Momentum persisting but where’s the “Santa rally”? – 16th December 2025

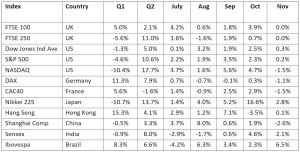

A mixed month for markets:

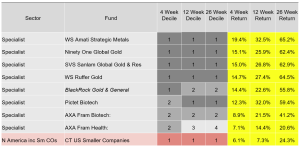

The momentum story is almost unchanged from October. If we look at the top ten funds over 4, 12 and 26 weeks, they are almost unchanged with only the alternative energy funds moving out and more biotech and US small cos coming up.

While developed markets had a quiet month, the momentum in Brazil and the “quiet,” headline-free rally in Emerging Markets continues.

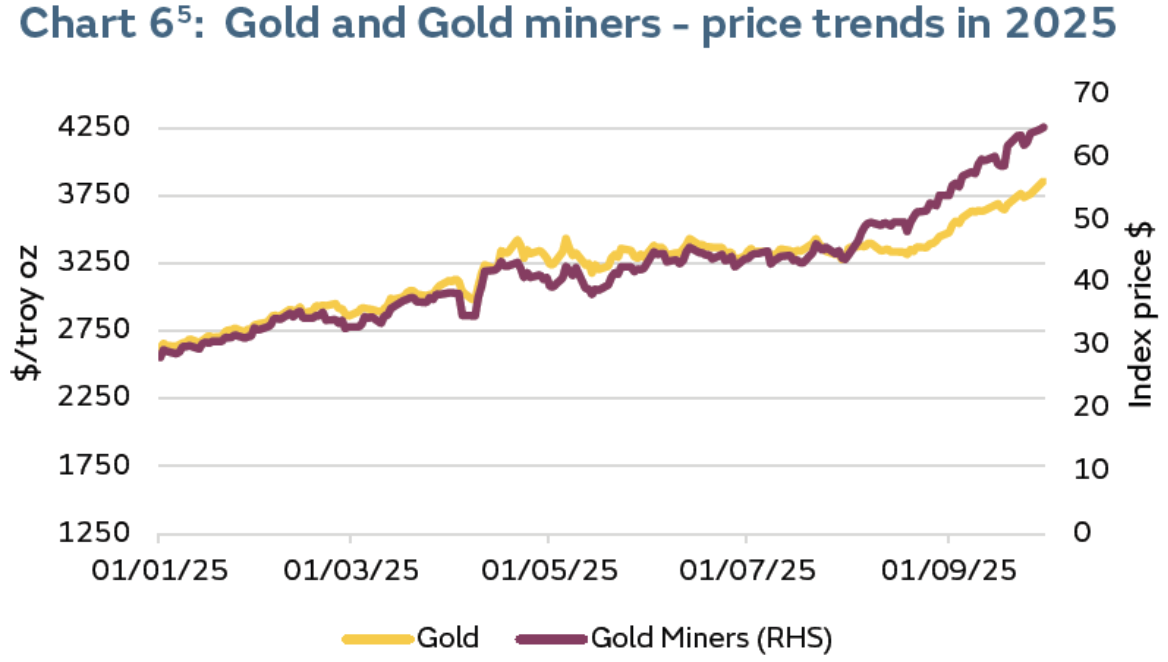

The gold story carries on, but as the gold price consolidates, rather than moving forward strongly, the miners have taken over:

Silver’s rally has also increased in pace with futures hitting new highs of $60!

With supply constraints a strong driver, alongside the relative value story compared with gold.

We mentioned biotech activity in our article last month – where we discussed improving confidence, rising deal activity and strong clinical results from new technologies all driving the sector. Bad gossip about disarray at the US regulators, doesn’t seem to have changed the mood.

Last month we talked about increasing hedging by US investors and the rotation away from US stocks. The big developing themes this month are again around risk: inflation and Japanese interest rates and their global implications:

Inflation is rising again: the following is a 5-year chart of WCOB – a broad commodity ETF.

We have not reached the 2022 peak which followed the start of the war in Ukraine, but we are at a new post-war high. Commodity stories are a stark theme in the month across nearly all segments:

- Copper Hits Fresh Record on Fears of Global Supply Squeeze – WSJ

- Natural Gas Prices Rise to Three-Year High – WSJ

But there is a more general theme which is the impact of Government stimulus, and the impact of AI/power investment on metals. Inflation is also a problem for Chinese markets (see the portfolio performance section).

The second issue is rising Japanese interest rates. The Nikkei has had an excellent year, but the new Prime Minister’s policies have increased the rate at which Japanese interest rates have risen.

