Payback period is a fundamental investment appraisal technique in corporate financial management. It is a measure of how long it takes for a company to recover its initial investment in a project. It is one of the simplest capital budgeting techniques and, for this reason, is commonly used to evaluate and compare capital projects.

What is the Payback Period?

The payback period is a simple measure of how long it takes for a company to recover its initial investment in a project from the project’s expected future cash inflows. It measures the liquidity of a project rather than its profitability. As such, it should not be used alone as an investment appraisal technique – other methods should be used such as ROI, NPV or IRR. In its simplest form, the payback period is calculated by dividing the initial investment by the annual cash inflow.

Note: this will only work for projects expected to generate constant annual cash flow returns, and we will look at a more realistic example further down the page.

Payback Period Formula

The formula for payback period is:

Payback Period (yrs.) = Initial Investment / Annual Cash Inflow

Where:

Initial Investment = the upfront cost of the project

Annual Cash Inflow = the annual net cash flow expected from the project

For example, if a project requires an initial investment of $100,000 and is expected to generate $20,000 of net cash inflow per year, the payback period is:

Payback Period = $100,000 / $20,000 = 5 years

Therefore, the payback period for this project is 5 years, which means that it will take 5 years to recover the initial $100,000 investment from the annual cash inflows of $20,000.

In a simple analysis, the shorter the payback period, the better. So, it is only a relative measure.

How to Calculate Payback Period in Excel – for non-regular cash flow returns

The above method is a simple division sum. In reality, projects are unlikely to have constant annual projected returns. In this case, setting up a table in Excel will help evaluate and estimate the payback period.

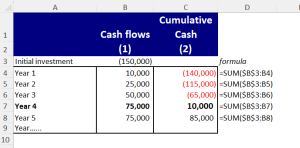

Take an example where a project requires an initial investment of $150,000. In its first three years, the project is expected to return net cash of $10,000, $25,000, and $50,000. Then cash flows will stabilise at $75,000 pa.

This simple tabular layout will make evaluation clear:

Interpretation: The cumulative cash balance turns positive in Year 4 sometime, so the payback is 3yrs and unknown number of months.

If we assume the cash flows occur evenly during the 4th year, the payback is 65,000/75,000ths through the 4th year, noting that $65,000 is the negative balance at the end of Year 3, and $75,000 is generated in Year 4.

65,000/75,000 *12mths = 10.4 months.

So, we can say the Payback Period is just approximately 3yrs and 10 months.

Uses of Payback Period in Corporate Finance

Payback period has several important uses in corporate finance:

- It is used to screen projects – projects with shorter payback periods may be preferred as they recover investment faster.

- It helps evaluate liquidity risk – projects with shorter payback have less risk as the initial investment is recovered quicker.

- It is used to compare projects – projects can be ranked by payback period for capital rationing decisions.

- It is easy to calculate with limited data

Advantages and Disadvantages of Payback Period

Advantages

- Simple and easy to understand

- Low data requirements – only initial investment and annual cash flow required

- Liquidity focused – indicates when capital is recovered

- Useful for screening proposals and capital rationing

Disadvantages

- Ignores cash flows after payback period – no indication of overall profitability*

- Ignores time value of money

- It does not factor in total RISK! So, when comparing projects it is incomplete as a rounded measure.

- Does not measure profitability of an investment*

*For example, if you had limited capital and solely looked at Payback, one project may pay back in 2 years, another in 4 years. The 2-year project has less liquidity risk, and lower risk of loss, but the 4-year project may generate higher profits and have an overall longer life, thus adding more value.

Discounted Payback Period (DPP)

The discounted payback period extends the concept of the payback period by considering the time value of money. Here, future cash inflows are discounted using a particular rate, reflecting their present value.

Each future cash flow is discounted using the regular discounting formula, where:

PVCFn = CFn x [1/(1+r) ^ n]

Where:

CFn = Cash Flow at time n

r = appropriate discount rate (the cost of capital)

This method provides a more realistic payback period by considering the diminished value of future cash flows.

This still has the limitation of not considering cash flows after the discounted payback period.

Comparing Payback Period with Other Methods

- Net Present Value (NPV): Unlike the payback period, NPV considers all future cash flows and accounts for the time value of money, providing a dollar value that represents the added or subtracted value of the project to the company.

- Internal Rate of Return (IRR): While the payback period calculates the break-even point in terms of time, IRR identifies the break-even point in terms of the discount rate, showcasing the project’s expected rate of return.

Both NPV and IRR, unlike the payback period, consider the entirety of a project’s lifecycle and the time value of money, offering a more holistic view of its financial viability and, more importantly, a direct link to shareholder value.

In summary, the payback period and its variant, the discounted payback period, serve as useful initial screenings for investment projects, focusing on liquidity risk. Despite the simplicity and ease of use, considering other metrics like NPV and IRR is imperative to encompassing a project’s true financial impact and ensuring a balanced investment decision-making process.

For a more comprehensive look at investment appraisal techniques in the context of broader financial management, see our e-learning program on Finance for the Non-Financial Manager.