From the lockdown baking book of finance…

Forget the lockdown sourdough baking challenge that has trended over the last year, we have seen in action this last week how to cook up the perfect storm and nearly bankrupt a hedge fund!

For the home-bakers of finance out there who want some clarity on the subject, I thought I could share with you the recipe of these mini-disasters. Follow the recipe below and it’ll leave you with some food for thought.

Ingredients

- One overvalued, poorly performing company with publicly listed stock (please note you’ve got to have the right type of stock for this recipe)

- Some cash (margin) or other acceptable low-risk collateral to cover your short position with the broker

- A dash of hope – that the stock price will go down

- A social media frenzy to act as the ultimate retail investor raising agent

- More cash to cover your margin calls

- More cash to cover more margin calls

- ….you get the idea….

Voila! The recipe for a perfect disaster.

The final result will be thrust into your face, you big disgrace, having shorted the stock all over the place…(other similar catchy, spanning phrases are available on request). This is what hit Melvin Capital last week. Assets down 53% in January, even after a $2.75bn injection to keep them covered.

Wow, shorting sounds mad and bad!

No, short selling in itself is not bad. Many would agree that it makes for efficient investing – with funds being able to express/monetise a negative view on a stock. Long-only limits opportunities and the only action that funds can take to express their negative view of a stock is to ‘not buy’ it. With shorting, if a stock looks to be overvalued based on the fundamentals, then short selling will capture the over-valuation and indeed push the price in the right direction. More efficient markets, right? Yes, in the longer term. But in the short term? Well……. this recipe for disaster can bake you up a big problem!

The method

To understand the ‘method’ for this recipe, it makes sense to first make sure you’ve got the nuts and bolts of the stock lending market. We can then overlay the factors that made the GameStop situation so different – and a bit of a curveball.

The simple short selling formula to making money is that the hedge fund borrows the stock, sells at current price, buys back when it’s cheaper to return the stock to the original owner. It’s not buying stock, so needs no capital: just a margin to its broker to cover any possible rise in price in the immediate term. Typically, around 5% maximum. Trading on margin? – nothing like a bit of leverage to spice up any trade. With just $5 outlay you can gain exposure to $100 of company stock.

In fact, ‘stock lending’/ ‘borrowing’ is a misnomer. The trades are actually structured as purchases and sell-backs by the hedge fund (sale and buy-back by the broker). How else could the hedge fund be allowed to sell the stock? It needs to be able to settle, and if it’s not the legal owner then it can’t!

The borrowing

The hedge funds get access to the stock as one of the services offered by their prime broker. The brokers will borrow from ‘buy and hold’ investors who have no intention to sell in the immediate term. Think of the index funds for example, who buy and hold, rebalancing only quarterly. The average borrowing period is in the region of only 2 weeks. Often less. The lender will charge a fee – and the broker will take a small slice of course, too. But note: the ability to lend must be in the original fund mandate, and only those investors who are holding longer term, not the speculative, shorter term investors.

There will be times when the stock is harder to borrow – E.g. it may be scarce in dividend season, or with earnings announcements. The stocks become ‘hot stocks’ to borrow and costs spike.

So, to clarify your fund’s position, let’s say you have borrowed $100 of stock through your broker. The broker has sold it in the market for you. You now have $100 cash, $100 of stock borrowed and you have posted $5 of margin. If prices rise, it’s going to cost you more than the $100 to buy back: the broker wants to make sure you can buy back at the higher price – hence the initial 5% margin; acting as a buffer to any rising price. If you’re not going to buy back at, say $102,103,104….. the broker will ask for more margin. If you don’t settle the additional margin? Your position will be closed out and your losses will be realised.

The GameStop imbalance – the perfect storm

So, what was it that made the GameStop situation extreme?

The GameStop scenario became precarious due to the notable imbalance in the borrowing market. It got so extreme on the short side that there was no easily-accessible stock to borrow and short.

Normally, markets move slowly and liquidity returns so that there is no significant issue. The Reddit social media community made things different this time.

Word got out about the imbalance in the shorting market due to the significant short positions taken by hedge funds. The word spread quickly: a short squeeze might happen. Momentum gained and Reddit followers started buying a slice of the GameStop action. Even if the stock crashed, they could afford a loss on a small position. Have a go! The accumulation of buying power however, just catapulted the market price upwards.