The danger from this is not just to Japanese stocks but also to US interest rates. “The carry trade” whereby Japanese and international investors borrow in Yen to invest abroad will potentially unwind very rapidly if interest rates rise, particularly if rates -short and long fall in the US.

The worst scenario, as described by Shanaka Anslem Perera on a recent Substack post, is where Japanese rates continue to rise as investors worry about poor fiscal management/inflation and the carry trade unwinds, pushing up US rates as investors sell treasuries and other assets – despite bullish comments from the Bank of Japan governor.

Inflation and easy money in Japan could start this off and leave the US with rising yields, inflation, and a bad environment for stocks.

There also is a new narrative developing around bonds and how they are not a risk diversifier. The logic is that major issuance to fund AI build out means corporate bonds could be poor performers in a collapse of the “AI bubble”. The corollary of this is that gold and precious metals are taking on that traditional role of bonds. Is there any news which isn’t good for gold?!

Linked to the inflation and risk narrative is re-emergence of commodities as an investment and as a diversifier and risk reducer.

Whilst this doesn’t fit into our high volatility momentum trading, this is a valuable risk mitigation strategy in a more conventional diversified portfolio. Again, it reflects that rising perception of persistent inflation in investors’ minds.

Our Portfolios

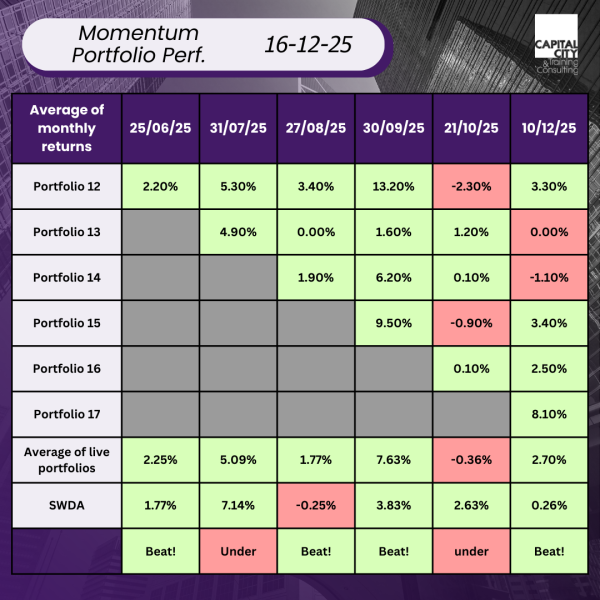

So how have the portfolios performed?

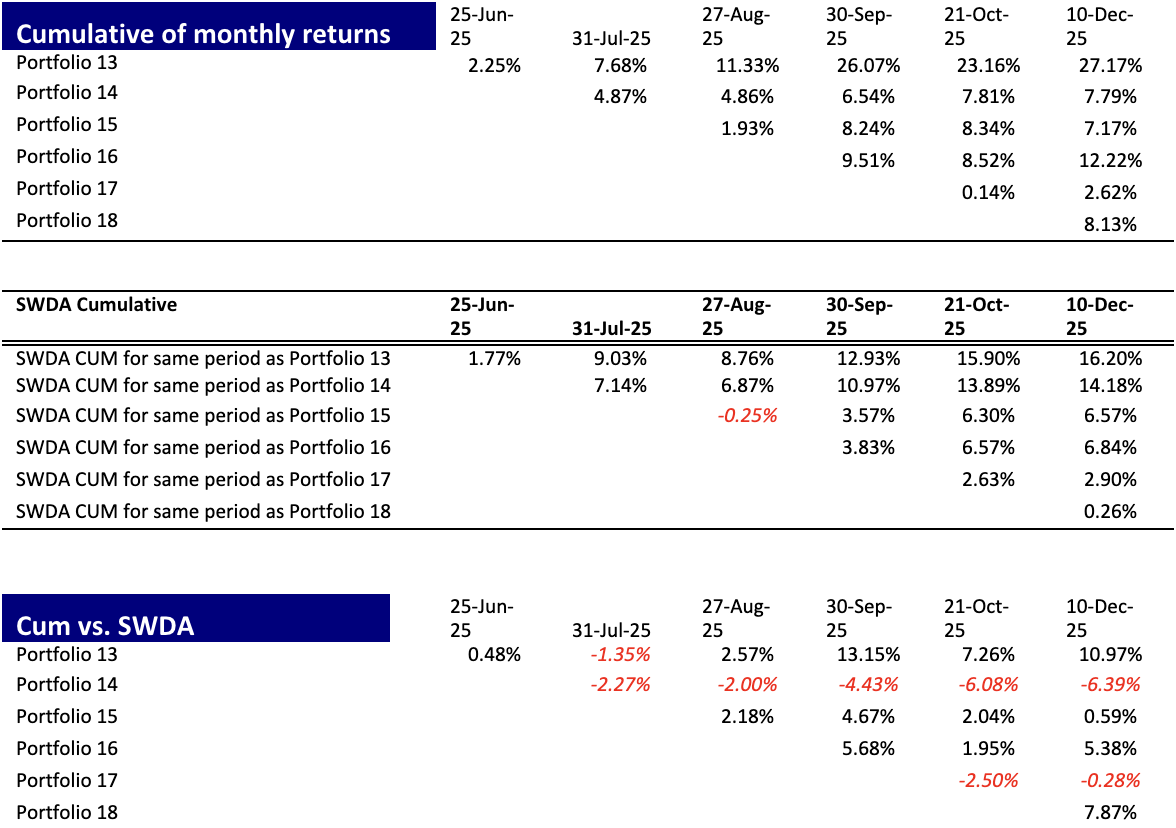

Is there value in the strategy? The following tables shows 1) cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see four out of 6 portfolios have outperformed on a cumulative basis.

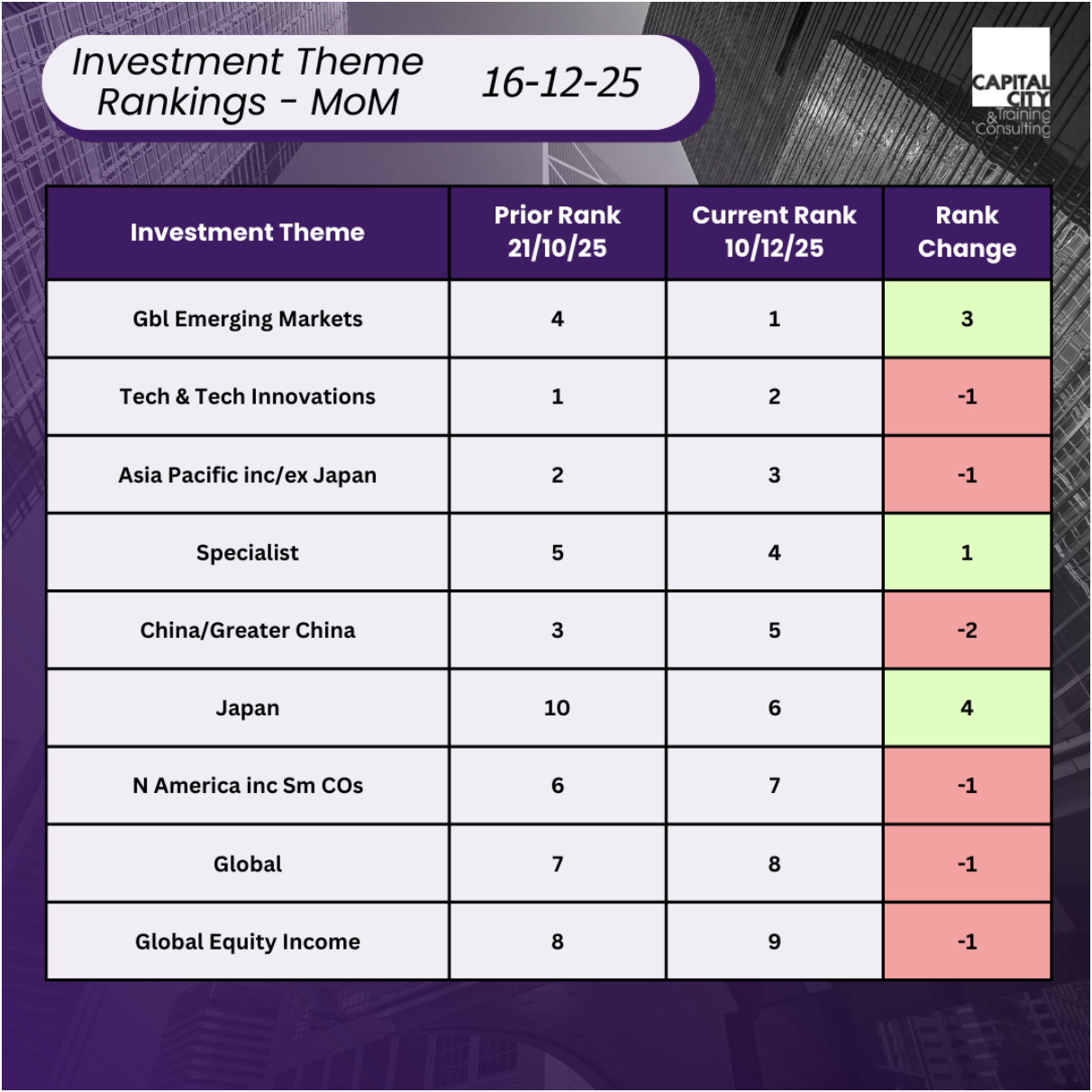

The “mood music” mentioned last month, against the US, AI, and pro – EU, Asia and emerging markets is continuing.

And the emerging markets fund in the last portfolio has gone well. China, meanwhile, has gone backwards for the second month in a row.

Very broadly, there is a good argument that the strategy will outperform SWDA over the next 3-6 months: US performance may be muted over this period. Why? We see signs of weak growth in the broad economy outside of AI. The dollar is weakening, US stocks are expensive and the rotation away from US stocks and moderation of the AI boom could all mean that the biggest component of the SWDA, i.e. the US at 70%, could be an OK, rather than a standout performer. There are a number of triggers which could all adversely affect the US particularly: bigger losses and loss of market share at OpenAI; rising Japanese rates; US economic weakness, rising inflation and a knock-on rise in the US yield curve. The plus side is a strong earnings outlook for US large caps.

Discuss!

