Discount Rate Guide: Definitions, Formulas, Examples

The discount rate is a crucial concept in corporate finance and investment appraisal. It is used to determine the net present value (NPV) of future cash flows thus accounting for the time value of money and enabling the comparison of projects and investments with cash flows spread over different time periods.

Article Contents

Key Takeaways

| Takeaway | Description |

| Definition | The rate applied to future cash flows in order to calculate their present value. Accounts for the time value of money and investment risk. |

| Impacts | Critical in investment appraisal, project timing, capital rationing, financing choices, and business valuations. |

| Comparison to Other Metrics | Broad term that covers a number of more specific metrics such as cost of capital, interest rates, and hurdle IRRs. |

| Common Ranges | Varies widely by industry and project risk – from low single-digit percentages for stable assets (e.g. government bonds) to double-digit percentages for higher risk assets (e.g. startups, technology ventures.) |

| Uses in Excel | Input into the NPV formula. |

What is the Discount Rate?

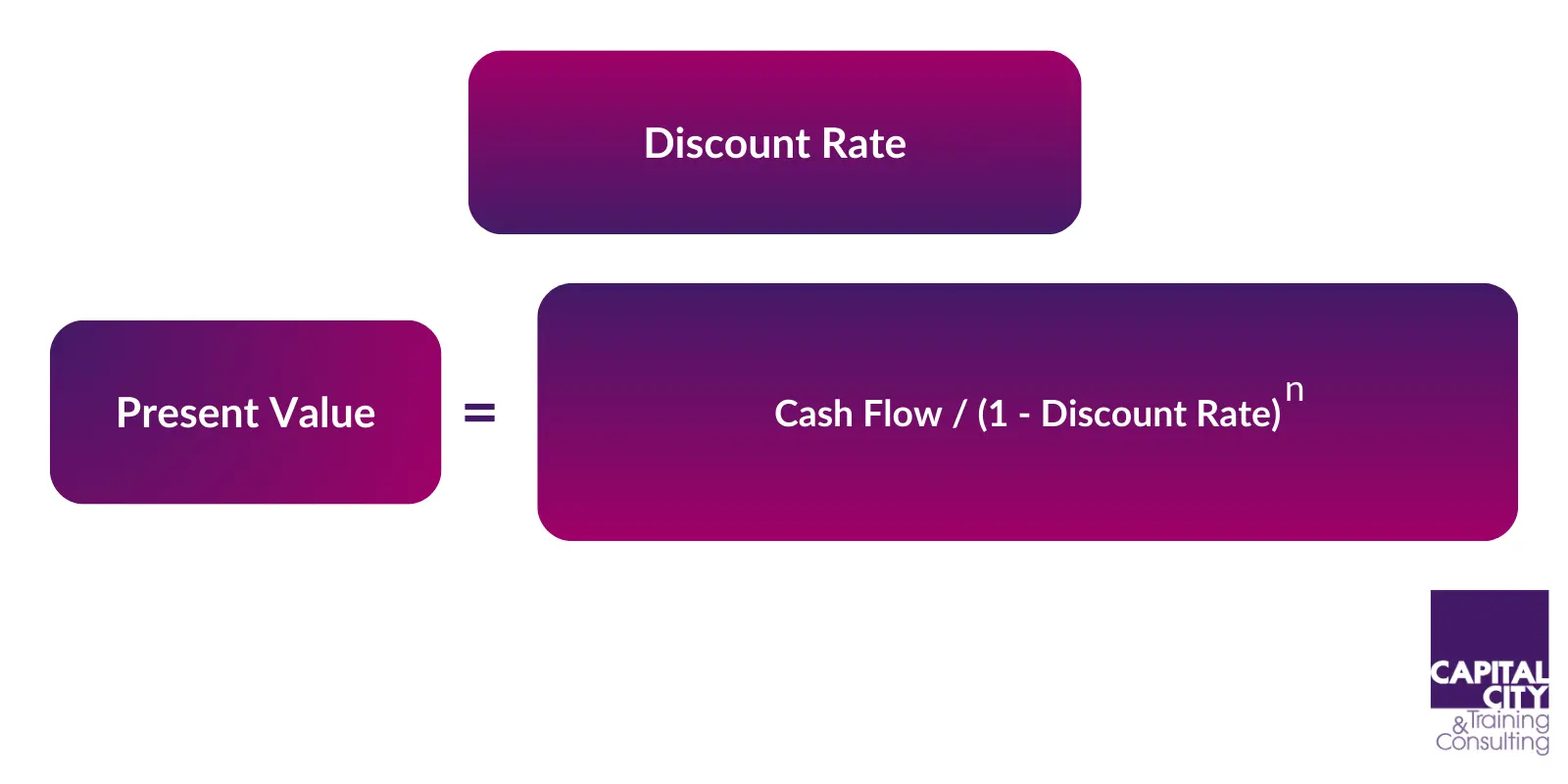

The discount rate is the rate used to determine the present value of future cash flows. It can also be considered as the rate of return that could be earned in alternative investments of equivalent risk. The discount rate reflects the impact of the time value of money – the idea that money available today is worth more than the same amount in the future, due to its potential earning capacity.

The higher the discount rate, the larger the sum of money you would expect to receive in the future, if you were to invest the same amount today. As such, it also implies that a certain set of future cash flows are worth less today than if a lower discount rate was used. Corporations apply discount rates to determine the present value of long-term projects and investments, and thus is crucial in capital budgeting and net present value analysis.

Net Present Value (NPV) and Discount Rate

Net Present Value (NPV) measures the difference between the present value of cash inflows and outflows over the lifetime of a project or investment. The NPV is calculated by discounting the projected future cash flows to their present value, using the discount rate.

If the NPV is positive, the discounted future cash flows exceed the initial investment, and the project is likely to be profitable. If the NPV is negative, the initial investment is higher than the present value of future cash inflows and the project is likely to be unprofitable.

Using Discount Rate in Excel

The discount rate can be used in Excel within the NPV formula:

=NPV(discount_rate, cash_flow_series)

Where:

- discount_rate = The annual discount rate to be applied, formatted as a percentage.

