ROTATION AWAY FROM THE US DEVELOPS AS A THEME – 28-08-25

A nuanced story this month! Whilst the US has produced a series of records over the month: the Nasdaq reached a new record, the Dow approaching all-time highs, and a really aggressive stance taken by investors buying stocks with borrowed money, but, and it’s a big but, the US markets are only up 1-2% month to date (DJI 1.6%, S&P 1.43%, NASDAQ 1.94%.%). The margin trading story is interesting – it’s not necessarily a 100% bullish signal.

We are seeing the market performance widening, so small caps are moving up, not just the Magnificent 7, but this performance has been outshone by Gold +2%, Gold miners Blackrock Gold and General up 16.6%, and emerging markets, China and Asia outperforming: Our LatAm fund pick +3.5%, China +5.4%, EM 2.75% (*nb. all our fund picks not indices).

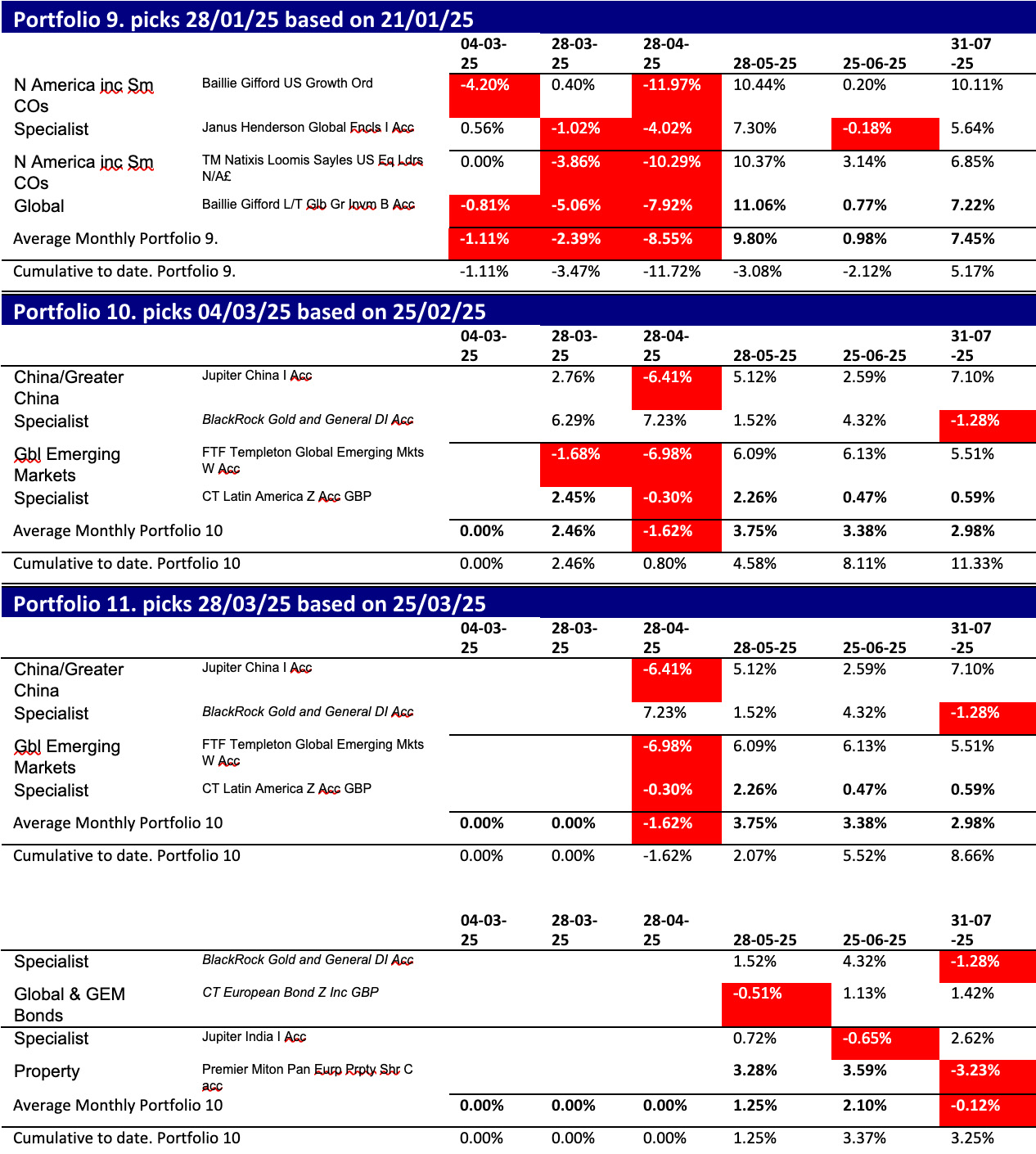

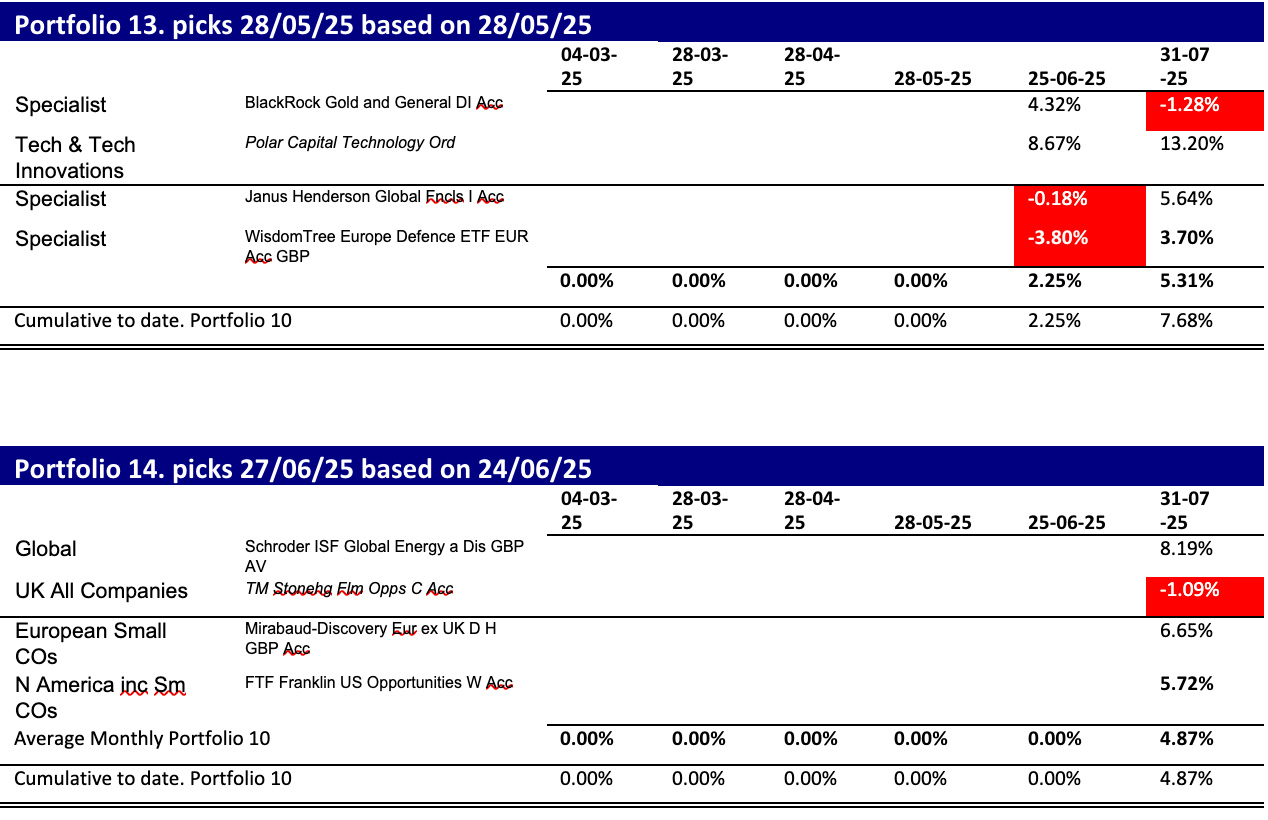

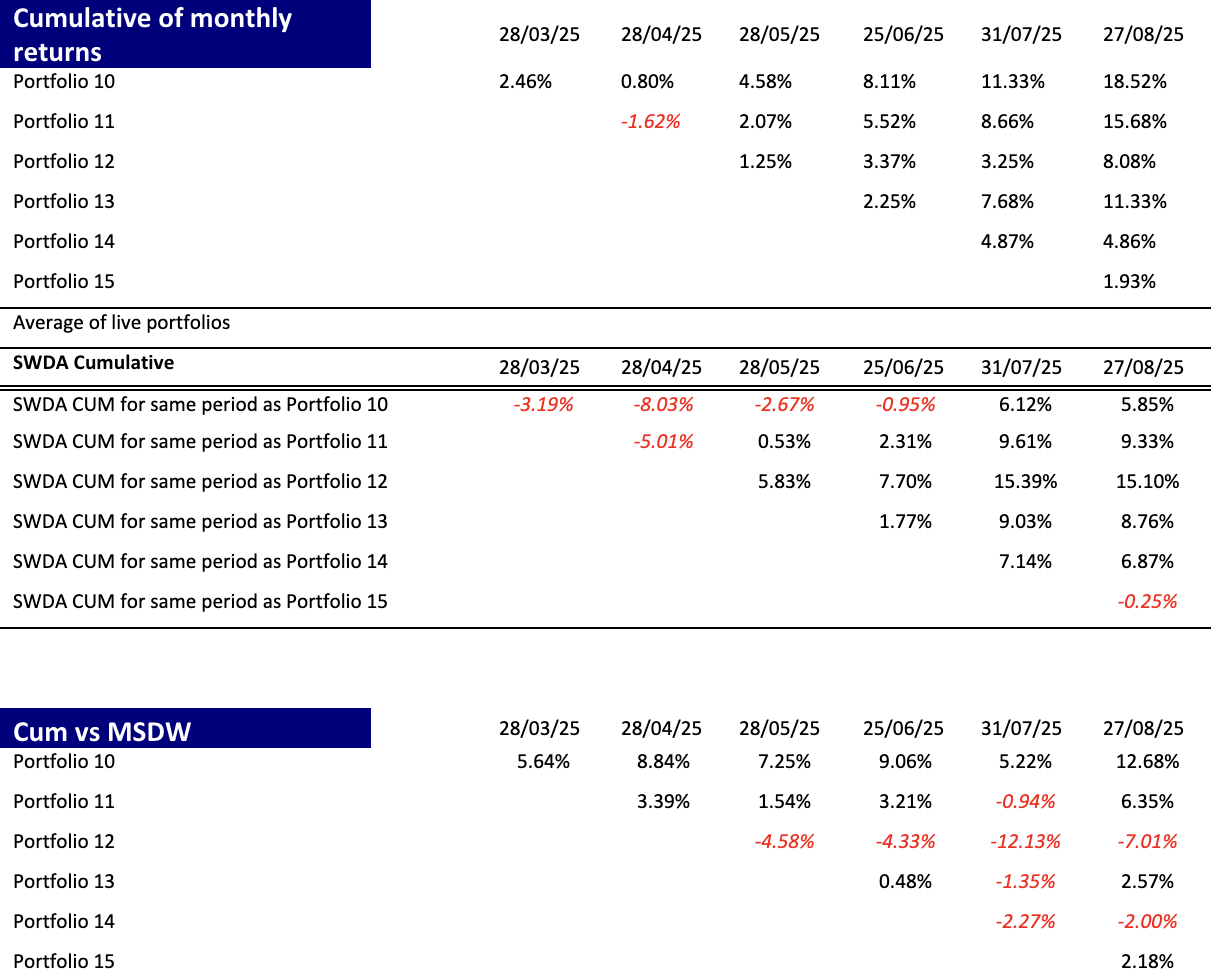

Is there value in the strategy? The following tables shows 1) Cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see four out of six portfolios have outperformed this month.

The mood music in markets continues to go against the US and AI and pro – EU, Asia and emerging markets: the magnificent 7 slow down, politics, tariffs, weak jobs growth and inflation are all US worries, and is AI adding value?

In contrast in China, we see Government policy moves stimulating markets: Government is waiving some property taxes and removing limits on second home buying. Even the bombed out and bankrupted property sector is resurrecting. Could Hong Kong’s recent strength infect the mainland?

We also see investors rotating into emerging markets and large public investors rebalancing way from the US.

These stories are all borne out in the performance data.

