What is a Bond: Definition, Guide and Examples

Bonds represent one of the cornerstone investment vehicles in global capital markets, playing a crucial role for fund raising for organisations and presenting investment opportunities for institutional and retail investors. The vast majority of bonds are fixed-income securities and have therefore bonds have historically provided investors with steady returns as well portfolio diversification opportunities – giving steady returns when equity markets may be volatile. But they are not without their own risks – they just have to be evaluated differently. This comprehensive guide will explore the fundamentals of bonds, their various types, how they function in financial markets, and their importance (risk and return) in investment strategies.

Article Contents

Key Takeaways

| Category | Key Points |

| Definition | A bond is a debt instrument representing a loan from an investor to a borrower, typically corporate or government entities. They are an alternative source of borrowing to traditional bank lending. They are traded in a secondary market, likes company shares. |

| Components of a Bond |

|

| Types of Bonds | They are characterised by:

|

| Investment Strategies |

|

| Trading |

|

| Valuation and Risk Metrics |

|

| Risks |

|

| Examples |

|

What is a Bond?

A bond is a debt instrument that represents a loan made by an investor to a borrower, typically corporate or governmental entities. In essence, when you purchase a bond, you’re lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. You are exposed to the risk of the issuer not being able to repay the debt – default risk. Unlike depositing money in the bank, there is no protection for the investor.

Key Components of a Bond:

- Principal (Face Value): The amount borrowed that must be repaid at maturity.

- Coupon Rate: The interest rate paid to bondholders.

- Maturity Date: When the principal amount must be repaid.

- Issue Price: The initial price at which the bond is sold.

Example of bonds include:

- UK Government Gilts

- US Treasury Bonds

- Corporate Bonds from companies like Vodafone or BP

- Municipal Bonds issued by local authorities

How Bonds Work

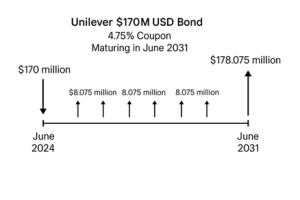

Take this example from above of the Unilever $170m USD bond issued in June 2024, 4.75% coupon, maturing in June 2031

- Issuance:

- The issuer determines the bond’s terms with the aid of an advising (arranging) bank. (maturity, coupon rate, etc.).

- The bond is offered to investors through a syndicate of distributing banks in primary markets (direct to investment institutions). Governments have their own issuing department (the Treasury office) which manages the process.

Above: This shows Unilever receiving $170m in June 2024 from investors. However, investors may not be willing to pay the FULL value for the bond if the coupon is not attractive enough (e.g. if markets have moved in the meantime since the bonds coupon was fixed). In this case, Unilever may receive <100% of the $170m. However, Unilever’s repayments will still be fixed at 4.75% of the full (face) value of the bond, so all subsequent cash returns to investors are fixed.

- Regular Payments:

- The issuer makes periodic interest payments (usually semi-annually). Above shows simple annual coupon cash flow payments by Unilever to the investors. A paying agent will administer the distribution to investors – whoever the registered investors are at the time the coupon is due.

- These payments are calculated based on the fixed coupon rate, set at issuance.

- Maturity:

- At the end of the bond’s term, the issuer repays the principal (face value) regardless of what investors paid for their bond upfront.

- The bond contract is then complete.

Bond Risk

Despite being fixed income for investors, these investments are not without risk.

- Default risk: the issuer may suffer a severe downturn in business and not be able to repay interest and / or principal when due. It may be delayed or not paid at all.

- Interest rate risk: investors are locking into a fixed interest rate for the life of the bond. The risk is they lock in to, say, 4.75% for 7 years, but interest rates rise but they get no higher return. It’s like an ‘opportunity cost.’ If investors try to resell their bond in secondary markets with a 4.75% fixed coupon when equivalent rates are now higher, the bond will be less valuable, and they will suffer a loss when selling.

- Inflation risk: the risk that higher than expected inflation eats into the real returns earned on the fixed income instrument.

- Liquidity risk: the risk that an investor who wishes to sell their bond in the secondary markets prior to maturity may find it hard to do so, meaning they have to accept a lower price. Lack of liquidity is typically represented by lower selling prices and higher buying prices (wider bid-offer spreads) in the secondary market.

Duration as a risk measure.

Duration is the measure of interest rate sensitivity (risk) of a bond’s price to a change in the interest rate environment. A bond with a duration of 4, will suffer a 4% loss in value if interest rates suddenly jumped up by 1%. This will never happen, so it is often broken down into a smaller measure which measures the sensitivity of the bond value to a 0.01% change in interest rates (the PV01 of a bond – the price value of a 1 basis-point change in interest rates)

Think about it: If you buy a fixed coupon bond paying 4% interest for 5 years, and straight after you bought it, the ‘fair’ equivalent interest rate goes up to 5%, you are missing out! Not only that, but the value and price of your bond will have fallen – it is less attractive to investors in the secondary market. But how much will the price have fallen?

Duration (and PV01) is a simple measure that quantifies this risk. It is a function of:

- The size of the coupon

- The current interest rate environment

- The maturity of the bond

All other things being equal, a bond will have a higher duration if:

- It has a lower coupon compared to other bonds.

- It has a longer maturity than other bonds.

- Is issued in a low-rate environment.

Remember: “Low, long, low” is riskier.