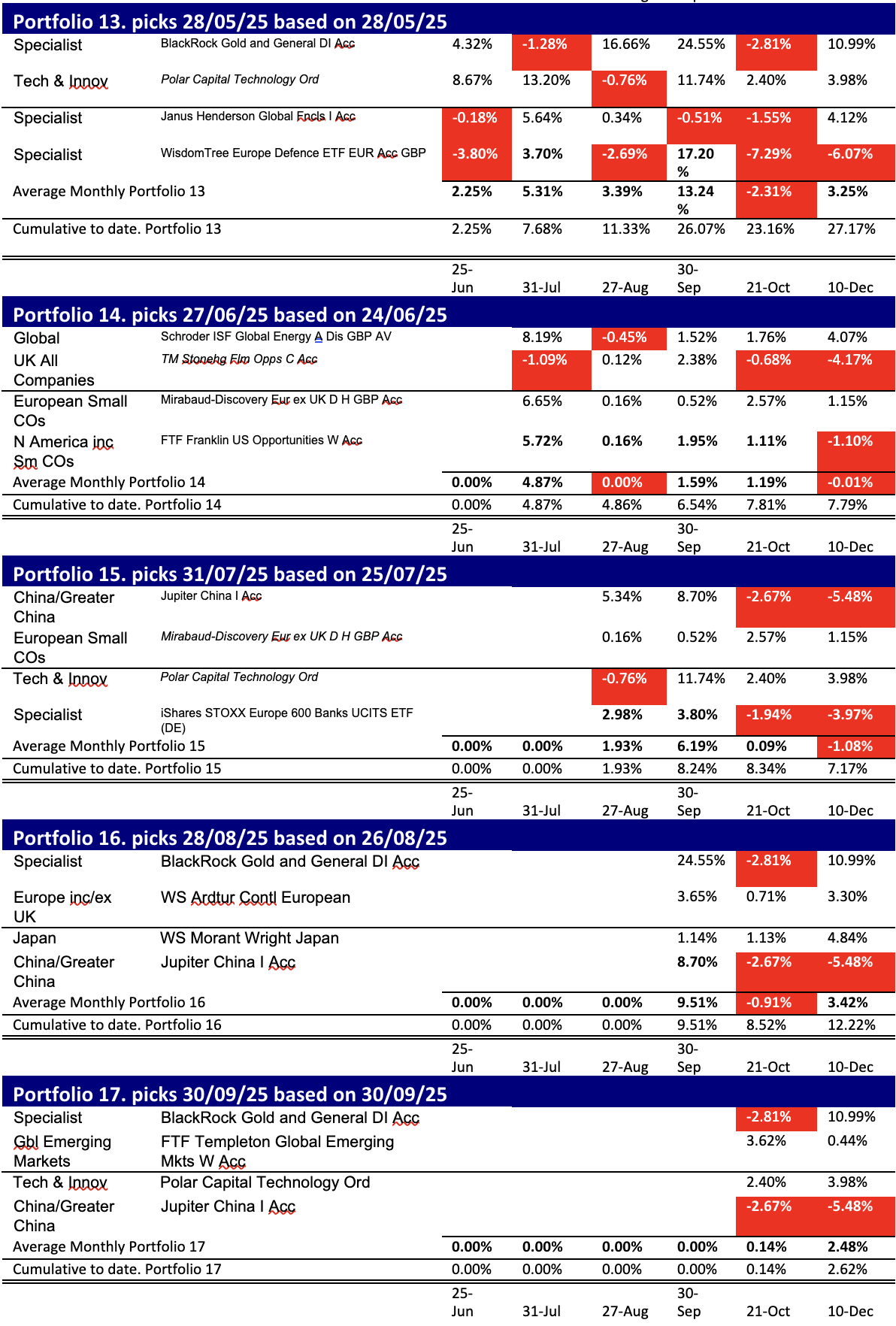

How have the individual portfolios performed?

So, what have been our worst and best portfolios: The best current portfolios are portfolio 13, 16 and last month’s portfolio 18. having achieved total returns of 27.17% and 12.22% and 8.13% respectively over 6, 3 and 1 months, all beating our benchmark the iShares MSCI world index (SWDA). Portfolio 14, our worst, has returned 7.79% over 5 months but has significantly underperformed SWDA (SWDA returned 14.18% over the same period).

The Best Portfolios

Portfolio 13 has benefited from containing two of the four enduring themes: technology, gold and also getting a one-month bump from the impact of increasing tensions with Russia on Defence stocks. 16 has gold and two reasonable performances from Europe and Japan. China has reversed its previous form letting the portfolio down. The big tech stories of the month were NVIDIA and Google. Nvidia’s strong earnings settled the markets, Google is also performing strongly on the back of its success with its Tensor AI training chips.

We are now starting to see some significant divergence in the performance of the Magnificent 7 stock.

China is suffering domestically, notwithstanding its now trillion-dollar trade surplus. It’s that old inflation story again, but this time with producer price deflation at the same time!

The Worst Portfolio 14

Portfolio fourteen has only one loser, its UK exposure, undone by the impact of the UK budget. It’s other three sectors have all just produced OK returns, not the momentum they promised.

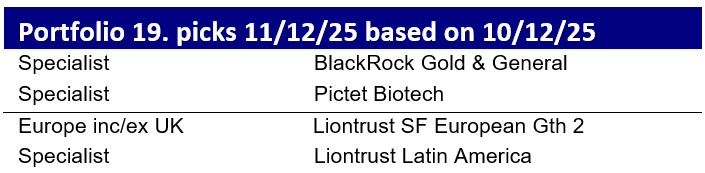

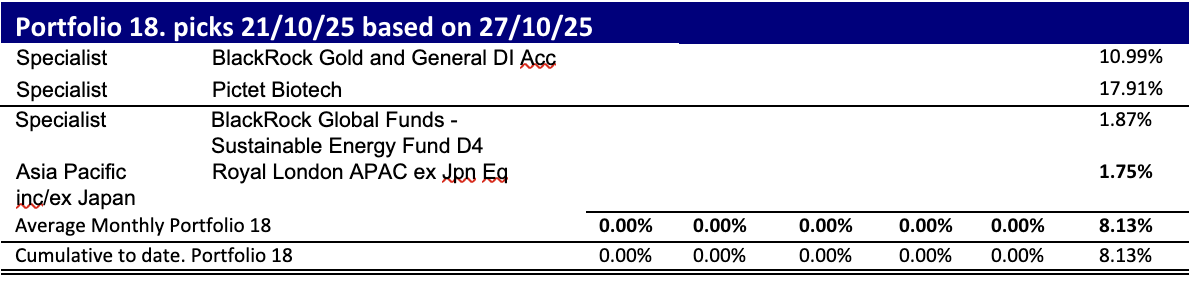

Momentum in November and a New Portfolio Nineteen End 1st Week December

Staying with the pure momentum approach, if we continue, then the 6-month data suggest only a change in rank order: 1) Gold, 2) Emerging markets 3) Tech and 4) Asia Pac ex Japan.

If we look at the last four weeks as a guide, then we get a more complex picture: momentum has slowed significantly, except for gold and biotech. Strong momentum has narrowed further from the top 3 segments, i.e. gold, biotech, and alternative energy we identified last month. There are not compelling third and fourth picks, so I will stick with the broadest trends – the rotation away from the US to EU and Emerging markets, in the latter case – Brazil in particular.

Is the world looking riskier? Momentum is a high-risk strategy, so damn the torpedoes and merry Christmas!

This Month’s Portfolio