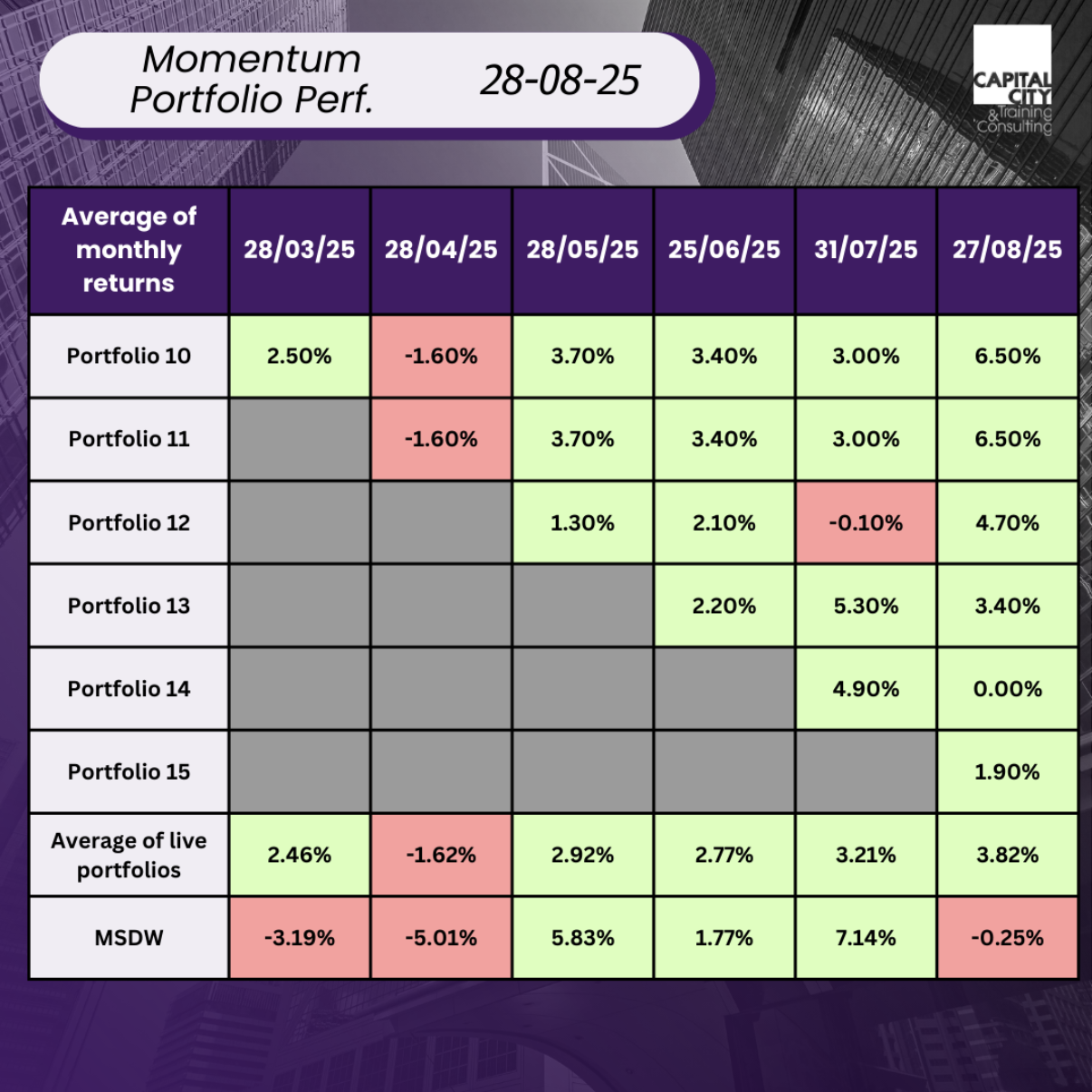

Whilst the news on gold has been almost non-existent, gold miners are catching up with the gold price, as we see in the performance of Blackrock Gold and general. This implies that even if gold prices aren’t going to continue up, Markets think current price levels are a “new normal.” Discuss!?

Blackrock Gold and General acc.

