Hi-HO Silver AWAY! Momentum up! Will the resource grab take metals to new highs?

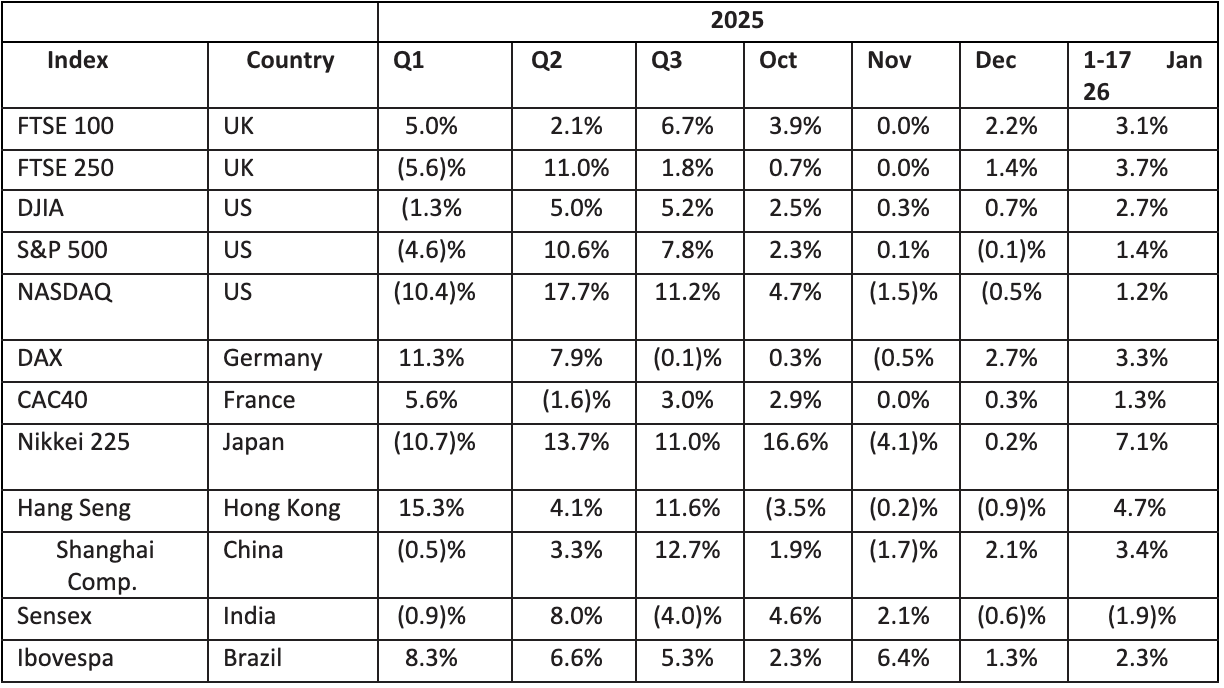

The big momentum story is largely unchanged: Precious metals and miners are the big story, the rotation out of US and into Emerging markets and Europe carries on.

A very positive start to 2026:

Notwithstanding the excitement in markets briefly caused by President Trump’s threat of sanctions to Europe over Greenland.

