Depreciation: Definition, Calculation and Examples

When we speak to many analysts, they say that depreciation isn’t a cash expense. True. It is subjective: somewhat true. It is based on accounting estimates, mostly the estimated time over which an asset will remain useful to the business. Despite these observations, depreciation a very important element of analysing financial statements and understanding the balance sheet and P&L.

At its core, Depreciation comes from the ‘matching’ accounting concept whereby businesses must match the cost of long-term assets over the periods in which they are expected to generate revenue.

When companies invest in fixed, operating assets (buildings, machinery, plant, fixtures and fittings, vehicles) – needed to keep the business running – then there is a significant cash outflow. It seems ‘unfair’ to make companies put the full cost through the P&L in the year of investment – the assets will be used for more than one ‘accounting period’ (more than 1yr) and so businesses are allowed to spread the cost through the P&L over the asset’s useful life. This share of the cost, an operating expense in the P&L, is depreciation. Depreciation therefore represents the systematic allocation of an asset’s cost over its expected useful life. It is not a reflection of a falling market value / resale value. It is simply an allocation of historic cost over future periods as the asset is used in the business to help keep the business operating. Neither is it a ‘notional’ expense. It reflects money that has already been invested / spent. It is a true economic cost.

Article Contents

- What is Depreciation?

- Understanding Depreciation in Accounting

- Common Depreciation Methods

- Calculating Depreciation Expense – Formulas & Case Studies

- Factors Influencing Depreciation Rates

- Types of Depreciation

- Impact of Depreciation on Financial Analysis

- Depreciation in Financial Modelling

- Common Interview Questions Regarding Bonds

- FAQs

Key Takeaways

| Category | Key Points |

| Definition | Depreciation is the systematic allocation of an asset’s cost over its useful life. |

| Purposes |

|

| Accounting Perspective |

|

| Methods |

|

| Formulae | Varies by method – see examples below. The most common is Straight-line where:

|

| Factors Influencing Rates |

|

| Types of Depreciation |

|

| Financial Impact | Influences profitability ratios, asset efficiency, and valuation metrics (e.g., EBITDA). |

| Use in Financial Modelling | Key for forecasting investment, EBIT, scenario analysis, and sensitivity testing. |

| Case Studies and Examples | See below |

| Common Questions | At interview on in exams, questions arise about the different methods, cash flow effects, method selection criteria, and its relation to capital expenditure.

Note that if Capex each year is less than depreciation, the Fixed Asset balance in the balance sheet will fall over time. This is a sign of under-investing and a weakening balance sheet, or a shrinking business: “not enough investment to sustain existing operations.” |

What is Depreciation?

Depreciation is a non-cash expense that recognises the use of tangible assets over time. The equivalent for intangible assets is Amortisation. It serves multiple purposes in financial reporting and business operations:

- Cost Allocation: Distributes the initial cost of an asset across its useful life.

- Asset Replacement Planning: Helps businesses plan for future asset replacements.

- Financial Analysis: Assists in accurate financial reporting and analysis.

Understanding Depreciation in Accounting

In accounting, depreciation plays a vital role in:

Financial Statements

Where to find it?:

- Balance Sheet: Reduces the book value of assets as they are ‘used up’

- Income Statement: Appears as an operating expense.

- Cash Flow Statement: Added back to net income or EBIT in operating activities to reconcile to operating cash flow.

Tax Implications:

Due to the use of accounting estimates which vary from company to company, the tax authorities will apply their own calculation of how much depreciation is allowable for tax deductibility. They will not allow the accounting (GAAP) depreciation. This prevents companies over-depreciating assets just to get a cash-flow advantage by paying less tax.

Here is a summary of major geographies and what the tax authorities allow:

| Country | GAAP Depreciation Tax Deductible? | Notes |

|---|---|---|

| USA (US GAAP) | ❌ Usually not | The IRS uses a method called Modified Accelerated Cost Recovery System (MACRS); GAAP depreciation is ignored for tax. |

| UK (UK GAAP / IFRS) | ❌ No direct link | HMRC uses “Capital Allowances” – a completely different system. |

| Germany | ❌ No | Tax law has its own depreciation rates and methods. |

| India | ❌ No | Companies Act vs. Income Tax Act – different rules. |

Where the P&L will show a tax expense based on GAAP, and actual tax paid is based on the tax-rules, this gives rise to Deferred Tax (DT) in the balance sheet. Companies paying more tax than the P&L expense will end up with a DT asset, and vice versa for a DT liability. But over time the asset or liability will fade away as the difference is only a timing issue.