So, what happens to the hedge fund with $100 of short positioning and $5 margin? They must post more margin. Where from? Pledging other positions. They really want to continue the shorting trades to balance out the buying frenzy going on – but they can’t find any GameStop to sell. Well, they can get hold of some, but the borrowing costs have spike to an annualised 32%! When I worked at Barclays, 2% was considered pricey!

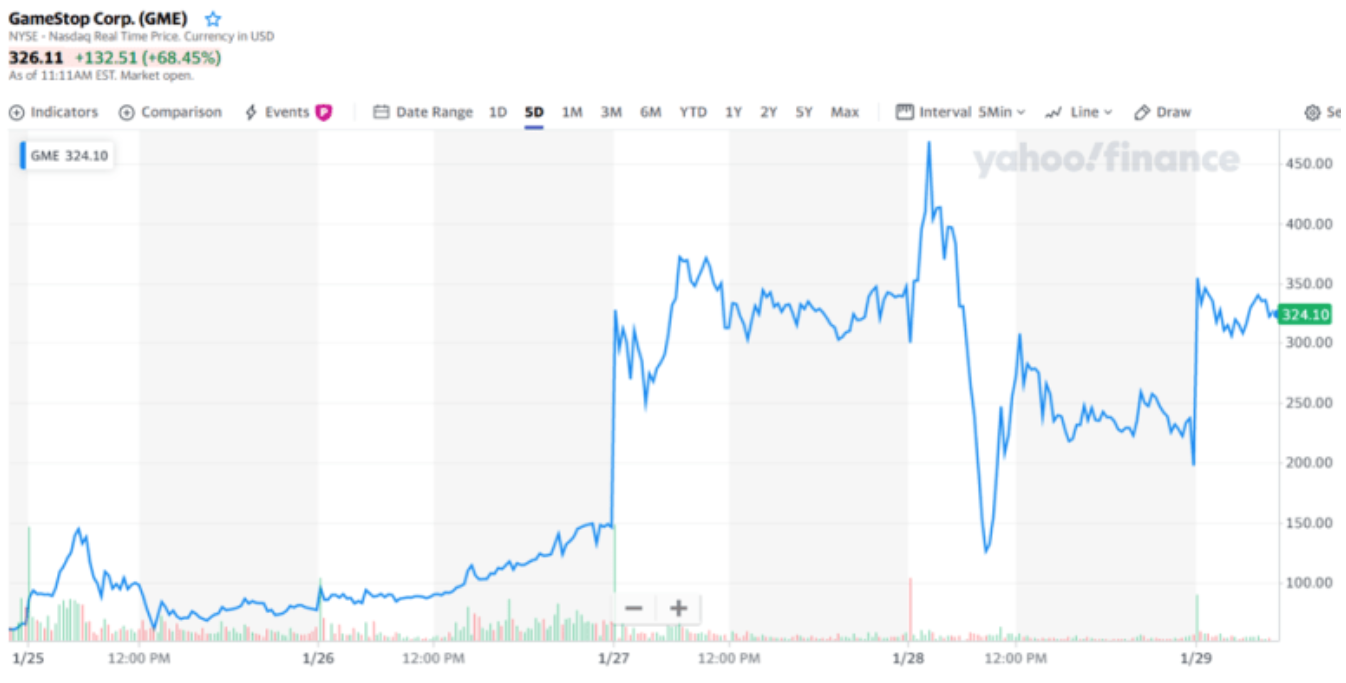

Now, the price keeps moving up. Knowing a squeeze is starting you panic. You cannot afford the margin calls. At best, you can afford it for now, but can see your collateral assets being consumed before your very eyes. So, another step is to close your short positions to limit your losses. That means buying back stock, that pushes the price higher still……. Ping! What a horrible corner to be stuck in. Look at the chart below on 27 January. It’s a quick death at least.

In ‘normal’ situations, the buyers would see the upward movement to a reasonable level take their profits and a fair, stable market price would be achieved. Alternatively, the price might stay low and the HFs proved right, realising their gains. But not this time. The Reddit people just bought, held on, reducing the free-float, and eliminating the ability for shorters to continue their trade.

A final thought

So, is this a victory for the underdog against the hedge fund elite? Many would have you think so. But this kind of instability is damaging all around to market confidence. It creates a disconnect between the market prices and fair value and undermines the whole reason for the markets in the first place.

With my rational hat on, I can just see it as a simple, short-term imbalance between supply and demand. Things will calm down and my confidence will be restored. And besides, as long as my portfolio is diversified and not overly leveraged, I’m ok. But I’m not Melvin Capital.