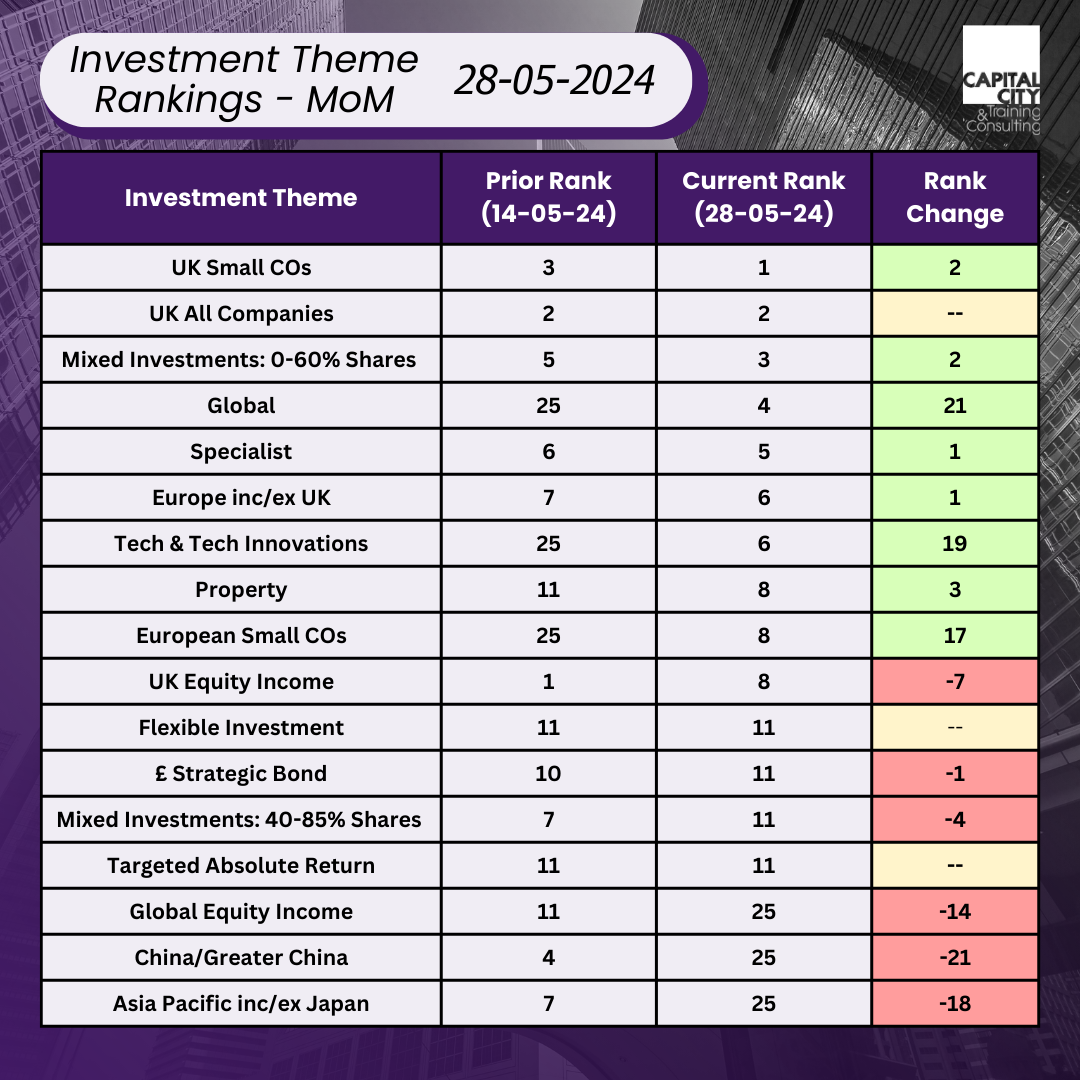

Market Momentum Tracker Analysis – 28-05-24

Sector Momentum ranking 1 = sector with most funds in top 100 performers

The table shows which category of funds- in this case UK Equity Income- had the largest proportion of funds in the top one hundred performers over the last four weeks. This is “rank 1”. So, UK equity income have moved up by two places from third place by number of winners since the week before. Europe inc./exc. UK has improved its position dramatically.

In our portfolio experiment we looked at 6 monthly returns. In this analysis we are looking at 4-weekly returns. The focus here is to potentially spot trends as they begin to develop, rather than when they are quite mature

.

UK Equities

The UK’s strong performance continues with the Small and All company funds staying in the top three places. UK equity income has fallen, so momentum is consolidating in smaller and UK mid cap companies, the larger more mature segments dominating the UK equity income – so banks, oil and gas and mining have eased a little but are still performing well. This theme is echoed in Europe, where large caps have good momentum, but small caps have suddenly started moving quickly! This suggests that we are perhaps starting to see a cyclical rotation into small caps now that the spectre of recession is receding Europe (and the UK), and the prospect of lower interest rates will boost demand and small company earnings. Small caps tend to be more volatile. Less liquidity means less money moves the stock a lot. They are also disproportionately affected by interest rates.

Global & Tech Momentum

Global (+21) and Technology (+19) have both improved momentum. There is quite a lot of overlap, many “Global funds” in the group we cover have broad mandates and lots of technology stocks/sub-funds. The NASDAQ has performed well following NVIDIA’s strong results – quarterly revenue tripled year on year, with net profit increasing sevenfold.

China

China has lost momentum over the last two weeks. It will be interesting to see if this is just a brief interlude; China has been in the news as central and regional governments provide new support to the housing market and broader stimulus through issuing long-dated 20 and 50 year bonds for the first time. Credit growth has slowed slightly. US tariffs on cars is not good news for corporate China.

More broadly a lot of other segments are infected by the moderating of US stock performance over the last month. US stocks make up more than 50% of the MSIC ACWI high dividend yield index for example.