Steadying down, except for Gold! – CCT MMT – 28th October 2025

Last month’s “booom” is now having a bit of a break:

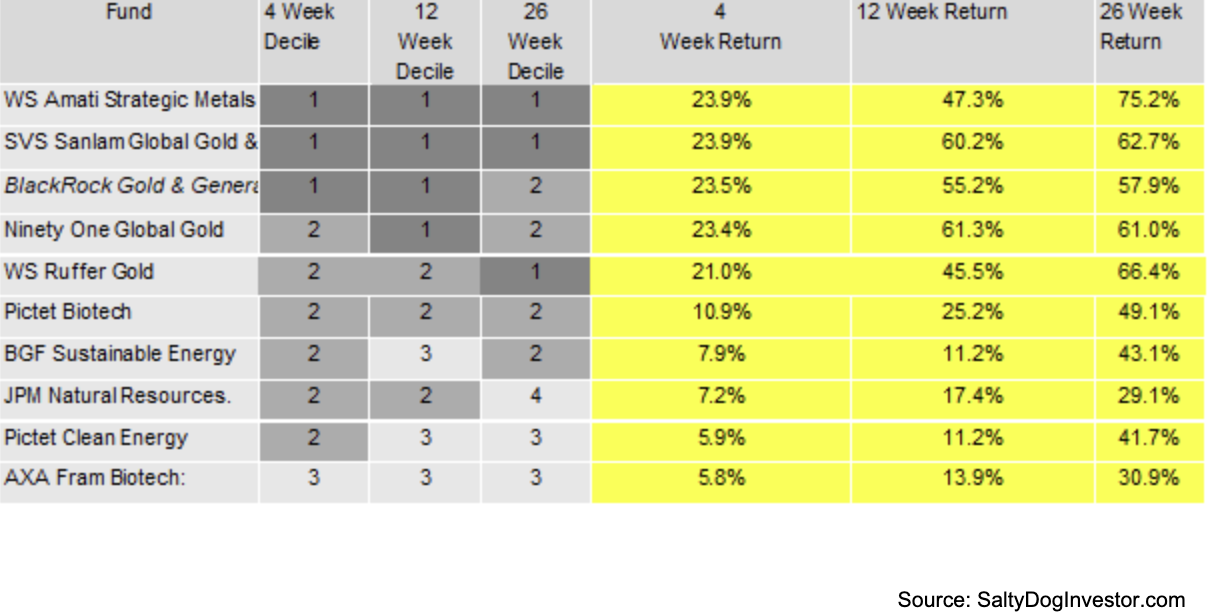

The big momentum sector has been gold, with the top five risers in the month and last 6 months all being gold and gold linked funds:

It is interesting also to see the strong performance of biotech and a range of alternative energy related funds.

The gold story has been covered extensively, in recent blogs, but US commentators are attributing the post August run up to the “Powell Pivot.”

The geopolitical issues are still in the background. Silver has also convincingly joined the party.

The biotechnology story has had some coverage.

And from my own portfolio I’ve seen patience rewarded as my investments in RTW Biotechnology and Axa Framlington’s biotech fund benefitting from an improving market. In RTW’s case several assets have been bought out at prices averaging 2.5X entry cost since August. Mergers and acquisitions activity in Biotech is increasing in pace. These developments are all happening from a quite depressed valuation base.

The alternative energy sector performance has had no direct coverage, but the energy shortages arising from AI investment have been regularly reported on.

