Internal Rate of Return (IRR): Formulas, Examples and Implications

The Internal Rate of Return (IRR) can be viewed as the rate of return implicit within a set of cashflows. It could be interpreted as a sort of compound average growth rate (CAGR) – because it essentially is, but the cash flows are periodic rather than from one point in time to another. Think of it as a compounded average rate of return over a project / investment’s life.

It is one of the key financial target measures for return on private equity investments.

IRR is pivotal in capital budgeting, enabling the measure and comparison of investment profitability. Within the realm of corporate finance, IRR facilitates the ranking of various investment projects based on anticipated returns.

Article Contents

Key Takeaways

| Description |

|---|

| The compound average rate of return in a set of cash flows, or the discount rate where the net present value of an investment is zero. |

| 0 = Σ [CFt / (1 + r)^t] from t = 0 to n, where CFt = Net cash flow at time t, r = IRR, t = Time periods, and n = Overall number of time periods. |

| Requires an iterative process, usually done using Excel or a financial calculator. The IRR function in Excel has the syntax =IRR(cash flows, [guess]). |

| Regular cash flows (e.g. bond) have a single IRR, while irregular cash flows (e.g. with decommissioning costs) can have multiple IRRs. |

| Comparing returns, estimating returns, evaluating hurdle rates, capital rationing, and investment proposal screening. |

| Net Present Value (NPV), Payback Period, and Return on Investment (ROI). |

| Intuitive percentage return, recognizes time value of money, and relatively easy to compute. |

| Can yield multiple solutions, may inaccurately estimate profitability, assumes cash inflows are reinvested at the IRR rate, and can conflict with NPV. |

| Helps identify strategic choices, evaluate risk, communicate with stakeholders, and benchmark against competitors. |

What is the Internal Rate of Return?

Internal rate of return (IRR) is the compound average rate of return in a set of cash flows. You might also see it as the discount rate where the net present value of an investment is zero. The attractiveness of a project increases with its IRR: the higher the IRR, the more favourable the project outcome.

The additional value in IRR is that it recognises the time value of money, emphasizing that earlier-earned money holds more value than the same amount secured later. It’s crucial to note that IRR is expressed as a percentage rate.

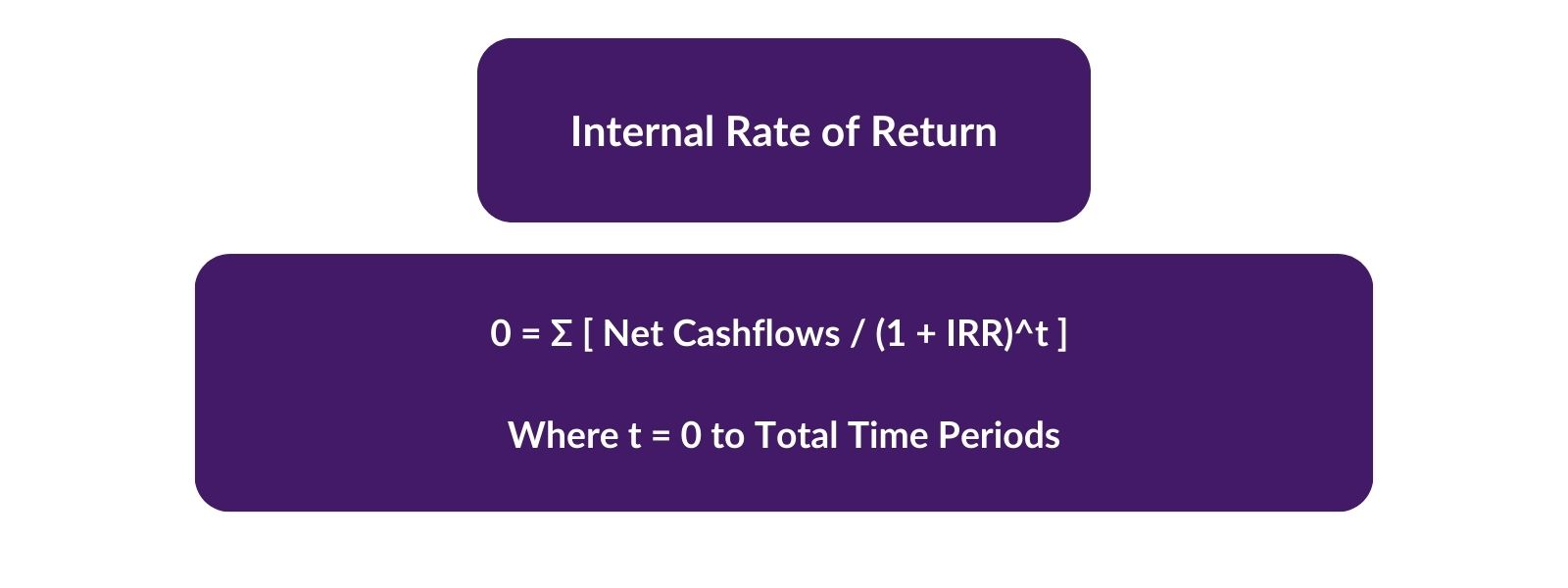

IRR Formula

The IRR formulation equates the present value of impending cash flows to the initial investment. The discount rate (r) is discerned through this formula:

0 = Σ [ CFt / (1 + r)^t ] from t = 0 to n

Where:

- CFt = Net cash flow at time t

- r = IRR

- t = Time periods (commonly years)

- n = Overall number of time periods

Traditionally, the initial investment mirrors a negative cash flow, symbolizing an outflow.

