Annuities are an essential concept in both individual finance and corporate finance contexts. A simple annuity is a series of equal payments made at equal intervals over a specified period. Perpetuities are a special class of annuities which literally go on forever. Between 1751 and 2015 the British Government had a number of these (potentially) perpetual bonds (“Consols”) outstanding. Growing perpetuities do exactly what they say, with an initial contracted payment growing at a fixed rate, or in the case of many pension products, in line with inflation.

Grasping the mathematics of annuities concept enables companies and investors to accurately value cash flows and assets.

What is an Annuity?

An annuity is a financial product sold by financial institutions that delivers a consistent stream of payments to an individual, typically for their lifetime. These periodic payments can be made monthly, annually, or at other regular intervals.

Annuities are designed and sold by insurance companies. In exchange for a lump-sum payment or a series of payments, the insurer guarantees lifetime fixed payments. From the insurance company’s standpoint, this structure allows them to pool the risks of numerous investors to ensure steady income streams.

Some key terms related to annuities include:

- Annuitant: The person receiving the annuity payments.

- Accumulation Phase: The period when the annuity accumulates funds before starting payouts.

- Payout Phase: The annuity’s disbursement period.

- Deferred Annuity: Payments are deferred, allowing for further accumulation of assets.

How Do Annuities Work?

An annuity contract involves a buyer and an insurance company. The buyer funds the annuity during the “accumulation phase.” Once this phase concludes, the “payout phase” commences, during which the annuitant receives payments periodically.

Types of Annuities

There are diverse annuity types, typically categorised by the onset of payments and payment structure:

- Immediate Annuities: Payments begin immediately post-purchase.

- Deferred Annuities: Payments commence at a future date.

- Fixed Annuities: Offer stable, guaranteed payments.

- Variable Annuities: Payments vary based on investment outcomes.

- Indexed Annuities: Payments correlate with certain market indices.

How to Analyse Annuities in Excel

Annuities can be appraised using Excel’s PMT, PV, FV, RATE, and NPER financial functions. These functions can assist in determining present value of annuities, their future value, and other critical metrics linked to annuity payments.

Advantages and Disadvantages of Annuities

Annuities carry both benefits and potential drawbacks:

Advantages:

- Guaranteed life-long income.

- Tax-deferred growth.

- Fixed payments remain unaffected by market volatilities.

- Beneficiaries receive death benefits.

Disadvantages:

- They are intricate products with associated fees.

- Liquidity challenges with withdrawal penalties.

- Potential opportunity costs.

- Payments typically halt post-death, barring death benefits.

Interpreting Annuities in Corporate Finance

In corporate finance, annuities have several applications:

- Valuing Fixed-payment Assets and Projects: Corporate projects, especially long-term investments, can have annuity-like cash flows. By discounting these cash flows, businesses can determine the net present value of projects and gauge their viability.

- Loan Amortisation: Corporations often finance large projects through loans that require fixed payments. Annuity formulas allow companies to determine periodic loan payments and forecast cash requirements.

- Leases and Rentals: Many corporate leases, particularly for equipment or property, involve fixed periodic payments. Annuity formulae allow us to price these contracts.

- Retirement and Pension Planning: “Final Salary” corporate pension plans typically give employees an index-linked life-time annuity. Properly valuing these obligations is crucial for long-term financial planning for the company and the employee.

- Capital Budgeting: In capital budgeting, where future cash flows are evaluated against initial investments, understanding annuity maths allows us to make informed investment decisions.

Exercises and Examples for Annuity

Here are some corporate finance-related exercises for annuities:

Exercise 1

A company is considering a project with a $250,000 initial investment and expected fixed annual returns of $50,000 for ten years. What’s the investment’s rate of return?

In Excel we can use the RATE() function to solve this.

=RATE(10,50000,-250000,0) = 15.098%

The sign convention in these Excel formulae is that when you invest (i.e. you the investor have a cash outflow) this is a negative number in Excel. A payment received from an investment, like an annuity payout is a Positive Flow.

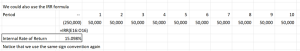

We could also use the Internal Rate of Return formula: =IRR():

Exercise 2

A corporation borrows $500,000, repayable in five annual instalments at 6% interest. What will be the yearly repayments?

In Excel we can use the PMT() Formula =PMT(6%, 5,500000) = (118,698)

Exercise 3

An energy company expects $15 million in fixed quarterly royalties for two decades from mineral rights sales. If the chosen Quarterly discount rate is 3%, what’s this asset’s present value?

We can use the =PV() formula =PV(3%,80,15) = $453.01m

There is a simple algebraic formula for this question:

PV = pmt/rate*(1-1/(1+Rate)^(no. pmts)) = $m/3%*(1-1/(1+3%)^80)

Where ^ is the Excel symbol for “raise to the power” or exponent.

Exercise 4

To fund a CEO’s retirement bonus, a company plans to offer $80,000 annually for 15 years. If the discount rate is 8%, how much should the company invest now to finance this future commitment?

We can use the =PV() formula =PV(8%,15,80000) =(684,758)

In conclusion, understanding annuities is pivotal for various fixed-payment scenarios and cash flow forecasts in both personal and corporate finance.

To learn more about calculating annuities, take our Financial Maths course, or to learn more about interpreting them in a corporate finance setting, look into our Valuation course.