Source: Interactive Investor

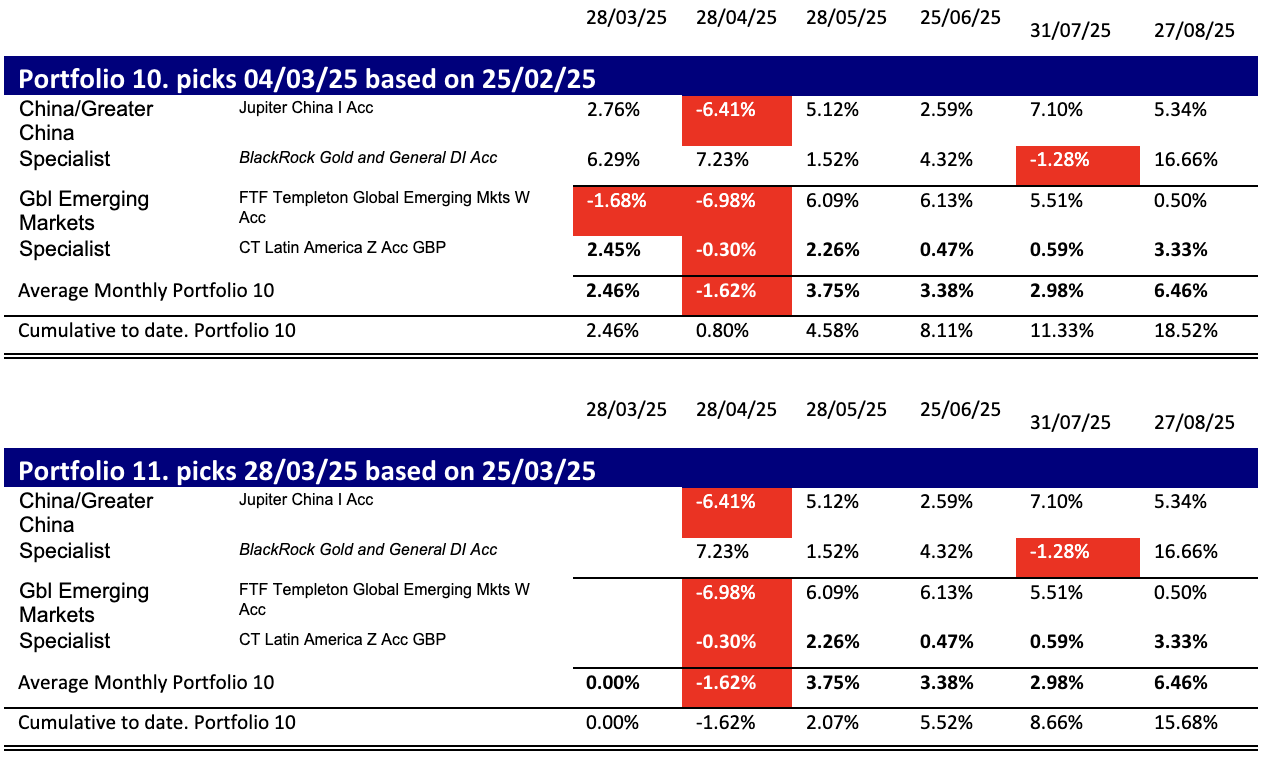

How have the individual portfolios performed?

So, what have been our worst and best portfolios: in absolute terms our winner to date is portfolio 10.

The Best – Portfolio 10 carries on again

Here’s last month’s commentary:

“All of its components, none of which are US, have all performed well. China is interesting, the Mainland market is flat, being dominated by old economy stocks but Hong Kong in contrast is up 20% as Chinese investors seek out tech stock opportunities. So, an Asian spin on the tech theme. Equally Emerging markets which are the other big component of the portfolio have performed well. The argument here is that investors are diversifying away from US assets. This may be happening, but interestingly Credit Suisse’s family office survey shows its respondents staying firmly and heavily weighted towards the US markets.”

All this momentum seems to be being maintained.