Fixed Asset Management:

- Tracks asset value over time. As the book value erodes over time it gives an indication of when assets will need replacing – assuming the estimates made for its useful life were fair in the first place!

- Aids in replacement decisions – as noted above.

- Supports maintenance planning.

Common Depreciation Methods

- Straight-line Depreciation

- Most common and straightforward method.

- Equal annual depreciation amounts.

- Suitable for assets with predictable useful lives.

- Declining Balance Method

- Accelerated depreciation in early years.

- Decreasing amounts over time.

- Appropriate for technology-based assets.

- Sum-of-the-Years’-Digits (SYD)

- Another accelerated method.

- Front-loaded depreciation.

- Used for assets with higher early-year productivity.

- Units of Production

- Based on actual usage.

- Varies with production levels.

- Ideal for manufacturing equipment.

Calculating Depreciation Expense – Formulas & Case Studies

The depreciation expense formula varies by method:

Straight-line Depreciation:

Annual Depreciation = (Asset Cost – Salvage Value) ÷ Useful Life

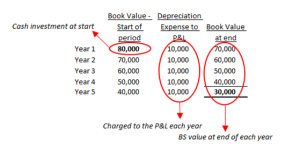

An asset costing £80,000 has an estimated useful life of 5 years. After this time, it has an estimated residual value of £30,000. So, the Fall in Value over 5 years is £50,000, and this will be charged evenly (straight line) over 5 years as follows:

Declining Balance:

Annual Depreciation = Book Value × Depreciation Rate

An asset costing £80,000 has an estimated useful life of 5 years. Its residual value is uncertain, but the company has a policy of depreciating at a rate of 20% per year.

You can see that the depreciation is ‘accelerated’ in that the charge is more in the early years of the asset’s life. This is consistent with assets considered to be more productive in their early years.

Sum-of-the-Years’-Digits:

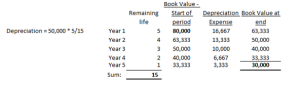

Annual Depreciation = (Remaining Life ÷ SYD) × (Asset Cost – Salvage Value)

An asset costing £80,000 has an estimated useful life of 5 years. After this time, it has an estimated residual value of £30,000.

This is, again, an accelerated method but in this case the residual value is set up front, unlike the Reducing Balance method.

Units of Production:

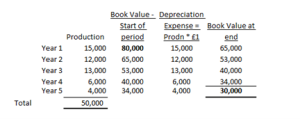

Depreciation per Unit = (Asset Cost – Salvage Value) ÷ Total Expected Units

An asset costing £80,000 has an estimated productive capacity of £50,000 units of output over its life. After this production is achieved, the asset has a residual value of £30,000.

So, depreciation per unit of production is (£80,000 – £30,000) / £50,000 – £1 per unit of production.

Factors Influencing Depreciation Rates

- Asset Type

- Nature of the asset – does it have limited productive capacity? Hours of use?

- Expected wear and tear – when do we estimate it to be of no further use to the company? How will wear and tear impact its efficiency? Its residual value?

- Technological obsolescence.

- Industry Standards

- Common practices e.g. for useful life.

- Industry-specific considerations.

- Some typical useful life estimates:

- IT equipment: 3–5 years

- Vehicles: 4–7 years

- Manufacturing plant: 10–20 years (longer for heavy machinery, shorter for light)

- Buildings: 30–50 years, allowing for maintenance expenses along the way

- Furniture and fixtures: 5–10 years

- High-end hotels carry out soft furnishing replacements every 7 years

- Office furniture perhaps replaced only every 10 or more years

- Company Policy

- Internal guidelines.

- Strategic objectives – how does the age of assets fit in with our brand, strategy etc?

- e.g. with airlines this is often a selling point – are you a budget airline with older aircraft, or a luxury airline with a fleet you intend to keep up-to-date?

- Asset management approach – does the company replace assets while the residual value is still high, or wait until the assets are fully worn out?

- External Factors

- Tax regulations.

- Accounting standards.

- Market conditions – note that if there is a change in market conditions that means an asset is less valuable to the business (a sudden fall in the market price of output, say) then this may lead to an extra one-off depreciation-type charge called an Impairment.