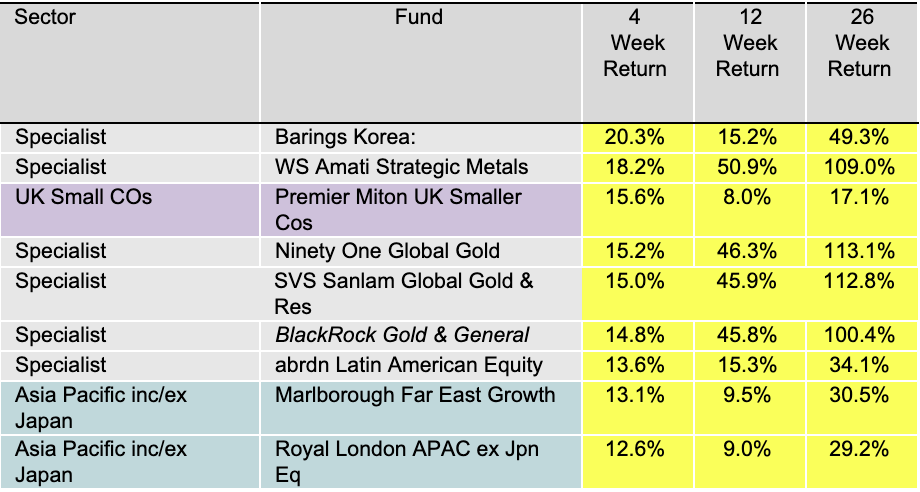

Precious metals and miners continue to perform

The big momentum story is largely unchanged: The dominance of precious metals and miners continued, as you will see with all of the specialist precious metal/miner funds being in the top 10.

Source: SaltyDogInvestor.com

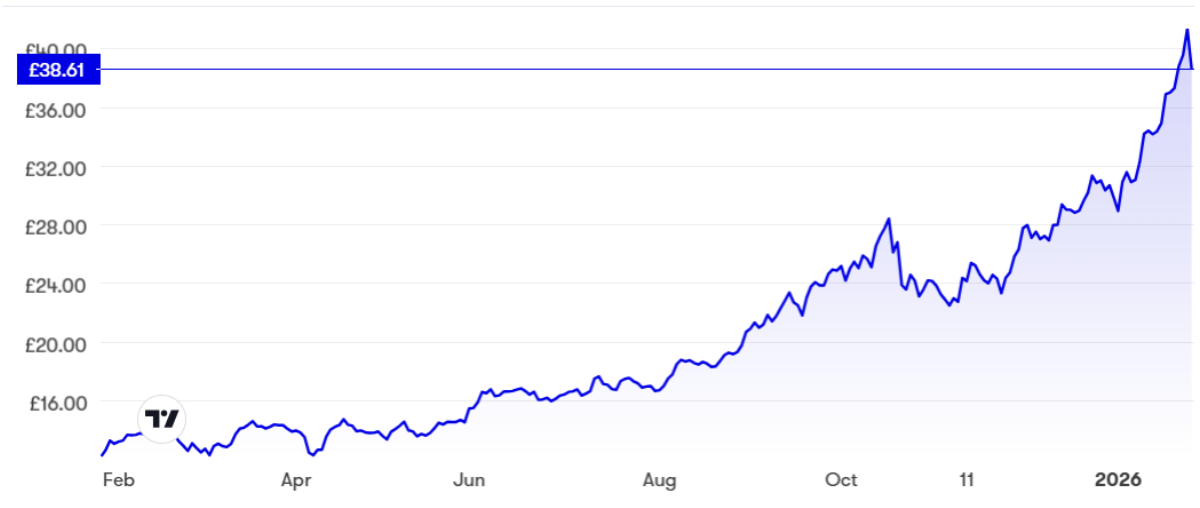

Silver picks up pace

The breaking of new records for gold and the transfer of momentum to Silver has been dramatic!

Silver has set a series of new records, and the momentum does not look likely to diminish.

As I write, silver is off its peak in Europe at 115.01 USD/ounce. Meanwhile in China, the country’s largest precious metal recycler, RongTong Gold is offering citizens 128.52 $/ounce.

It appears this story is not over.

A turning point in history?

The current situation feels like a historic turning point, like 2020, when the 30+year bull market in US treasuries ended. Yields- which had peaked in the low teens when I entered banking in the 80s- fell to a fraction of a percent in (0.65% for the UST 10 yr) before rising back to the 4.5% we see today.

China’s military aggression and its response to Trump tariffs, i.e. choking supply of rare earths and of key military metals like Titanium have sparked a resource grab/retaliation, namely the US’s denial of Venezuelan oil to China. China is stockpiling silver throwing into sharp relief the persistent supply shortage in silver and its key importance in so many green technologies – solar panels, new solid-state batteries and so on. It does no harm that relatively cheap Silver, “poor man’s gold” is also an asset to acquire to protect against the debasement of fiat currencies. Silver is no longer cheap compared to gold in historic terms, but the dynamic for Silver in terms of supply and demand is very problematic in the short run.