- cash_flow_series = The projected cash flows for each period of the investment, discounting to present value.

Impact on Corporate Decision Making

The discount rate significantly impacts capital budgeting and corporate finance decisions, including:

- Investment Appraisal – Discount rates determine the NPV of projects and whether they are profitable. A higher discount rate will make the same investment appear less favourable.

- Valuations – Discount rates are applied in valuation models like discounted cash flow analysis to determine the present value of companies.

- Financing Decisions – Discount rates help corporations decide between debt and equity financing by evaluating the required returns.

Discount Rate vs. Other Financial Metrics

The term discount rate is a broad one that can often be used to cover a number of more specific metrics, including:

- Cost of Capital – A company’s weighted average cost of capital, based on the expected return on its debt and equity financing, is often used as a discount rate.

- Internal Rate of Return (IRR) – IRR is the discount rate at which the NPV of future cash outflows and inflows equals zero. A higher IRR indicates a more desirable investment.

Real-World Applications and Examples of Discount Rate

- Oil and Gas Companies: Can apply low double-digit discount rates, factoring in commodity price volatility and extraction risks. For example, an oil exploration project might use a higher rate to account for the uncertain nature of finding viable reserves.

- Pharmaceutical Firms: For drug development projects, pharmaceutical firms can often use discount rates ranging from high single-digit to low double-digits. The extended duration of these projects, often spanning 10-15 years, and the uncertainty in regulatory approval and market acceptance, justify this range.

- Real Estate Investors: Utilise mid-single digit discount rates typically, influenced by property type, location, and financing costs. For instance, a commercial real estate project in a prime urban location might have a lower discount rate compared to a residential development in a less developed area.

- Renewable Energy Producers: Generally estimate discount rates in the mid-to-high single digit region, considering factors like project lifespan, production variability, and government incentives or tax credits.

- Tech Startups: Given their higher risk profile, new tech ventures often use higher double-digit discount rates when valuing future cash flows. The higher rate reflects the greater uncertainty and potential for high growth in these businesses.

The discount rate is a fundamental concept in corporate finance that reflects the time value of money and risk. By applying suitable discount rates, corporations can accurately assess the profitability of long-term projects and investments.