Types of Depreciation

- Book Depreciation

- Used for financial reporting.

- Follows accounting standards.

- Reflects economic reality.

- Tax Depreciation

- Follows tax regulations.

- Usually different from book depreciation.

- Optimised for tax benefits.

- Accumulated Depreciation

- Total depreciation to date.

- Is the total reduction in Balance Sheet value (book value) of the asset since it was purchased.

- Shown in the notes to the accounts, at asset-type level (not asset by asset).

Impact of Depreciation on Financial Analysis

Depreciation affects various financial metrics:

- Profitability Ratios

- Return on Assets (ROA): All other things being equal, as asset values are depreciated, ROA increases. This is not sustainable as, at some point, the assets will be disposed, reinvestment should occur, and so asset values should increase again.

- Operating Margin: Accelerated depreciation will reduce operating margins in the early years, so consider this if comparing companies with different depreciation policies.

- Net Profit Margin: Similar to above. Note that in the P&L, the tax expense is based on GAAP depreciation and all the accounting estimates that go with it. Actual tax paid will not be affected as tax rules dictate what is allowable.

- Asset Efficiency

- Fixed Asset Turnover (Revenue/Fixed Assets book value): Companies with falling asset values will experience a rising Asset Turnover, all other things being equal. However, there may be no real, sustainable increase in efficiency. This ratio will be less distorted for large companies who continually reinvest in their assets.

- Capital Intensity: The inverse of the above ratio with the same considerations.

- Valuation Metrics

- EBITDA should not be affected by depreciation. That is why it is often seen as a more comparable measure of profit. If one company accelerates its depreciation versus its peers, EBITDA will ‘ignore’ this, making the companies more comparable.

- Asset Base.

Depreciation in Financial Modelling

Financial models incorporate depreciation through:

- Forecasting

- Future depreciation expenses.

- Asset replacement cycles.

- Capital expenditure planning – modelling to ensure the balance sheet assets are not depleted over time. This has a direct link to Capex. If Capex < Depreciation, the BS will shrink, and this is not sustainable for a going concern company. Checking the Asset Turnover and Capex vs depreciation is a key part of forecasting cash flows.

- Scenario AnalysisIn models, it can be useful to adopt different assumptions for depreciation using scenario analysis. This will help an analyst understand the sensitivity of various ratios to companies accelerating their investment cycle, or stretching it out.

- Different depreciation methods.

- Varying useful life assumptions.

- Alternative salvage values.

Common Interview Questions regarding Depreciation

- “What is the difference between straight-line and declining balance depreciation?”

Answer: Straight-line provides equal annual amounts, while declining balance front-loads depreciation with higher early-year expenses. Companies with accelerated depreciation will show lower operating profit in the early years of an asset’s life, all other things being equal. - “How does depreciation affect cash flow?”

Answer: Depreciation is a non-cash expense that reduces operating profit, but in effect does NOT impact on cash flows. However, it is shown in the cash flow statement as it is added back to EBIT to reconcile to cash flow from operations (for the very reason that it is not a cash flow!). - “Why is depreciation important in financial analysis?”

Answer: It affects profitability metrics, asset productivity ratios (such as asset turnover), asset book values, and tax calculations in the P&L (but not tax paid in the cash flow), providing a more accurate picture of business performance. - “How do companies choose the appropriate depreciation method?”

Answer: They will consider asset type, usage pattern, industry standards, and business objectives when selecting a method. These all impact the estimate of the useful life to the business as well as its residual value. - “What is the relationship between depreciation and capital expenditure?”

Answer: Depreciation helps plan for future capital expenditure by recognising the gradual ‘consumption’ of existing assets. Companies – under GAAP – should never have ‘zero book value’ assets. So as assets approach low book values, they must be ready to be replaced soon. Monitoring depreciation as it impacts book values will help analysts understand the investment cycle. As a rule of thumb, for a steady-state business, capex should be at least equal to depreciation on average. To allow for inflationary prices of assets, capex should, in fact, be a little bit more than depreciation for a stable business (the balance sheet assets will grow in line with inflation).

Understanding depreciation is essential for financial professionals as it impacts various aspects of business operations, from financial reporting to strategic planning. The concept’s application in accounting, tax calculations, and financial analysis makes it a crucial topic for anyone working in finance or accounting roles.