Types of Bonds

Government Bonds:

- Gilts (UK)

- Sovereign Bonds – any government bond, any currency

- Treasury bond – issued by the Treasury department in local currency

- Municipal Bonds

Corporate Bonds:

- Investment Grade (a credit rating may be published as an indication of credit risk at issuance. The ratings scale distinguishes between Investment Grade and Sub-investment grade. Of course, it may improve or deteriorate!)

- High Yield (below investment grade with higher coupons as a result)

- Convertible Bonds (which may be converted into corporate shares at the investors’ choice, rather than the issuer repaying cash at maturity).

- Callable bonds – the issuer has the option to repay the debt prior to its ultimate maturity. Call dates will be set at the issuance date.

Special Categories:

- Zero-Coupon Bonds (paying no regular interest; the interest is rolled-up and paid at maturity)

- Inflation-Linked Bonds (the coupon is linked to a consumer price index)

- Asset-Backed Securities (the coupons are paid dependent on the returns from specified assets held by the issuer – typically financial assets such as loans)

- Perpetual Bonds – with no set maturity date, but often will be repaid at the issuers choice when the interest rate environment is favourable to them (i.e. they can issue a new bond with lower interest and use the proceeds to redeem the perpetual)

International Bonds:

- Eurobonds – nothing to do with the EUR currency! A Eurobond is a bond issued in a currency that is not native to the country where it is issued. The aim is to access international investors and / or issue with reduced regulation.

- For example: A bond denominated in USD but issued in London or Singapore. They are subject to fewer regulatory burdens and are issued outside the jurisdiction of the currency used.

- Foreign Bonds – issued in a local market in the local currency by an overseas issuer. Will be subject to local market rules and regulation. E.g. a Japanese company issuing a US$ bond in the US. These all have fancy nicknames – here the US$ bond would be a Yankee. A US company might issue a Samurai bond in Japan, or a Bulldog in the UK, or a Kangaroo in Australia!

- Global Bonds – Covers Foreign and Eurobonds but can also go wider! A true global bond would be:

- Issued simultaneously in multiple markets.

ii. Cleared through multiple clearing systems (e.g., Euroclear and DTC in the U.S.) - Available to both domestic and international investors

- Issued simultaneously in multiple markets.

Investing in Bonds

Bond investment strategies vary depending on investor objectives and market conditions:

Buy and Hold Strategy:

- Purchase bonds and hold until maturity.

- Focuses on regular income generation.

- Minimizes trading costs.

Laddering:

- Purchasing bonds with staggered maturity dates.

- Provides regular reinvestment opportunities.

- Helps manage interest rate risk.

Portfolio Allocation:

- Traditional 60/40 stock/bond split.

- Risk management through diversification.

- Income generation for retirees.

Trading Bonds

Bond trading occurs in both primary and secondary markets:

Primary Market:

- New bond issues.

- Direct purchase from issuer.

- Usually involves financial intermediaries.

Secondary Market:

- Trading of existing bonds.

- Over-the-counter (OTC) transactions.

- Electronic trading platforms.

Trading Considerations:

- Liquidity

- Bid-ask spreads

- Transaction costs

- Market access

- Price transparency

Risks Associated with Bonds

- Interest Rate Risk:

a. Price sensitivity to rate changes.

b. Duration measure.

c. Yield curve risk (is the yield curve changeable/volatile) - Credit Risk:

a. Default risk.

b. Credit rating changes.

c. Spread risk. - Inflation Risk:

a. Erosion of purchasing power.

b. Fixed income vulnerability.

c. Real return considerations. - Liquidity Risk:

a. Secondary market trading.

b. Bid-ask spreads.

c. Market depth. - Call Risk:

a. Early redemption possibility.

b. Reinvestment risk.

c. Premium considerations.

Bond Case Studies and Examples

Case Study 1: UK Government Gilt

- 10-year gilt issued at 2% coupon.

- £1,000 face value.

- Semi-annual payments.

- Impact of Brexit on pricing.

Case Study 2: Corporate Bond Investment

- Investment-grade corporate bond.

- Credit rating change impact.

- Trading strategy analysis.

- Return calculation.

Case Study 3: High-Yield Bond

- Risk-return profile.

- Default scenario.

- Recovery rate analysis.

- Portfolio implications.

Common Interview Questions Regarding Bonds

- “What is the relationship between bond prices and interest rates?”

- Answer: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, and vice versa. This occurs because existing bonds become less attractive when newer bonds offer higher yields.

- “Explain duration and its significance.”

- Answer: Duration measures a bond’s price sensitivity to interest rate changes. It represents the weighted average time until all cash flows are received and is expressed in years. Higher duration indicates greater price sensitivity to rate changes. Higher duration is evident in bonds with longer maturity, Lower coupons and Low-rate environments, all other things being equal.

- “What is credit spread and why is it important?”

- Answer: Credit spread is the difference in yield between a bond and a risk-free government bond of similar maturity. It represents the additional return investors demand for taking on credit risk.

- “How do you value a bond?”

- Answer: Bonds are valued by calculating the present value of all future cash flows, including coupon payments and principal repayment, discounted at the appropriate market rate.

- “What factors affect bond yields?”

- Answer: Key factors include:

– Interest rates

– Credit quality

– Time to maturity

– Market liquidity

– Economic conditions

– Inflation expectations

- Answer: Key factors include:

Bonds remain a fundamental component of financial markets and investment portfolios. Understanding their characteristics, risks, and valuation methods is crucial for anyone working in finance or managing investments. Whether used for income generation, capital preservation, or portfolio diversification, bonds offer unique advantages and challenges that require careful consideration and analysis.