Central Banks continue to buy gold as they diversify reserves.

Threats of instability, such as the demonstrations in Iran will always provide a short-term fillip to precious metals, but precious metals will stay important as globalisation continues to reverse.

The above is very much a personal perspective, but I think I’m joining the dots, rather than putting on a tinfoil hat!

The transfer of momentum from gold to miners noted last month is also happening in Silver.

ETFs can offer niche focused plays, without going all-in on a single stock

A gap in the investment fund/trust analysis that I use in my investing is that it does not cover a much wider universe of ETFs. The following chart is of a small ETF that I own. Were it included in the SaltyDog analysis it would be the top performer. Writing a momentum newsletter does give me some good trade ideas!

![]()

SILG: Global X Silver Miners ETF (USD)

It is also frustrating in that as a designated “retail investor” by my international broker, I can’t buy straightforward US and EU listed non-UK compliant ETFs like SILJ (small-cap Silver miners) and EXV1 (EU bank stock ETF run by BlackRock – can you believe it). But I’m not bitter.

One implication of the rise in precious metal prices is an increase in inflation and the move up in commodity prices generally that I highlighted in December has continued.

Commodities more broadly are being affected by metals and geopolitics

WCOB – a broad commodity ETF.

For now, this rise in inflation seems benign in the US, investors read it as showing growth.

Emerging markets start 2026 as they ended 2025: strongly.

In terms of interesting opportunities, a market which has only just turned up in the top 20 is Korea. The story is somewhat like Japan, regulatory reform to improve governance and successful technology businesses. This is probably an interesting direct bet – rather than doing emerging markets more generally. Having said that emerging markets funds have all been positive contributors this month to the various portfolios: FTF Templeton Global Emerging Markets (GB00B7MZ0J00, +10.87%), Royal London APAC ex-Japan (GB00B5ZNJ896, +11.86%) and Liontrust Latin America (GB00B5ZNJ896, +13.24%) – all over the last 7 weeks.

find us on substack & Youtube

Our Portfolios

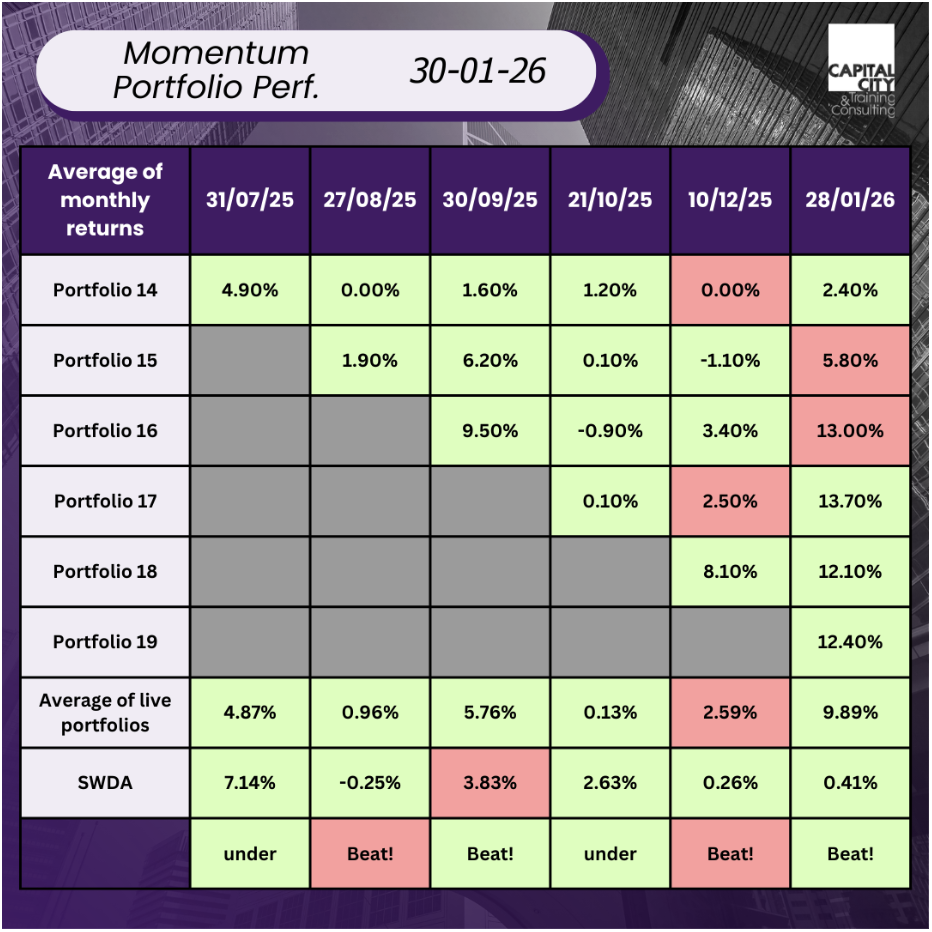

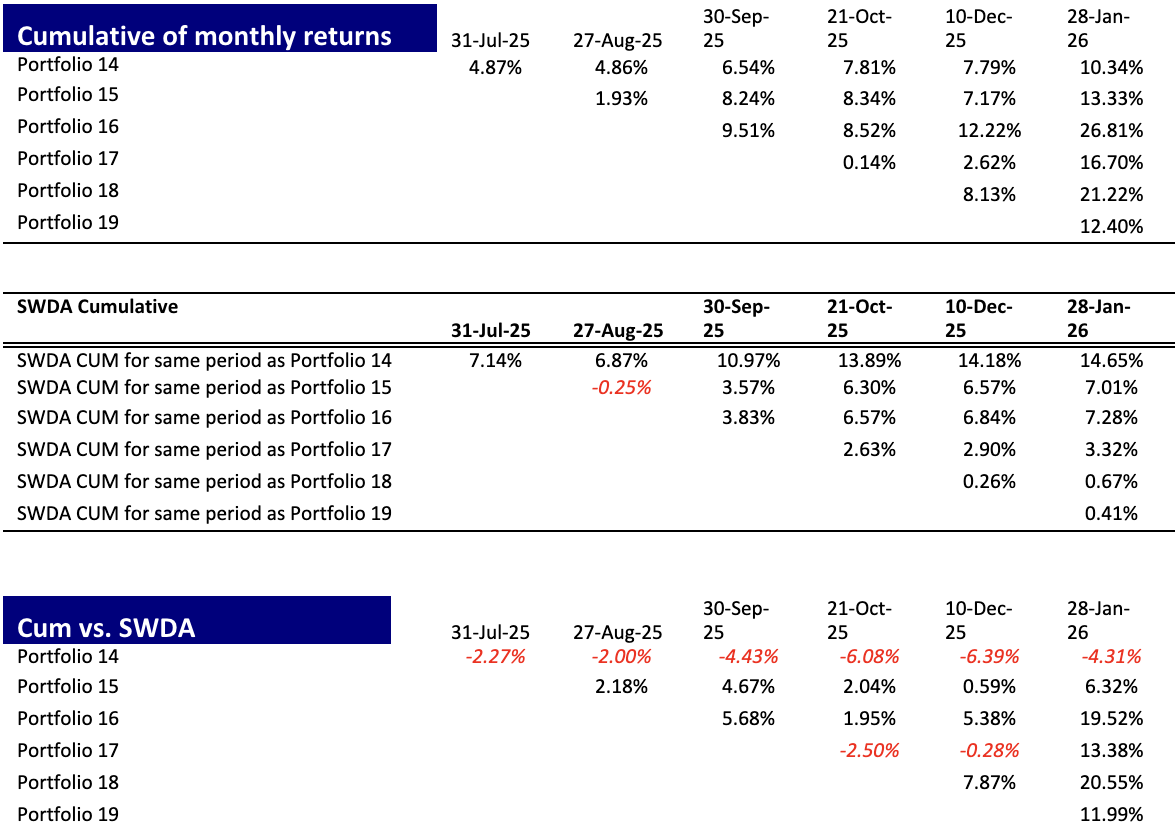

So how have the portfolios performed?