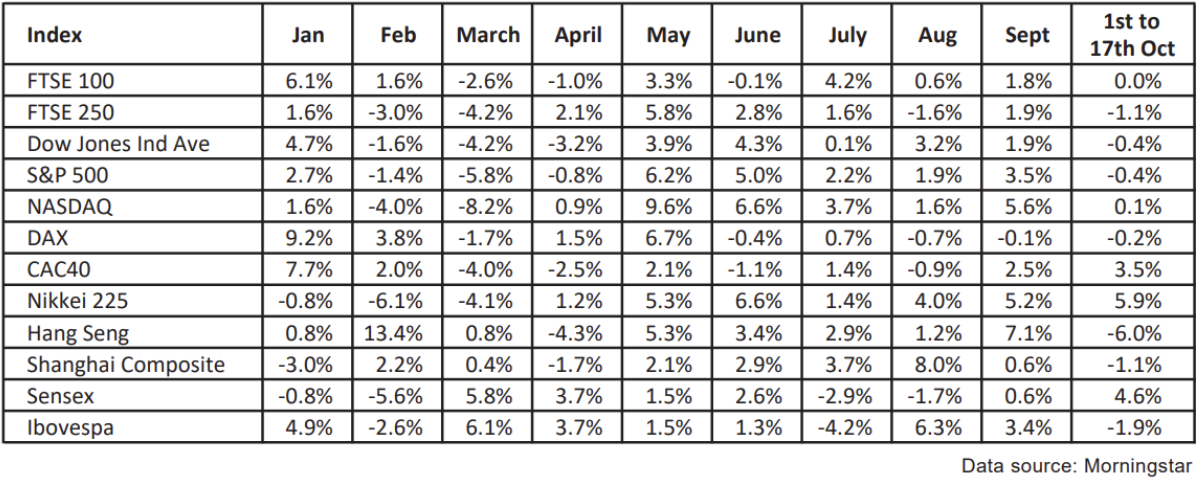

More broadly the mood in the US markets has been mixed with concerns about Chinese tariffs early in the month, giving way to a much more positive tone at the end of the month as Trump and Xi meet.

This aside US earnings have reported have been good!

Consumer commentary for major reporting banks has also been good, notwithstanding the stories about sub-prime auto loans and the hangover from COVID handouts.

After such a strong run from the markets and spectacular behaviour from gold, it is not surprising that investors are starting to get concerned about the risk of at least a correction. Not all the new is good – regional banks have posted loan losses and seen their shares punished this month.

We are starting to see investors hedge market exposure pushing up option prices.