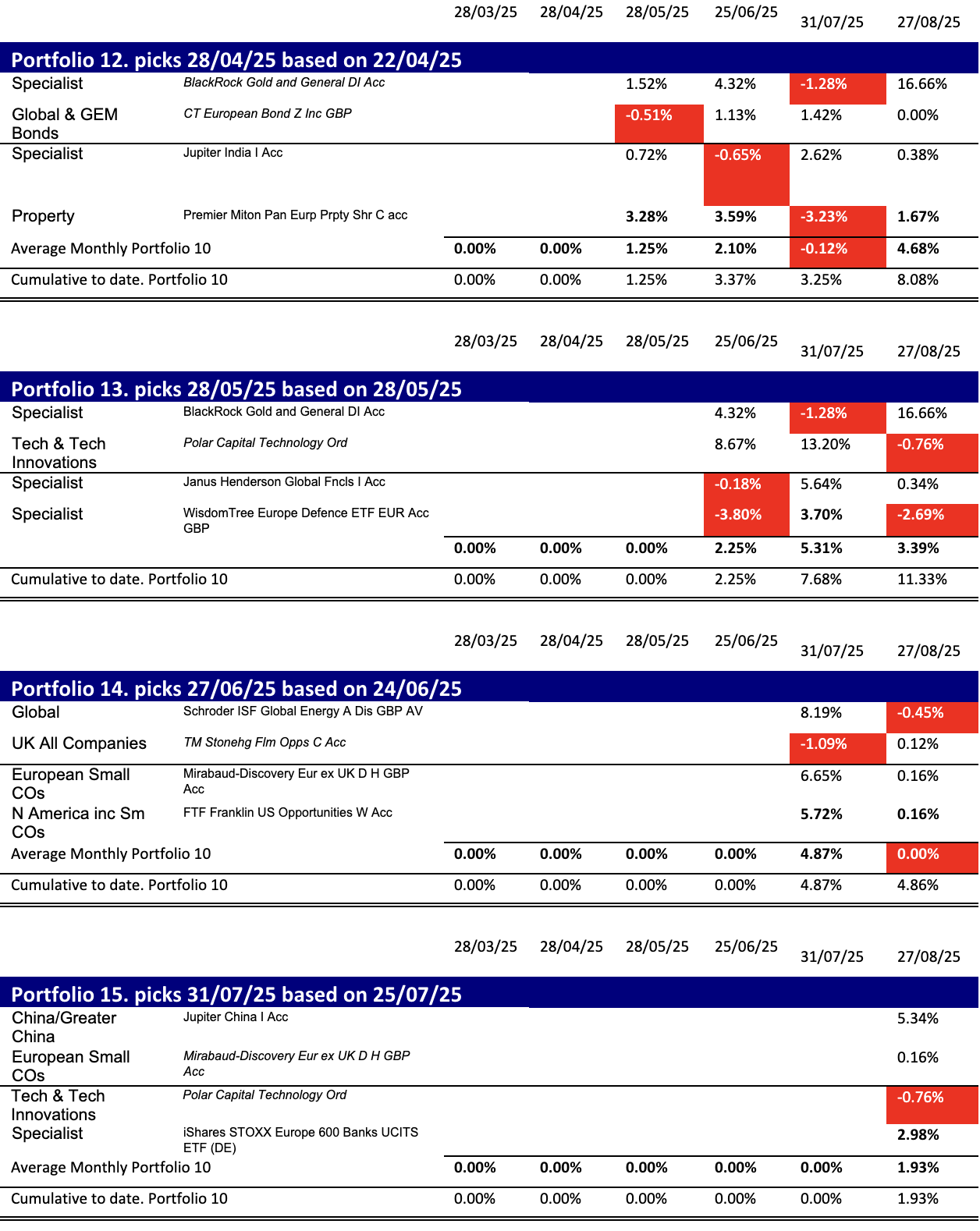

The Worst – Portfolio 12

The portfolio has made an 8.5% return. Still good, just nowhere near SWDA’s 15% over the same period. Again, like portfolio 10, the themes and momentum seem settled for now. European bonds – steady, now showing more typical low volatility, Blackrock gold and general moving ahead strongly again after a slow month. India markets have gone sideways, suffering over tariff uncertainty. Unfortunately, immediately after the portfolio snapshot above, India has finally been hit by punitive 50% US tariffs for buying Russian oil.

Performance in September will be even worse. The UK domestic component is not a positive as UK economic management drives the country towards stagflation and UK gilt (bond) yields rise. The good news for the UK is that the FTSE100 is not very UK at all (see below).

