + (D/E) * (1 – Tax Rate))

Unlevered Beta = Levered Beta / (1 + (D/E) * (1 – Tax Rate)) |

– Formulas show how levered beta is calculated by adjusting for capital structure |

| Methods of Estimation | – Historical beta (regression of stock returns vs. market returns)

– Bottom-up beta (unlevering comparables) – Fundamental beta (using accounting data) |

– Historical beta is most common

– Bottom-up and fundamental methods provide alternative perspectives |

| Adjusted Beta | Adjusting historical beta to reflect expected future changes in risk factors | – Subjective adjustments based on analyst’s expectations (e.g., changes in leverage, business model) |

| Practical Application | Used in CAPM and WACC calculations for cost of equity estimation, capital budgeting, and investment decisions | – Levered beta used in CAPM and WACC formulas to account for financial leverage risk |

Unlevered Beta

Unlevered beta refers to the beta of a company and only reflects the riskiness of the underlying assets and operations of a business. Unlevered beta is also sometimes known as asset beta.

Levered Beta

Levered beta refers to the beta of a company that includes the impact of any financial leverage / debt the company may have, alongside also reflection the business risk. Levered beta can also be known as equity beta.

The levered beta of a company is always higher than the unlevered beta because financial leverage amplifies risk. The presence of debt financing increases variability in earnings and hence results in a higher beta.

Levered and Unlevered Beta Formulas

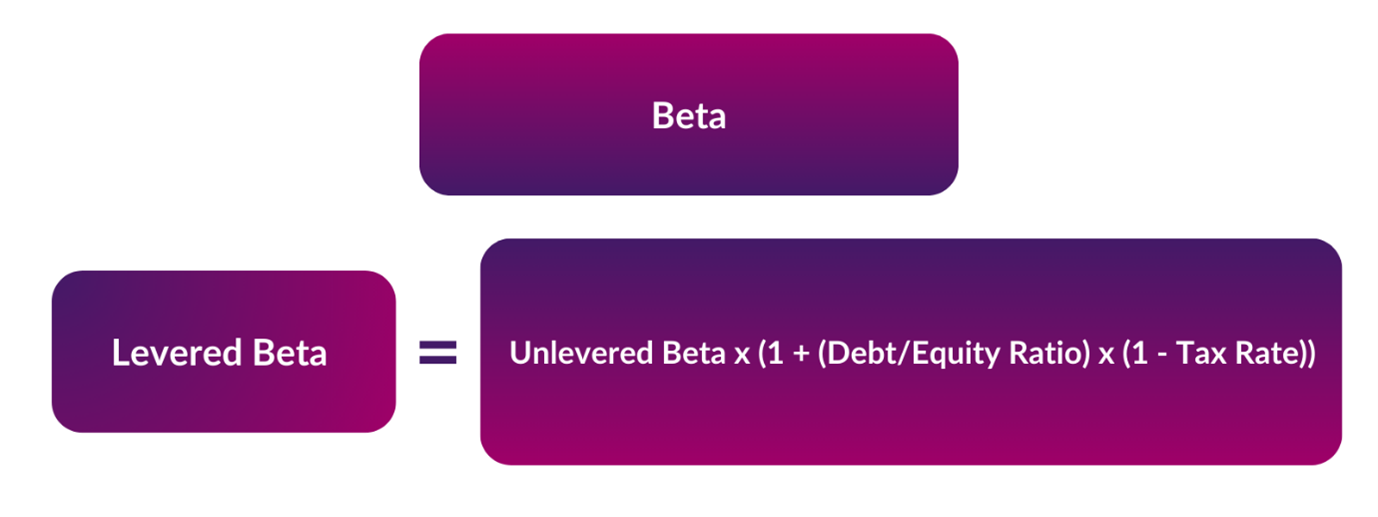

The levered beta is calculated using the following formula:

Levered Beta = Unlevered Beta * (1 + (Debt/Equity Ratio) * (1 – Tax Rate))

Where:

- Unlevered Beta = Beta of assets or operations of the firm

- Debt/Equity Ratio = Total Debt/Total Equity

- Tax Rate = Corporate Tax Rate

This formula demonstrates that levered beta is determined by adjusting the unlevered beta of the business based on the company’s capital structure.