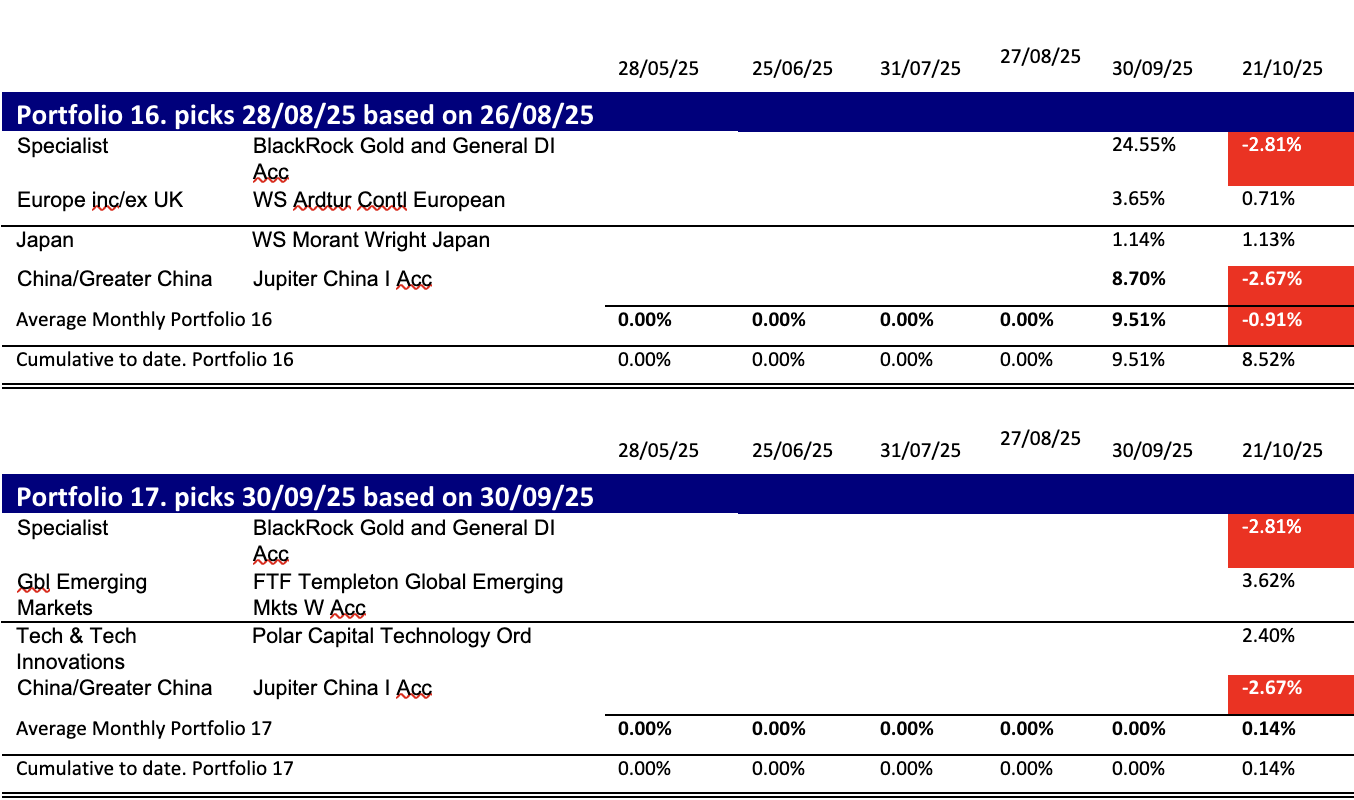

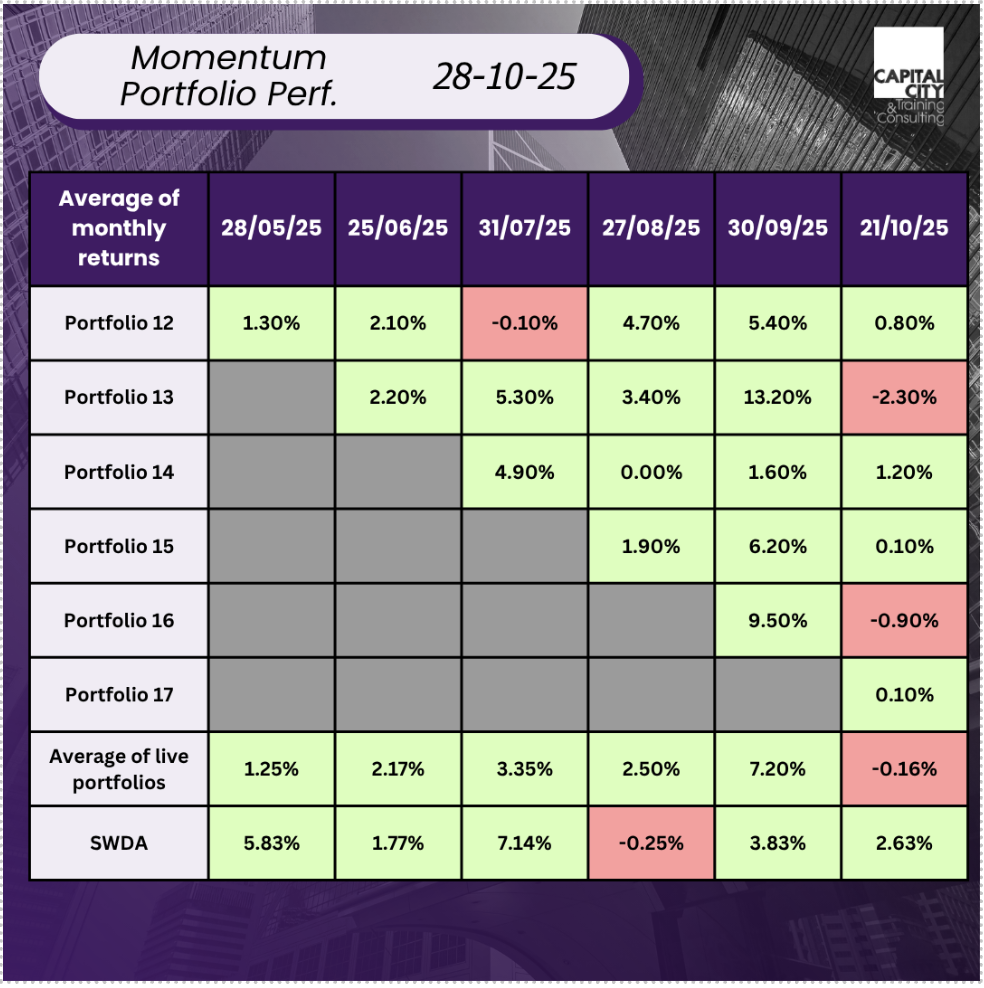

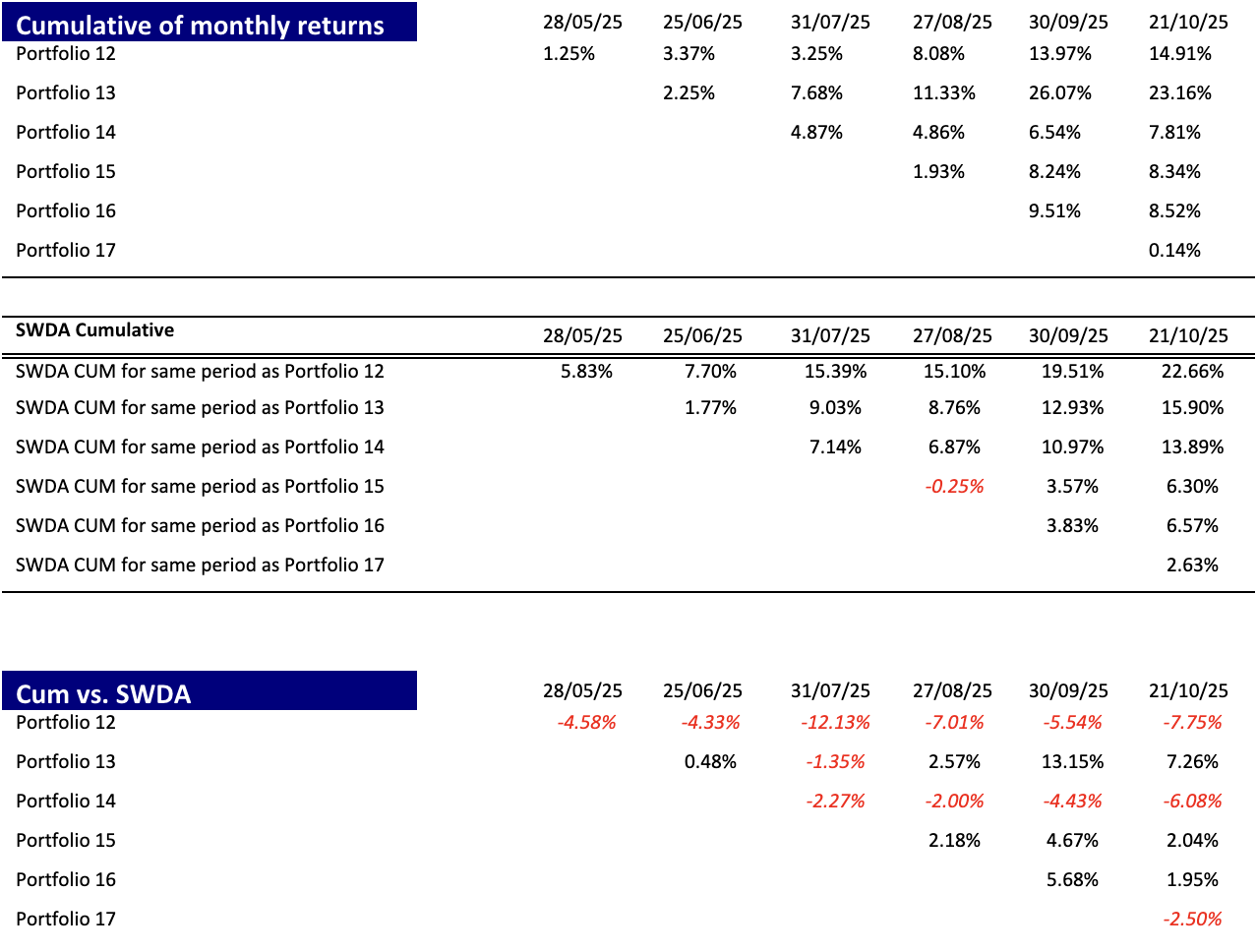

So how have the portfolios performed?

Is there value in the strategy? The following tables shows 1) Cumulative returns of the SWDA Index and 2) the relative Cumulative performance of each fund over the same horizon in each case. As you can see the average of the portfolios has outperformed in four out of six months.