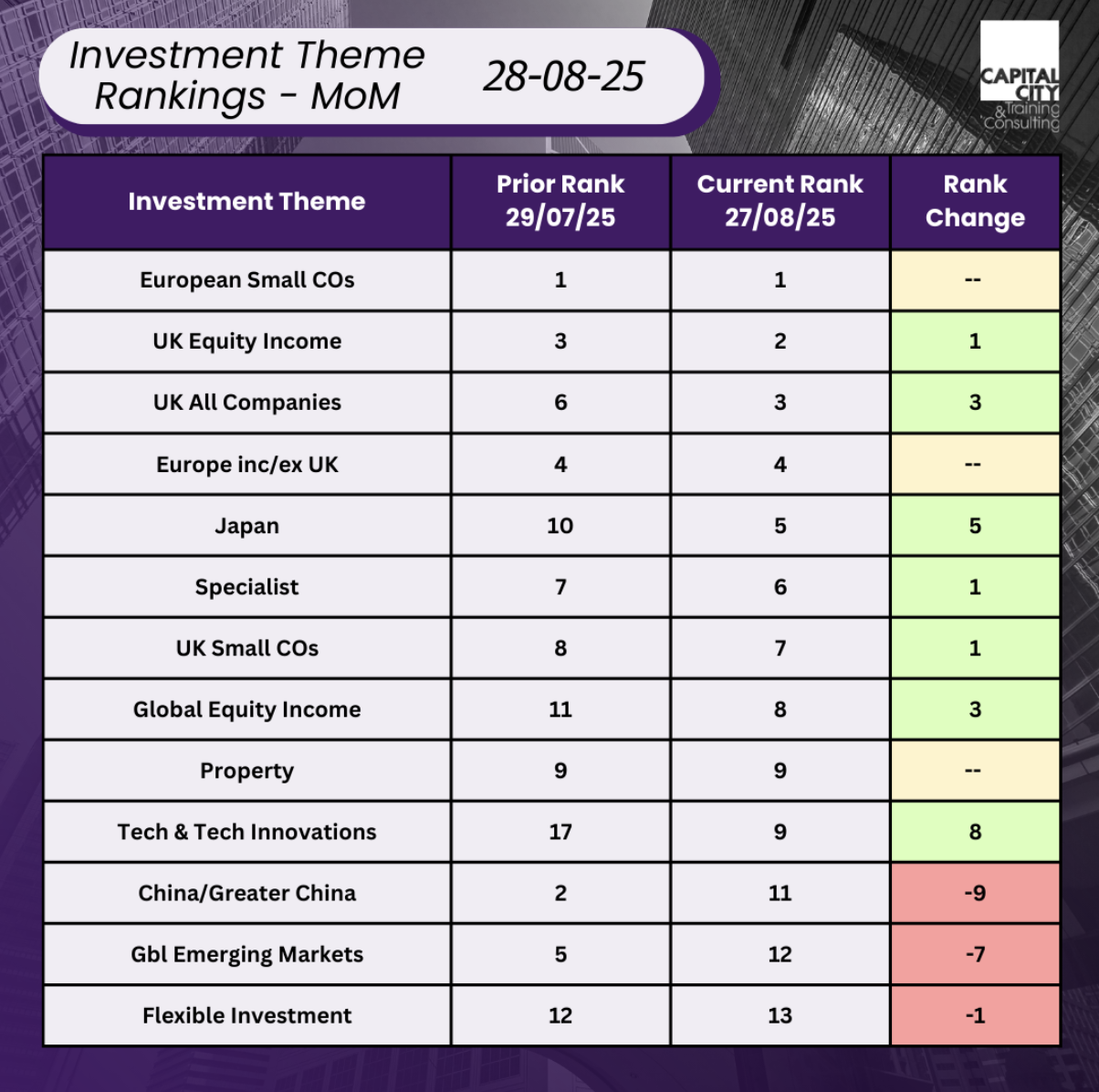

Momentum in August and a new portfolio fifteen end July

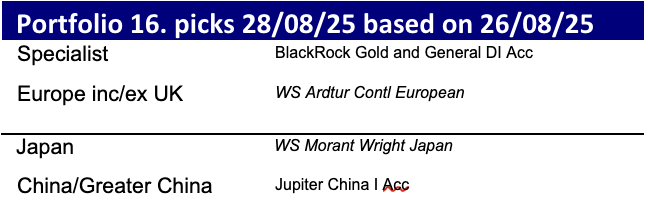

Staying with the pure momentum approach, if we continue, then the 6-month data suggests:

- Gold

- EU

- UK

- Japan, which has been enjoying a quiet “stealth rally”

If we look at the last four weeks as a guide, then that suggests:

- Japan

- China

- UK equity Income

- UK all companies

I think the mood music is against domestically focused UK stocks, I’ll go with China, however volatile (which is after all what we are trying to capture).