How to Calculate IRR

IRR can only be computed using an iterative process, so Excel (or a financial calculator) are necessary to get an accurate answer. In Excel there is the function =IRR(….)

The syntax is:

=IRR(cash flows, [guess])

The cash flows are selected as an array of adjacent cells (in a single row or column) and the guess is optional in most cases. However, there are some series of cash flows that are ‘irregular’ and can have more than one IRR, or even a negative IRR. Your guess can help excel with resolving an otherwise confusing scenario.

IRR Examples in Excel

To solidify understanding, consider the following IRR scenarios:

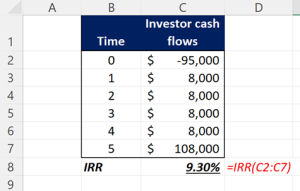

Example 1 – regular cash flows e.g. a bond

An investor pays $95,000 for a fixed interest bond which pays a coupon of $8,000pa for 5 years and then matures at $100,000 What is the bond IRR?

Note that the initial cash flow has to be the opposite sign to the return cash flow, otherwise Excel will return a #NUM! error message. Remember the IRR is the rate that sets the NPV to zero. If all signs were positive or negative, there is no rate that would give an NPV of zero!

In this example above, we have computed the Yield-to-Maturity (YTM) on the bond – sometimes referred to as the Gross Redemption Yield (GRY) on UK government bonds

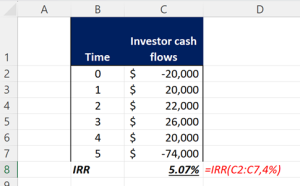

Example 2 – non-regular cash flow

Multiple IRRs

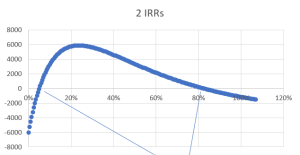

Now, it is possible to have more than 1 IRR. How? Well, it’s just how the numbers work out. Unusual, but perhaps a case like this where there are significant decommissioning costs at the end of an infrastructure project. Look at this:

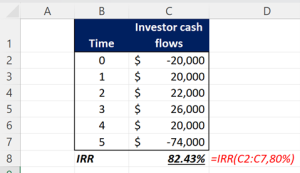

Excel tells me the IRR is 5.07%. But then again:

What we find is that if the cost of capital is anywhere between 5.07% and 82.43% the NPV is positive, so we can conclude the project would be worthwhile. But it’s still a little confusing. You would think that if your cost of capital was purely cheap debt at, say, 3% a project with an IRR of 5.07% would be worthwhile. Certainly worthwhile with an IRR of 82.43%! But in fact, a low cost of capital means that the final payment of $74,000 is too significant in PV terms as the time value is so small. Weird, but true.

The NPV profile of the project looks like this, just to give you the picture:

Uses of IRR in Corporate Finance

In corporate finance and capital budgeting, IRR is routinely employed to assess and order investment projects. Its primary uses encompass:

- Comparing Returns: IRR facilitates the ranking of independent ventures by potential profitability. Projects with superior IRRs are usually favored.

- Estimating Returns: IRR pinpoints the expected annual return rate for an investment. Decisions can be based on the minimum IRR required.

- Evaluating Hurdle Rates: Many companies uphold minimum IRR benchmarks, which projects must surpass to gain approval. e.g. a private equity investor may have a target IRR of 20%

- Capital Rationing: For businesses with limited capital, IRR aids in selecting ventures maximizing returns on accessible resources.

- Investment Proposal Screening: IRR, being a quick metric, conveniently screens out proposals failing to satisfy return criteria.

Alternatives to IRR

While IRR is a pivotal metric, other methods also provide valuable insights into investment decisions:

- Net Present Value (NPV): This calculates the difference between the present value of cash inflows and the present value of cash outflows. A positive NPV suggests a potentially profitable investment.

- Payback Period: The Payback Period indicates the time needed for an investment to recover its initial cost.

- Return on Investment (ROI): A percentage that compares the profit of an investment to its cost.

Advantages and Disadvantages of IRR

Advantages:

- Intuitive understanding due to percentage return measures.

- Recognizes the time value of money.

- Comparatively accessible computation, particularly with computational aids like Excel.

Disadvantages:

- Can potentially yield multiple solutions.

- May inaccurately estimate profitability when differing projects exhibit fluctuating cash flow magnitudes and timings.

- Implicitly assumes cash inflows are reinvested at the IRR rate, which may not always hold.

- It may conflict with a pure NPV assessment as it ignores the scale of the cash flows. E.g. would an investor prefer a project with an IRR of 12% and an NPV of $3m, or an IRR of 10% and an NPV of $4m? If the investments are mutually exclusive which would you choose?

Decision-making Implications of IRR

Incorporating IRR into decision-making illuminates:

- Strategic Choices: Optimal strategic moves can be identified through comparative IRRs.

- Risk Evaluation: Weighing IRR against a project’s associated risks and market conditions can refine decision-making.

- Stakeholder Communications: Transparently communicating IRR figures can validate investment choices to stakeholders.

- Competitor Benchmarking: IRR provides a baseline to benchmark against competitors’ projects, providing strategic insights.

IRR remains a mainstay in corporate financial analysis, being a dynamic tool to gauge potential returns on investments. While it holds its value, integrating IRR with alternative metrics, understanding its limitations, and interpreting results within broader financial and market contexts empower more nuanced, strategic investment decision-making.

See IRR in action in our LBO modelling course. The IRR and other investment appraisal techniques are covered in our Finance for the Non-Financial Manager e-learning course.