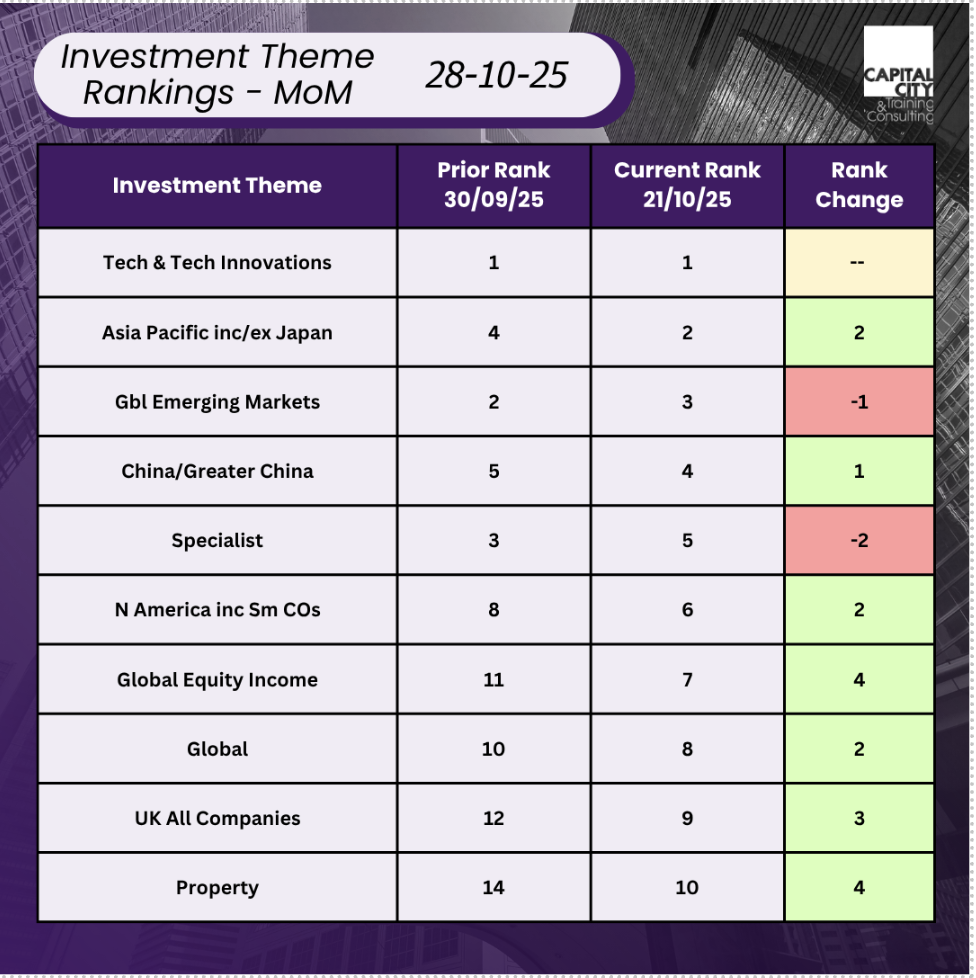

The “mood music” mentioned last month, against the US, AI, and pro-EU, Asia and emerging markets is continuing.

And the emerging markets fund in the last portfolio has gone well. China, after an excellent month has gone backwards.