When are UK stocks not UK stocks

The UK is not an open and shut case, however 70% of the FTSE100 earnings are from outside of the UK. The FTSE100 is overweight in defensive stocks, exactly the sort of companies you buy when you rotate away from growth. UK stocks are very cheap compared to the EU and the US. Some high performing funds under the “EU inc/exc UK headings are GARP/SmartGARP strategies – “Growth at a reasonable price” – i.e. value funds. So, if you are feeling lucky stick with China. If not, put some FTSE or UK income funds in the mix for the month.

I am not going to be afraid to diverge from the US, I think the issues around the maturity of the rally and valuation levels are clearly affecting investor behaviour – that means momentum. The amount of margin lending is a concern too, as is the levels of assets like bitcoin. Momentum now appears to be going against the US. I am not saying US stocks won’t perform, just less likely to outperform.

This month’s portfolio

US PERFORMANCE

At the risk of repeating the same message, the key issue here is US out/(under)performance. It dominates SWDA. An interesting question now is: “will the US keep pushing SWDA ahead of other markets”? Valuation articles last month were concerned about the difference between US and rest of the world valuations. Now the voices are shriller, and we keep hearing the word bubble!

The earnings season is underway, and a mixed set of results has not stopped the markets going better.

TARRIFS & TRADE DEALS

And it is being argued that US investors are looking through the potential short-term disruption from tariffs to the strengthening of US companies from reshoring and inward investment.

Two months ago, our headline was “TACO,” reflecting the markets recovery post “Liberation Day”. This month, trade deals around the world have moved markets up, Europe similarly has risen over the month, even if the post-deal response of EU member states seems to be one of remorse. And the US in particular has romped ahead.

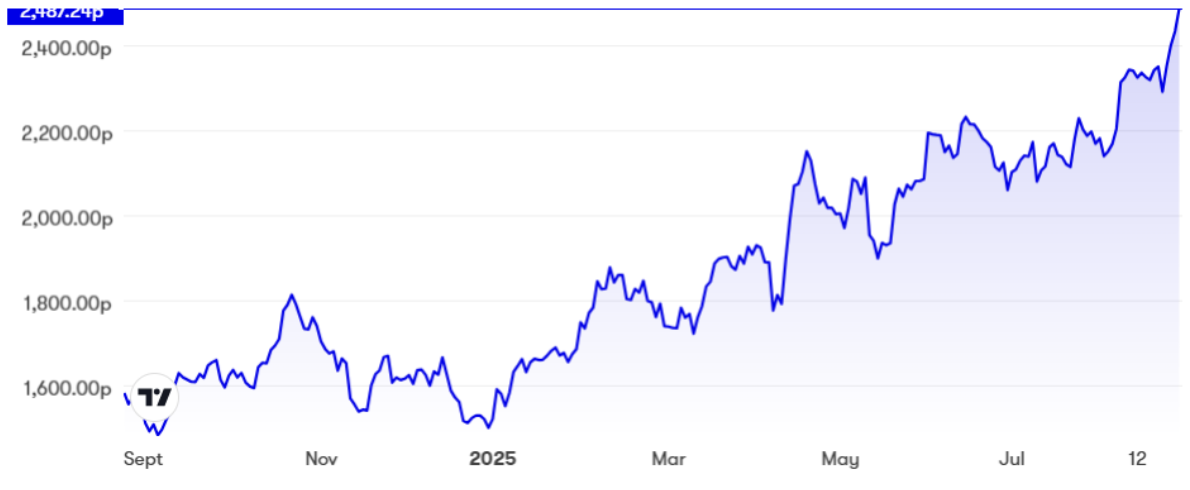

What are the factors driving the performance? Here are the individual portfolios: