Fixed Costs Explained: Definitions, Formulas and Examples

Fixed costs are a parallel concept to variable costs in corporate finance and business management. Understanding fixed costs allows companies to better forecast their expenses, set prices, and make informed budgeting decisions.

Article Contents

- What are Fixed Costs?

- Variable Costs vs Fixed Costs

- Introduction to Semi-Variable Costs

- Flexibility and Operating Leverage

- How to calculate Fixed Costs in Excel

- Industry-Specific Insights on Fixed and Variable Costs

- Interpreting and using Fixed Costs in Corporate Finance

- Exercises and Examples for Fixed Costs

Key Takeaways

| Key Takeaways | Summary |

| Definition | Fixed costs are expenses that do not change with increases or decreases in production or sales volumes. They remain constant within the limits of business capacity. |

| Examples | Rent, permanent staff salaries, insurance, interest, depreciation. |

| Comparison to Variable Costs | Variable costs fluctuate with production/sales volume. Fixed costs provide operating leverage – profits change disproportionately with revenue changes. |

| Calculation | Analyze profit and loss statement to identify costs that remain constant month-to-month or year-to-year. |

| Uses in Finance | Budgeting, break-even analysis, cost control, pricing decisions, evaluating operating leverage. |

What are Fixed Costs?

Fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. They remain constant, within capacity limits of a business.

Fixed costs may be direct operating costs (directly involved in the manufacturing / sales process), indirect or financial.

Examples of common fixed costs include:

- Rent on machinery or buildings

- Permanent staff salaries

- Insurance

- Interest expense

- Depreciation

The ‘fixed’ aspect doesn’t mean they never change or cannot be managed. Rather, a fixed cost is a cost that cannot easily be reduced in the short-term, and will continue to exist even when no goods or services are being produced.

If a business suffers from a decline in business and thinks this will continue, staff can be sacked, rent agreements terminated, surplus office space sold off or sub-let. None of these are simple solution though, and the costs are not a direct function of sales / production volume.

Variable Costs vs Fixed Costs

By way of comparison, variable costs are expenses that do fluctuate in proportion to production and sales volume. Examples include raw materials, hourly wages (staff on shifts), utilities (energy, water) and sales commissions. In contrast to fixed costs, variable costs can be reduced immediately by lowering production levels. Understanding the differences between fixed and variable costs is crucial for budgeting, pricing decisions, and measuring operating leverage. Companies rely heavily on fixed costs for scaling and growth, but excessive fixed costs can also make a company vulnerable in times of low sales.

Introduction to Semi-Variable Costs

Semi-variable costs, or mixed costs, have both fixed and variable components. A common example is a mobile phone bill which might have a fixed monthly charge plus additional costs based on usage. This understanding of semi-variable costs provides a more informed perspective on expense management and financial planning.

Flexibility and Operating Leverage

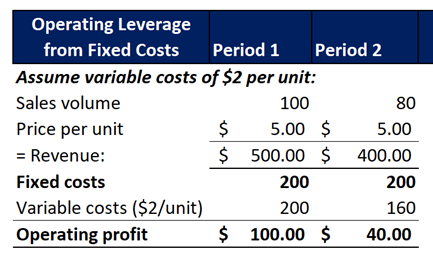

Due to fixed costs being inflexible, at least in the short term, they introduce operating risk (leverage). Take a look at these numbers to see the impact:

Note that from Period 1 to Period 2 the sales volume falls by 20% from 100 to 80 units. With fixed costs at $200 and Variables costs at $2 per unit, Profit falls by 60% . That’s leverage!

Of course, with an uptick in business of 20%, the opposite applies and profits would rise by 60%. Risk is a two-way street! In the absence of any fixed costs, the profit would fall and rise in line with Sales Revenues.

How to calculate Fixed Costs in Excel

There is no single method for analysing fixed costs in Excel. When performing detailed financial analysis, we would recommend going through the profit and loss statement by category to identify items that, by name or nature, seem to remain constant from month-to-month, quarter-to-quarter or year-to-year.

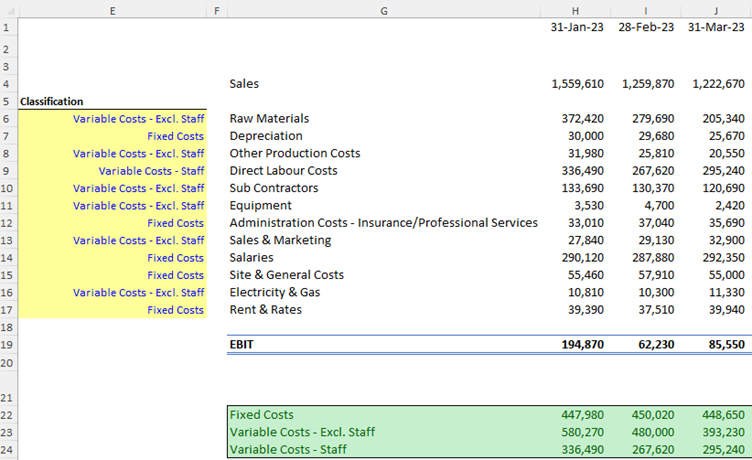

Here’s a snapshot of a model Capital City Training uses in its budgeting & forecasting training:

In this example:

- The P&L data by month is in columns H, I, J etc….