Performance has been excellent in all of the last 6 portfolios.

Is there value in the strategy? The following tables shows 1) Cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see five out of 6 portfolios have outperformed on a cumulative basis.

Why so successful? The argument against active managers is that “on average they don’t beat the index. Why pay the Fee?” Our benchmark index, SWDA, is heavily US and heavily tech and “Magnificent 7” weighted. While the US and the Mag-7 lead the world, this index is hard to beat.

The rotation is real, as the Mag-7 fragment

Our outperformance reflects the fact that investors are allocating to emerging markets, which are consequently outperforming the US. Investors are also turning from the Mag-7 which is also fracturing: performance of these companies is diverging and so is sentiment outwards them.

AI is also affecting sentiment to software stocks.

The outlook for the US is not bad: the Russell 2000 has just put its best performance against the S&P since 2008. Earnings growth is expected at 8.2% for the S&P.

I think my conclusion last month, that “there is a good argument that the strategy will outperform SWDA over the next 3-6 months” still holds. rising inflation and a knock-on rise in the US yield curve. The plus side is a strong earnings outlook for US large caps.

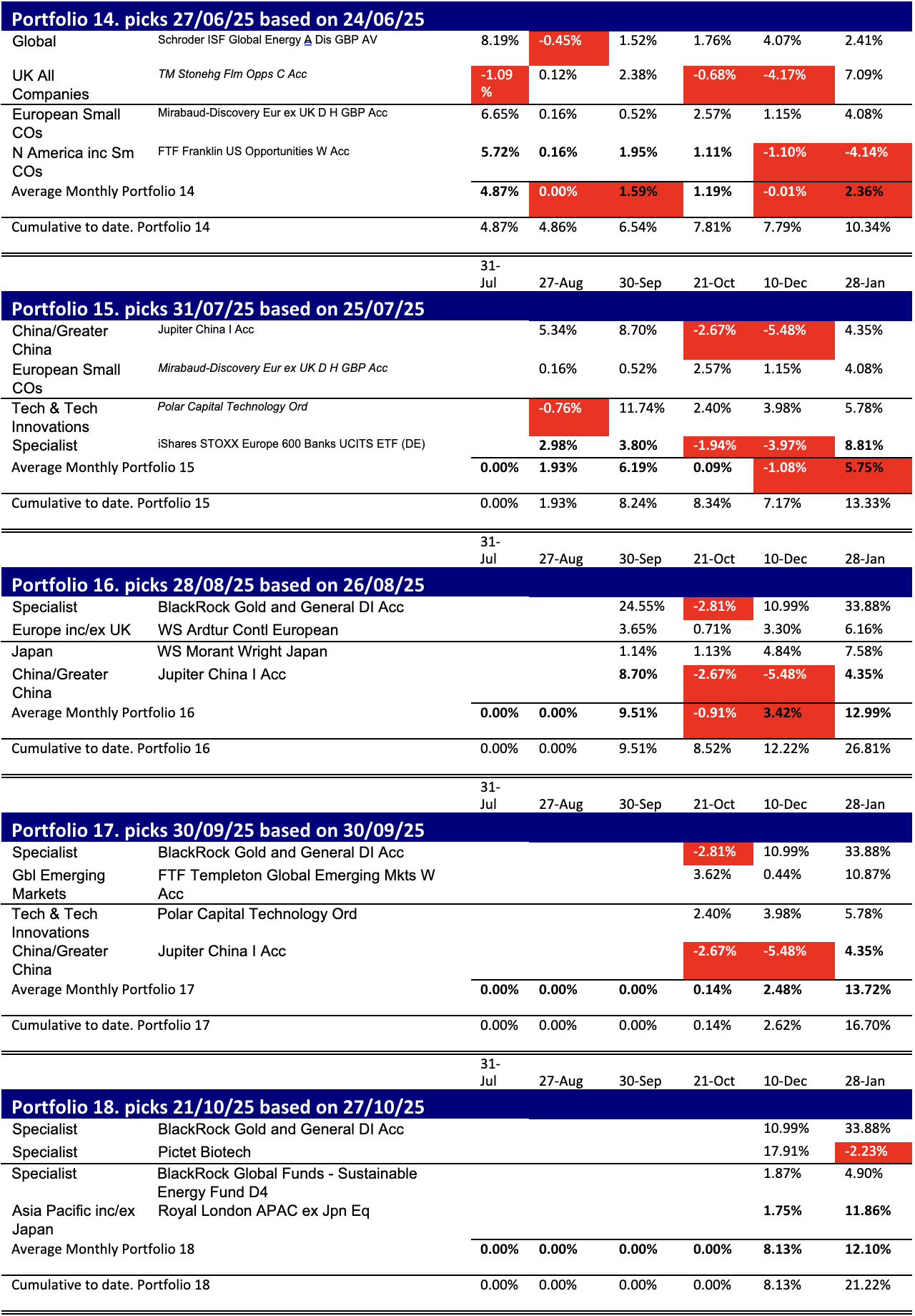

How have the individual portfolios performed?

So, what have been our worst and best portfolios: The best current portfolios are portfolio 16 (again) and last month’s portfolio 18 (again). having achieved total returns of 26.81% and 21.22% respectively over 3 and 1 months (yes 1 month!), all beating our benchmark the iShares MSCI world index (SWDA). Portfolio 14, our worst, has returned 10.34% over 6 months but has significantly underperformed SWDA (SWDA returned 14.65%over the same period).

The best portfolios

Portfolios 16 and 18 has gold/gold miners and good performances from a mix of biotech, Europe, Japan/Asia, and Lat Am.

The worst portfolio 14

Portfolio fourteen has only one loser, its UK exposure, undone by the impact of the UK budget on the FTSE 250. One bright month for UK mid-caps was just that. The FTSE250 was one of the worst performers of major indices in 2025. US small caps disappointed for most of this period too. That seems to be changing now.

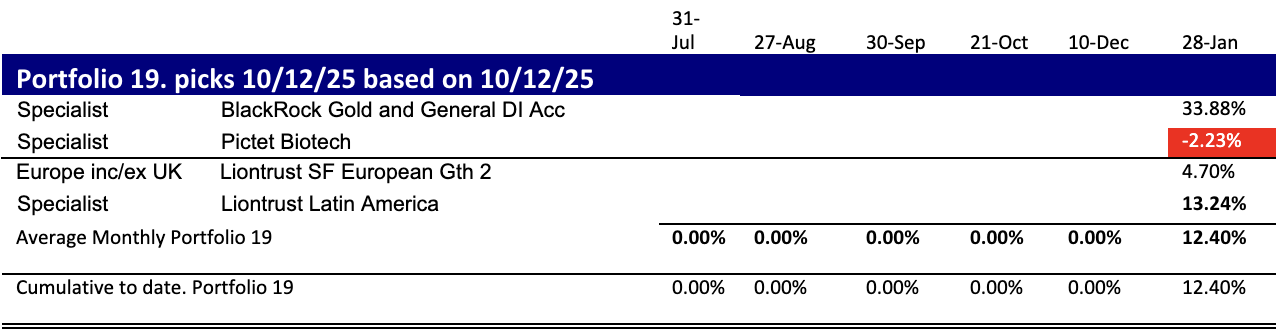

Momentum in November and a New Portfolio Nineteen End 1st Week December

Staying with the pure momentum approach, if we continue, then the 6-month data suggest:

- Silver

- Gold and gold miners

- Emerging markets

- Asia Pac ex Japan.

If we look at the last four weeks as a guide, then we get the same picture: so I will stick with the broadest trends silver, gold and the rotation away from the US to EU and Emerging markets, in the latter case – Brazil in particular.

This month’s portfolio