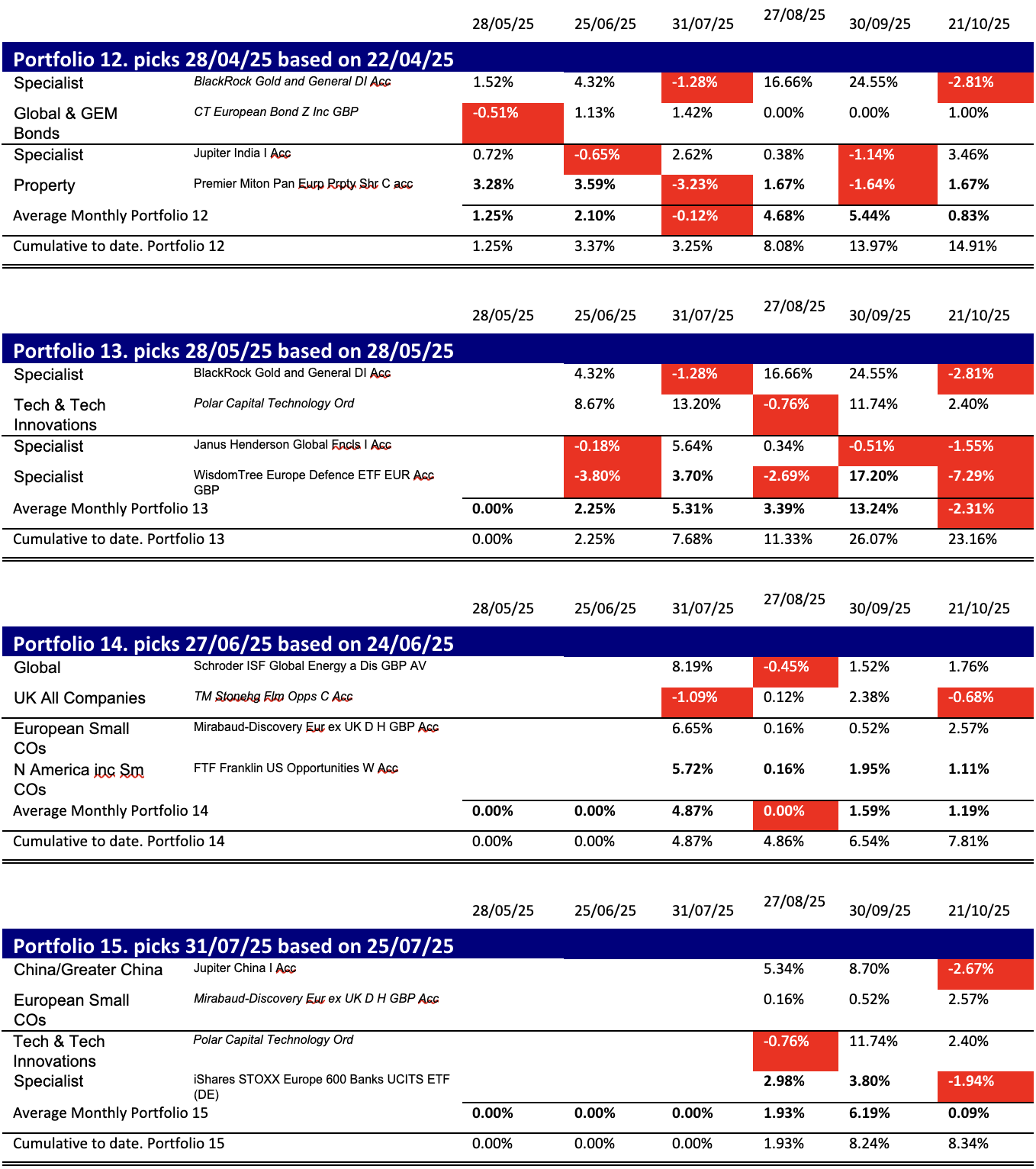

How have the individual portfolios performed?

So, what have been our worst and best portfolios: The best current portfolios are portfolio 13 and 15, having achieved total returns of 23.16% and 8.34% respectively over 5 and 3 months, both beating our benchmark the iShares MSCI world index (SWDA). Portfolio 12, the least “momentum” portfolio has been sedate.

The Best Portfolios

Portfolio 13 has benefited from containing two of the four enduring themes: technology and gold and also getting a one-month bump from the impact of increasing tensions with Russia on Defence stocks.

The Worst Portfolio 12

As it matures this month, portfolio 12 has made a cumulative return of 14.91% over 6 months, in the context of SWDA’s 22.6%!! over the same period, not so great. Still good. Again, like portfolio 10, the themes and momentum seem settled for now. European bonds – steady, now showing more typical low volatility, Blackrock gold and general moving ahead strongly again after a slow month. India markets have gone sideways, suffering over tariff uncertainty and perhaps due to suffer again thanks to President Trump’s new oil tariffs (yes twice in two months). Having said this, new direct tariffs on India last month didn’t stop Jupiter India moving up 3.46%.

Momentum in October and a new portfolio Eighteen end September

Staying with the pure momentum approach, if we continue, then the 6-month data suggests only a change in rank order: 1) Gold, 2) technology 3) Asia Pac ex Japan, and 4) Emerging markets.

If we look at the last four weeks as a guide, then we get a more complex picture: with biotech and alternative energy all performing strongly. There is also a narrowing of strong momentum into only our top 3 segments, i.e. gold, biotech, and alternative energy. Whilst technology stays well represented in the top 100 funds, the funds are lower down the ranks and momentum in absolute terms is weaker. This then suggests 1) Gold, 2 & 3) biotech/alt. energy, 4) Asia Pacific Ex Japan/ Europe inc. exc. UK.

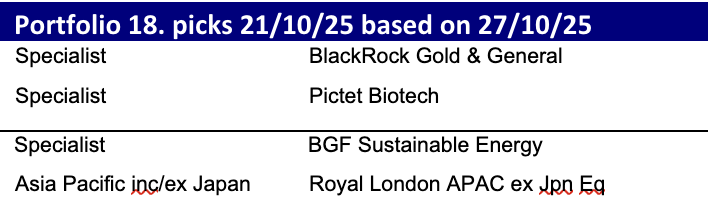

This Month’s Portfolio

SaltyDogInvestor.Com – Sign-up

If you are finding the blog intriguing and are interested in looking at this momentum data yourself, subscribe to saltydoginvestor.com. They top slice and analyse Morningstar’s fund data on a monthly basis, focusing on the funds available to retail investors.