- Column E (in yellow) uses a simple Data Validation dropdown* so the user can flag the classification for each of the cost categories named in Column G.

- The classification is determined by making assumptions based on the cost-description and / or by looking at the variability in the numbers.

- The green area then uses a =SUMIF(…) function to add the numbers according to their label. For example, the formula in cell H22 is:

- =SUMIF($E$6:$E$17,$G$22,H$6:H$17)

- The formula instructs Excel to add the numbers in the range H6-H17 where the labels in E6-E17 match the criteria of being “Fixed Costs” (in G22)

- =SUMIF($E$6:$E$17,$G$22,H$6:H$17)

Classifying a cost as variable or fixed is not always a straightforward, for example:

- Salaries – Some people would count these as variable – but it really depends on how quickly and easily the staff can be hired and fired!

- Sales & Marketing – Is this variable or fixed? As you spend more on marketing the sales should increase, so you can say variable (it varies directly with sales). But others might disagree and argue that marketing budgets are fixed up front for the season. It’s not always 100% clearcut. But that’s why analysis within a model is useful – you can easily change your assumptions and see what the impact is in doing so.

Industry-Specific Insights on Fixed and Variable Costs

Different industries can have varied structures of fixed and variable costs:

- Manufacturing Industry: Often encounters higher variable costs due to materials and direct labour.

- IT Services: May experience higher fixed costs due to substantial investment in infrastructure and salaried personnel. i.e. their sales are driven by a fixed investment in people and software.

- Retail: Balances between fixed (like rent and salaried staff) and variable costs (like hourly staff during peak seasons and stock purchasing).

These industry nuances inform strategic financial management and operational decision-making processes for business decision-makers – and how you structure your models as a financial analyst.

Interpreting and using Fixed Costs in Corporate Finance

Several key insights can be drawn from analysis of fixed costs:

- Budgeting – Fixed costs establish a foundation upon which variable costs can be projected and budgets can be framed.

- Break–even analysis – determining at what volume of sales a company will cover its fixed costs (see Example section below)

- Cost control – Managers can scrutinize fixed costs for potential reductions and cost-saving opportunities.

- Pricing – The totality of fixed costs informs the baseline prices needed to achieve break-even and profitability.

- Operating leverage – Elevated fixed costs amplify the relationship between revenue changes and changes in operating profit, influencing profitability and risk.

Exercises and Examples for Fixed Costs

Let’s look at some specific exercises and examples for analysing fixed costs:

Example 1 – Budgeting

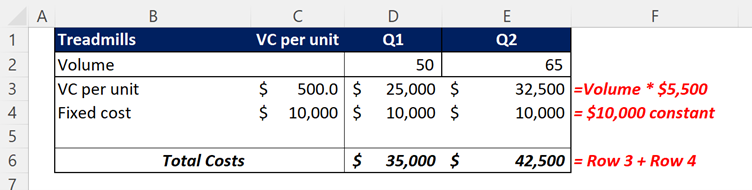

A manufacturer of treadmills produces at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. In Q1 they produced 50 treadmills, and in Q2 they produced 65.

What are the total variable and fixed costs each quarter? Why does this information help?

Solution:

- The total fixed costs are $10,000 in each period.

- Q1 variable costs are $25,000 and Q2 they are $32,500. So total costs are $35,000 and $42,000 respectively.

This information will help management with forecasting and budgeting costs and setting price levels to achieve required profit margins.

Example 2 – Cost Categorisation

A factory operator has the following costs last month. The finance manager wants to categorise them to enable accurate budgeting. What are the categories: variable, fixed or semi-variable?

- Depreciation: $6,000

- Permanent staff salaries: $3,000

- Raw materials: $9,000

- Distribution costs: $1.5 per unit sold

Categorise each cost as fixed or variable, or semi-variable.

Solution:

- Depreciation – Fixed – It will ‘step-up’ at some point as capacity increases and more space is needed, but in the short term it is Fixed. It is also worth noting that Depreciation is a non-cash expense and will not be relevant to cash flow forecasting.

- Permanent Staff Salaries – Fixed – Basic salaries will be fixed, but what if the staff have to work overtime at busy times of the year – being paid extra? In this case there would also be a top-up variable element so staff costs can also be classified as semi-variable – we just need a bit more information.

- Raw materials – Variable – Always! We only incur higher costs if we manufacture / buy more.

- Distribution – Variable – Probably – if we send the goods to customers by a courier, say, then the company will be charged according to volume. However, what if we run our own vehicles for distribution? There will be fixed costs associated with this. So again, more information leads to better judgement.

This information will assist in forecasting and budgeting. The finance manager needs to flag up which costs will rise as sales activity increases.

Example 3 – Break-even Analysis

Take the same information from Example 1 above – the manufacturer of treadmills producing at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. Assume they sell at $750 per treadmill.

How many treadmills do they have to produce and sell to cover their fixed costs? This is called the breakeven volume.

Solution:

Firstly, note the idea of ‘contribution’ to profit. This is the idea that every unit bought and sold adds Revenue and (variable) costs to the P&L.

Fixed: $10,000

Contribution per unit = $750 revenue – $500 variable cost = $250

Break even volume is $10,000 / £250 = 40 treadmills. Anything less than 40 units sold, the manufacturer will not cover Fixed Costs and will make an operating loss.

Grasping the fundamentals of cost-classification is an essential part of analysis, budgeting and forecasting and making informed business decisions.