Rearranging the formula, the unlevered beta can be calculated as follows:

Unlevered Beta = Levered Beta / (1 + (Debt/Equity Ratio) * (1 – Tax Rate))

Impact of Leverage on Beta

To understand why financial leverage amplifies risk and results in the levered beta of a company always being higher than the unlevered beta, it is worth considering how debt financing increases the variability in net income. When a company has higher levels of debt, its interest expense increases, making its net income more sensitive to changes in revenue. This increased sensitivity to market movements results in a higher beta. Therefore, a firm with a higher debt-to-equity ratio will experience more pronounced swings in its stock price compared to a similar firm with less debt, all else being equal.

Comparative Analysis: Levered vs. Unlevered Beta

In capital budgeting and corporate valuation, unlevered beta is often used to understand the pure business risk, especially when comparing companies with different debt levels. Levered beta, however, is more relevant for individual investors or equity analysts who will typically be more focused on the risk to equity holders. The choice between these two measures depends on the specific financial analysis being conducted and the aspect of risk one is trying to gauge.

Methods for Estimating Beta

There are several methods used to estimate beta:

- Historical beta – calculated by regressing historical returns on the stock against historical returns on the market index

- Bottom-up beta – estimated by unlevering betas of comparable companies and calculating an average / median

- Fundamental beta – derived from current and predicted fundamental data / accounting numbers for the company

The most common approach is using historical returns data to run a regression analysis and calculate beta. The financial industry typically uses 2-5 years of monthly returns for the calculation, however daily or weekly returns are also sometimes used. Historical beta relies on past market data, which might not always be indicative of future trends.

Bottom-up beta, which involves unlevering betas of comparable companies, can provide a more sector-specific insight but requires accurate identification of comparables.

Fundamental beta, derived from fundamental data and accounting numbers, attempts to predict future beta based on a company’s current financial situation but may not fully capture market sentiments.

Calculating Historical Beta in Excel

Beta can easily be calculated in Excel using the SLOPE function. The steps are:

- Obtain a time series of returns for the stock and a relevant market index (e.g. FTSE 100 for a UK stock).

- Use the data to calculate the covariance between the stock and market returns.

- Calculate the variance of the market returns.

- Beta is equal to the covariance of the stock and market divided by the variance of the market.

In Excel, the formula would be:

=SLOPE(stock returns, market returns)

This formula calculates the beta directly by doing a regression analysis between the two return series.

What is Adjusted Beta?

Adjusted Beta is the result of adjusting the historical beta of a stock to reflect expectations for the future. This adjustment is subjective but important for forecasting beta, since the past may not always represent the future accurately.

Reasons for beta adjustment include:

- Expected changes in leverage

- Possible changes in business model / mix, as a result of new projects / investments or structural changes to the company (e.g. mergers, spinoffs, divestitures)

Analysts adjust historical beta to estimate a forward-looking beta that reflects their views on expected risks. Various techniques are used for beta adjustment.

For instance, if a company is expected to increase its leverage in the future, its historical beta might underestimate future risk. Therefore, an analyst might adjust the beta upwards. Similarly, if a company is expected to diversify its operations, reducing its overall business risk, the beta might be adjusted downwards. This adjustment process is not standardised and varies depending on the analyst’s judgement and the specific circumstances of the company.

Practical Application of Beta in Investment Banking and Corporate Finance

The main practical application of beta in investment banking and corporate finance, is within the Capital Asset Pricing Model (CAPM), where beta is used to quantify risk and help estimate a cost of equity. This cost of equity is then often utilised to calculate a Weighted Average Cost of Capital (WACC) which in turn is used in capital budgeting and investment decisions.